Navigation: Loans > Loan Screens > Purchase Disclosure Screen > Disclosure History screen >

Disclosure History Information list view

Mnemonic: LNOPND

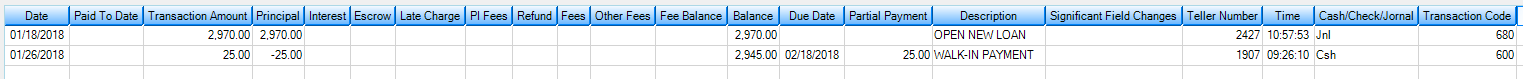

This list view at the top of the Disclosure History screen displays transaction history information for the customer loan account.

|

Certain options set up under Options > User Preferences screen > Options tab on the CIM GOLD menu bar affect this list view table:

1.Combine Balance in Disclosure History: If this option is selected, the Balance and Fee Balance columns are combined under the Balance column on the Disclosure History screen.

2.Combine Entries in Disclosure History: Use this field to indicate whether actions occurring within two seconds of each other should be combined when viewing the Disclosure History screen.

3.Some institutions want only simplified loan history on this screen. Others want detailed descriptions of transactions. Therefore, an option is available under Options > User Preferences in the CIM GOLD menu bar. This option, Show all Open/Payoff in Disclosure History, causes the system to display all transactions involved with opening or paying off a loan. Transactions included in this option are as follows:

Open loan transaction (tran code 680) Field Credit (tran code 510) LIP Disbursement (tran code 430) Amortizing Fee Credit (tran code 910) G/L Credit (tran code 1810) Payoff (tran code 580) Dealer Interest Increase (tran code 210-01)

It also displays all payoff information, such as: a.Overpayment/Underpayment information b.All insurance rebates c.All G/L transactions for items such as refunds for maintenance fees, late charges, loan fees, interest refunds, etc. |

The columns in this list view are as follows:

Date: This is the date of the transaction.

Paid To Date: This is the amount of payments made on the loan to date.

Transaction Amount: This is the amount of the transaction paid toward the loan.

Principal: This is the amount of the transaction applied to reducing the principal for the loan.

Interest: This is the amount of the transaction used to pay interest for the loan.

Escrow: This field displays any escrow payments made on the account.

Late Charge: This is the amount, if any, of the transaction that paid for any late charges accrued on the loan.

PI Fees: This is the amount of any principal and interest fees, if applicable.

Refund: This is the amount of refund, if any, due back the customer after the transaction is processed.

Fees: This is the amount of fees paid when this transaction was run.

Other Fees: This is the amount of any other fees (such as maintenance fees) that were paid when the transaction was run.

Fee Balance: This is the amount, if any, of fees left to be paid on the loan after the transaction is run. If an option is set (see above) this column is not displayed. Instead, the Fee Balance is combined with the Balance column.

Balance: This is the amount of the loan still due after the transaction is processed. This may be combined with the Fee Balance (see above).

Due Date: This is the due date of the loan payment.

Partial Payment: This is the amount of any partial payment made on the loan.

Description: This is a brief description of the transaction.

Significant Field Changes: These are CIM GOLD fields that were significantly altered in the transaction.

Teller Number: This is the teller number of the employee who processed the transaction.

Time: This is the time of day the transaction was processed.

Cash/Check/Journal: This is how the transaction was paid. Possible entries are:

CSH (cash transaction)

CHK (check transaction)

JNL (journal transaction)

ACH (Automated Clearinghouse transaction)

ATM (Automated Teller Machine transaction)

Transaction Code: This is the transaction code for the transaction. A list of transaction codes is found in Appendix D of the GOLD Services manual in DocsOnWeb. A more complete loan transaction code list is found in Appendix A of the Loan manual in DocsOnWeb.