Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Pre-payment Penalty tab >

Pre-Payment Penalty Code 30 field group

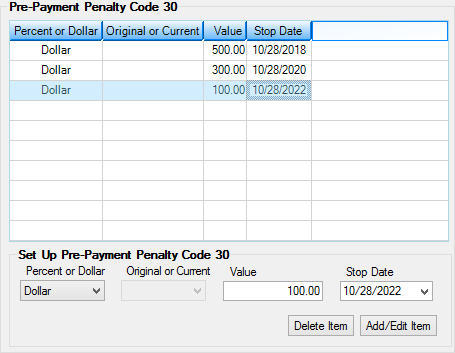

The following field descriptions describe the fields in the Pre-Payment Penalty Code 30 field group on the Pre-Payment Penalty tab of the Loans > Account Information > Account Detail screen.

The list view at the top of this field group displays up to 10 different calculations for any period of time for Prepayment Penalty Code 30. Loans that are paid off before the date in the Stop Date field are assessed a penalty. You can set up different fee penalties for different dates. For example, you can set up one fee amount for when borrowers pay off the loan before 2 years; another fee amount for when borrowers pay off the loan before 5 years; and a third fee amount for when borrowers pay off the loan before 7 years.

|

Note: These fields are not file maintainable until you select "30 - Pre-payment Penalty Code 30 - Loan Level Calculation" from the Prepayment Penalty Code field and click <Save>. |

|---|

The fields in this field group are as follows:

Field |

Description |

||

|

Mnemonic: MLUDOL |

Select either "Percent” or “Dollar” to indicate the prepayment penalty is based on a percent or dollar amount.

•If you select "Percent," the prepayment penalty uses the calculation explained in the Use Interest Penalty field to establish how much to charge for loans paid off before the Stop Date (see below). Note: The Value (see below), Stop Date, and Penalty Days fields are used with this calculation.

•If you select "Dollar," the system will charge a flat fee to accounts paid off before the Stop Date. You would enter the value of the flat fee in the Value field, and the date when the loan no longer is eligible for a prepayment penalty in the Stop Date field. The Penalty Days field is not used with this selection.

See below for more information.

|

||

|

Mnemonic: MLCURB |

Select either "Original" or "Current," or leave the field blank. This field should only be used if "Percent" is in the Percent or Dollar field above. This is the percentage of the original or current balance used in the prepayment fee calculation when calculating a fee amount based on a percentage. See the Use Interest Penalty field for more information. |

||

|

Mnemonic: MLVALU |

Enter either a dollar amount or a percentage factor depending on whether you selected either “Percent” or “Dollar” in the Percent or Dollar field above for the same line number. Two decimal places are available for both the percent and the dollar amount.

Example: A penalty of $1,500 would be entered "1500.00." A penalty of 2 1/2% would be entered "2.50."

Based on what is entered in these fields, the system can then calculate the prepayment penalty accordingly. |

||

|

Mnemonic: MLENDD |

Enter in this field the date when this penalty ends. If the borrower pays off the loan before this Stop Date, they are assessed the penalty amount. The penalty is assessed during payoff and displayed on the Adjustments of the Loans > Payoff screen.

If there is more than one prepayment penalty set up on the account, the system charges the first prepayment penalty amount if the loan is paid off before the first Stop Date in the list view above. Once that date has passed and the loan is not paid off, but then the borrower pays off the loan between the first and second Stop Date, the loan is assessed the second penalty amount, and so forth. |