Navigation: Loans > Loan Screens > Account Information Screen Group > Consumer Line-of-Credit Screen > Line-of-Credit Loan Information >

This help page explains how to pay a customer loan account to zero but leave it with an "open" status.

•Perform teller inquiry 197 (Pay-to-Zero inquiry) on the loan through GOLDTeller for the date that interest is to be calculated to. This transaction will give you the amount needed to pay the account to zero.

•Process transaction code 830 (Pay-to-Zero transaction) (cash/check/journal) for the amount and date selected from teller inquiry 197. When the transaction is processed, it will give history showing the portions to interest, principal, and late charges. Note: Reserves and miscellaneous fees must be cleared prior to the processing of this transaction.

Rules

|

Computations

The Pay-to-Zero transaction (transaction code 830) looks at the Loans > Account Information > Account Detail and Consumer Line-of-Credit screen to determine the interest due. In addition, it clears applicable fields with the processing of the transaction.

The Date Last Accrued is the benchmark for all calculations. If the transaction is done after the Date Last Accrued, transaction code 830 calculates the appropriate interest and adds this amount to the accrued interest and any current or prior finance charges due (Finance Charge Information tab of the Loans > Line-of-Credit Loans screen) to determine the total interest due. The total interest due is totaled with the principal balance of the loan to determine the amount required to pay the loan to zero.

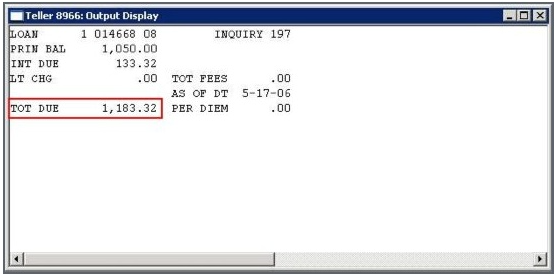

Fields used for inquiry 197 are Account Number and As of Date. The output of the transaction is displayed below; the highlighted information is required to obtain the desired output.

Example of the calculation for a "daily" payment method 5 loan:

Additional Interest 5000.00 * .08125 * # of days (1) = 1.11 365 (# of days is the number of days from the date last accrued to the transaction date)

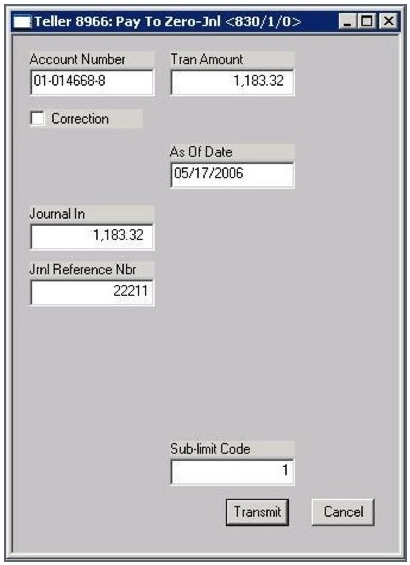

The 830 journal transaction requires the following field entries: Account Number, As of Date, and Journal In. See the following example:

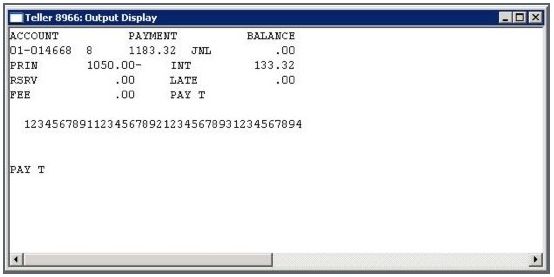

Once you fill in the fields on the initial transaction box for tran code 830 then click <Transmit>, the following output screen will appear. Note: If billing records have not been set up or if sub-limits are not linked to this account, you may get an error message. See item number 6 under Rules in the paragraphs above to understand about billing records.  The Loans > History screen will display that the 830 transaction was processed on the account. The 830 transaction zeros out any billings that are showing on the loan and advances the due date. The following is an example of the calculation for a "periodic" payment method 5 loan accruing interest to the due date. This example shows a loan that has been through the billing process on the 28th of August, and the date last accrued is projected to the due date of 9/01/10. The date last accrued is also advanced to 9/01/10. The transaction is being posted as of 8/30/10. Because the date last accrued was greater than the processing date, the total interest due is adjusted downward for the two-day difference. Loan Due Date: 9-01-10 5000.00 * .08125 * # of days (-2) = -2.23 Accrued Interest: 0.00 |

Transaction 830 Reversals

The following rules apply to transaction 830 reversals (tran code 838). Rules: 1.Do not use the As of dates when processing a correction of this transaction. 2.All transactions that have occurred following the processing of the 830 transaction that you want to correct need to be reversed in sequential order (most current to oldest). 3.An SOV (supervisor override) is required if any account activity has taken place on the loan. 4.Accrued interest is adjusted by the effect of the reversal on the loan. The adjustment is taken from the transaction history date to the current date last accrued on the loan. This date will be the greater of the date you process the corrections or the date last accrued on the loan. 5.When reapplying, do not use As of dates. 6.Correction of the 830 transaction when multiple rate changes have occurred on the loan will result in possible errors in the interest recalculation. An SOV is required when this situation is present on the loan, and manual recalculation of the account interest is highly recommended. An error message will be displayed when this condition exists on the loan. The error message will be "SOV - WARNING LAST RATE CHANGE DATE." (The date of the last change will be displayed.) 7.As part of the reversal processing, any unresolved billings will be put back onto the loan. The total interest due for the loan can be figured by adding the accrued interest, the current finance charges, and the prior finance charges due. 8.The loan due date will reflect the due date associated with the oldest prior billing that is put back onto the loan. Example of the calculation for a "daily" payment method 5 loan 830 transaction correction - with no activity following the original 830 transaction: Loan Due Date: 9-01-10 5000.00 * .08125 * # of days (2) = 2.23 Hist. Accrued Interest: 16.69 The following is an example of the calculation for a "periodic" payment method 5 loan 830 transaction correction – with no activity following the original 830 transaction processing: Loan Due Date: 9-01-10 5000.00 * .08125 * # of days (0) = 0.00 Hist. Accrued Interest: 0.00 The transaction correction date is 9-01-10; the history date last accrued is also 9-01-10. No adjustment to the accrued interest is needed. The due date and billing information will be returned just as they were prior to the initial processing of the 830 transaction. The new current finance charges on the account will be 18.92; the accrued interest on the loan will be zero. |