Navigation: Loans > Loan Screens > Statistics and Summaries Screen Group > Summary Screen >

Term Information field group

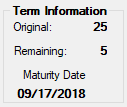

This field group displays term and remaining payment information for the customer loan account.

Field |

Description |

Original

(MLOTRM) |

This is the original term of the loan in months. This field is populated during loan origination and does not change. Even if the Loan Frequency changes, this field reflects the original term of the loan. |

Remaining

(LNCINO - LNINNO) |

This is the remaining number of installments on the loan. This field is calculated by subtracting the Installments Made from the Original Installment Number (LNCINO – LNINNO). If the Payment Frequency is changed on the Payment Information screen, this number will reflect the remaining installments using the new payment frequency.

Example: Original Installments on a loan are 12. The customer has made four payment installments; therefore, the Remaining field would be “8.” If three of those four payments were made in the same month, this field would still reflect “8.” If the Loan Frequency were changed from monthly to weekly, this field would then show "32."

This may be a negative number if deferments were made on the account. Deferments increase the Installments Made by the number of deferments. For example, if a loan had 36 Original Installments, and 36 payments were made in addition to two deferments, the Remaining field will display "-2."

See the Installments Made and Original Installment Number field descriptions on the Payment Information screen. |

Maturity Date

(LNMATD) |

This field contains the date the last payment is due and the loan should be paid off. It is pulled from the Maturity Date field on the Loans > Account Information > Account Detail screen. Institution Option RMTD rolls the Maturity Date when a deferment is made. Contact your GOLDPoint Systems account manager if you want this option set up for your institution. |