Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Pre-payment Penalty tab >

Use Interest Penalty details

This field is used with prepayment penalty code 30. If this field is checkmarked, the prepayment penalty calculation will use the Penalty Days field and the loan rate or the accrual rate on the loan to calculate the prepayment penalty. It will also use a percent of the original balance or a percent of the current balance for the calculation, as explained in the Percent or Dollar field in the Set Up Pre-payment Penalty Code 30 field.

The prepayment penalty will be calculated as follows:

[(Percent of original balance or current balance (see Value field) x Interest Rate) / Interest Calculation Method] x Penalty Days

Interest Rate = loan rate (LNRATE) or accrual rate (LNAMRT)

Interest Calculation Method (LNIBAS)

1 or 101 = 365/365 days per year

2 or 102 = 360/360 days per year

3 or 103 = 365/360 days per year

4 or 104 = 360/365 days per year

5 or 105 = 366/366 days in a leap year

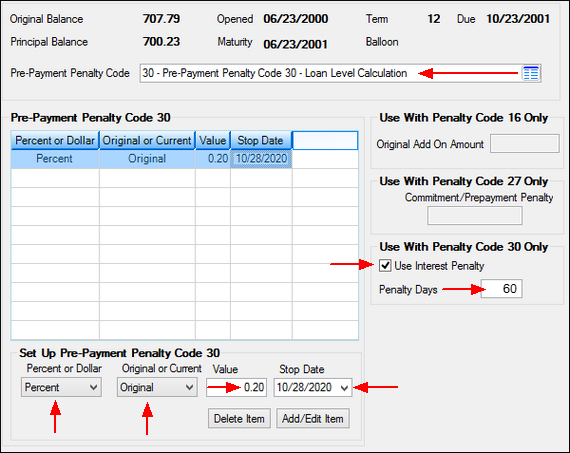

Example of penalty: Your institution uses two months (60 days, see Penalty Days field) interest penalty on 20% of the original balance if a loan is paid off within the first five years (see Stop Date). Therefore, you would set up the prepayment penalty fields on this screen like so:

Now let's say the Original Balance on the loan is $100,000.00.

The loan rate is 9.25%.

The Penalty Days field is set to 60 days.

And the loan Interest Calculation Method is 2 (360/360 days per year).

The prepayment penalty fee would be calculated as follows if the account was paid off before the date entered in the Stop Date field:

[(100000.00 x .20 x .0925) / 360] x 60 = $308.33

The prepayment penalty is assessed during payoff and displayed on the Adjustments tab of the Loans > Payoff screen.

|

Note: The Use Interest Penalty field will not work if prepayment penalty code 30 is set up as a fixed-dollar prepayment penalty. See the Percent or Dollar field for more information. |

|---|

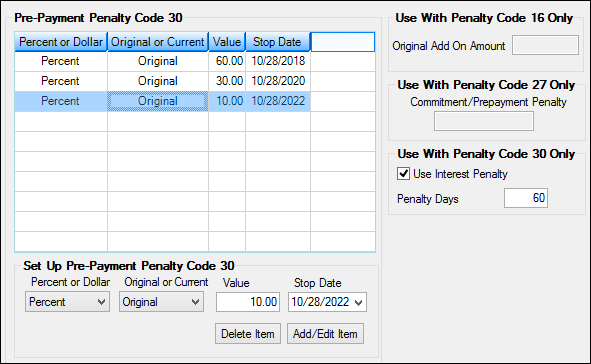

You can set up varying levels of fees for the prepayment penalty by using the Set Up Pre-payment Penalty Code 30 field group. For example, you can set up one fee amount for when borrowers pay off the loan before 2 years; another fee amount for when borrowers pay off the loan before 5 years; and a third fee amount for when borrowers pay off the loan before 7 years.

For this example, we're going to set a fee of 60 percent of two month's interest based on the loan's original balance if the loan is paid off within three years, 30 percent of two month's interest based on the loan's original balance if the loan is paid off within five years, and 10 percent of two month's interest based on the loan's original balance if the loan is paid off in seven years.

To set up more than one calculation:

1.Select "30 - Pre-payment Penalty Code 30 - Loan Level Calculation" from the Pre-Payment Penalty Code field.

2.Click <Save>. The fields in the Pre-Payment Penalty Code 30 field group are now file maintainable.

3.Check the Use Interest Penalty box.

4.Enter "60" in the Penalty Days field.

5.Select "Percent" from the Percent of Dollar field.

6.Select "Original" from the Original or Current field.

7.Enter "60.00" in the Value field.

8.Enter the Stop Date for three years from the Opened date.

9.Click <Add/Edit Item>. The prepayment penalty information now appears in the table above the fields.

10.Place your cursor in the row below the information that was just entered.

11.Select "Percent" from the Percent of Dollar field.

12.Select "Original" from the Original or Current field.

13.Enter "30.00" in the Value field.

14.Enter the Stop Date for five years from the Opened date.

15.Click <Add/Edit Item>. The prepayment penalty information now appears in the table above the fields.

16.Place your cursor in the row below the information that was just entered.

17.Select "Percent" from the Percent of Dollar field.

18.Select "Original" from the Original or Current field.

19.Enter "10.00" in the Value field.

20.Enter the Stop Date for seven years from the Opened date.

21.Click <Add/Edit Item>. The prepayment penalty information now appears in the table above the fields. See the example below illustrating these steps.