Navigation: Loans > Loan Screens > Transactions Screen Group > Make Loan Payment Screen > Payment Selection field group >

Spread Payment

Click this radio button in the Payment Selection field group to process a Spread Payment transaction (tran code 690-00). A spread payment means the payment is directed in specific ways other than what the Payment Application field uses.

For example, if a customer wants to make a payment of $100, but wants $75 of it to go to late charges and $25 to go to principal, you would use this transaction. This transaction should be used sparingly. This transaction requires a supervisor override before the transaction can be approved. Accounts that use the Spread Payment transaction should have the Use Spread Payments box checked on the Loans > Account Information > Account Detail screen > Payment Detail tab.

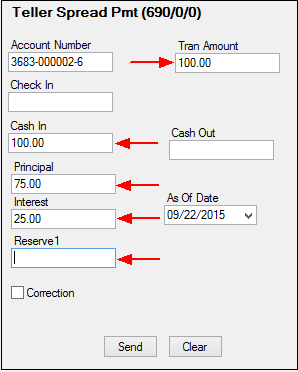

Once you enter information in the fields in the Transaction Information field group, and then click ![]() , CIM GOLDTeller launches with the Spread Payment transaction displayed, as shown below. The transaction allows you to designate the amount that will go toward principal, interest, or reserve 1.

, CIM GOLDTeller launches with the Spread Payment transaction displayed, as shown below. The transaction allows you to designate the amount that will go toward principal, interest, or reserve 1.

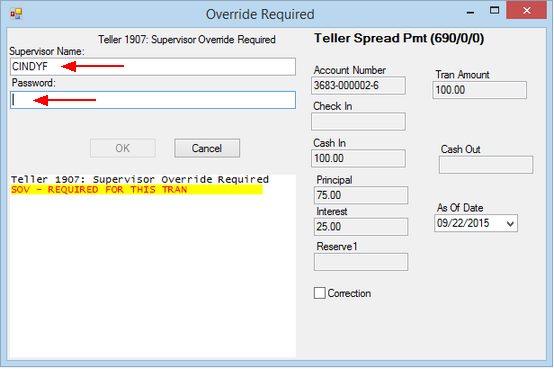

After you click ![]() on the transaction, the Override Required dialog box is displayed, as shown below. A supervisor must approve the transaction before it can be processed by entering their user name in the Supervisor Name field and password in the Password field, then clicking <OK>. Your supervisor can remotely verify this transaction, as explained in the CIM GOLDTeller User's Guide > Setup Requirements > Remote Override Setup section.

on the transaction, the Override Required dialog box is displayed, as shown below. A supervisor must approve the transaction before it can be processed by entering their user name in the Supervisor Name field and password in the Password field, then clicking <OK>. Your supervisor can remotely verify this transaction, as explained in the CIM GOLDTeller User's Guide > Setup Requirements > Remote Override Setup section.

For Conventional (payment method 0) and ARM Loans (payment method 7)

This transaction allows a payment to be posted for any amount, regardless of the amount due. It allows the teller to define what dollar amounts are spread to the principal, interest, and reserves using a supervisor override (SOV). This transaction will roll the loan due date. The system will not allow a 690 transaction or a 698 correction on line-of-credit loans (payment method 5).

For Interest-Bearing Loans (payment method 6)

The system will allow a payment to be posted for any amount, regardless of the amount due. It requires the teller to define what dollar amounts are spread to the principal, interest, and reserves using an SOV. This transaction will only roll the loan due date if the interest due amount is satisfied for the day the transaction is run. If the amount you spread to interest is less than the amount due for the day you are running the transaction, the due date will not advance. The payment will be accepted and entered into the Applied to Payment field. Use the Loans > Payoff screen to determine how much interest is due for a particular day (Per Diem field). Remember to take into consideration whether your institution collects interest through the payoff date or to the payoff date.

If you want to make a payment and collect interest as of a date in the past and have the loan due date advance at the same time, you can use the backdating feature. (Institution Option OPT3 BKDT must be enabled).

|

WARNING: These transactions could post less than the amount due and roll the loan due date. They are designed for institutions that have purchased loans that other institutions service for them. They allow the total principal and interest due to be placed in the P/I Constant field, but the purchasing institution posts the payment for a lower amount, which represents the payment less the service fee the servicing institution keeps. Use these tran codes with care. |

|---|

A 690 tran is not allowed if a loan is an ARM in negative amortization (deferring interest). In this case, the following message will be displayed: "DEFERRING INT. – 690 TRAN NOT ALLOWED."

Also, if posting more than the P/I Constant, this transaction will roll the due date as many times as are divisible into the amount posted.

See Spread Payment Options for information about institution options that affect spread payments.

See also: