Navigation: Loans > Loan Screens > Account Information Screen Group > Consumer Line-of-Credit Screen > Options tab >

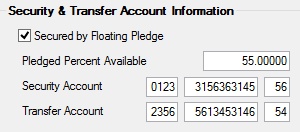

Security & Transfer Account Information field group

Use this field group to view and edit security and transfer information for customer line-of-credit (LOC) loan accounts that have a security deposit account attached.

To learn more about how LOC loans function, see the Line-of-Credit Loan Information help page. The fields in this field group are as follows:

Field |

Description |

||

|

Mnemonic: LNRLFP |

If this field is marked, the balance of the Security Account times the value in the Pledged Percent Available field cannot be lower than the value in the Line of Credit Limit field (unless Deposit transaction condition 46, which overrides any stops in the Loan system, is set for the Security Account).

For example, if the Pledged Percent Available is 90% and the Line of Credit Limit is $1,170, then the balance of the Security Account balance can never be lower than $1,300 (since $1,170 is 90% of $1,300).

If this field is marked, the balance of the Security Account times the value in the Pledged Percent Available field must be greater than the loan balance.

For example, if the Pledged Percent Available is 80% and the loan balance is $1,200, then the security account must contain more than $1,500, since $1,500 times 80% is $1,200. An attempt to lower the security account below the $1,500 limit will result in an error. Additionally, the loan will not be allowed to be advanced above the limit that is equal to the balance of the Security Account times the Pledged Percent Available.

If this field is marked and the loan is associated with a Security Account that is tied to an additional loan, a transaction that increases the principal balance of either loan will not be allowed.

For Non-Revolving LOC accounts, the Credit Used amount is included in the calculation. It is calculated as follows:

SECURED AMOUNT = LOAN BALANCE + (LINE-OF-CREDIT LIMIT - CREDIT USED)

|

||

|

Mnemonic: LNRLPA |

Use this field to indicate the percentage of the Security Account that is available to be advanced on the loan. |

||

|

Mnemonic: LNSECO, LNSECA, LNSECC |

Use this field to indicate the account number of the deposit account by which the loan is secured.

Before a closed loan is dropped, the system checks if it is an overdraft account or a security account in the Deposit System. If it is, the loan number is removed from the deposit account, and history is written for the deposit account. |

||

|

Mnemonic: LNXFRO, LNXFRA, LNXFRC |

Use this field to indicate the account number of the savings account that is used as a transfer account for purposes of overdraft protection or automatic loan repayment.

Loan payments can be drafted from deposit accounts that have overdraft protection. The system will post the payment and pull the funds from the overdraft account if necessary. The overdraft can be advanced from either the same loan for which the payment is being posted or from another account (based on your institution options).

Before a closed loan is dropped, the system checks if it has an overdraft or security account in the Deposit system. If it does, the loan number is removed from the deposit account, and history is written for the deposit account. |