Navigation: Loans > Loan Screens > Credit Reporting > Credit Reporting Screen >

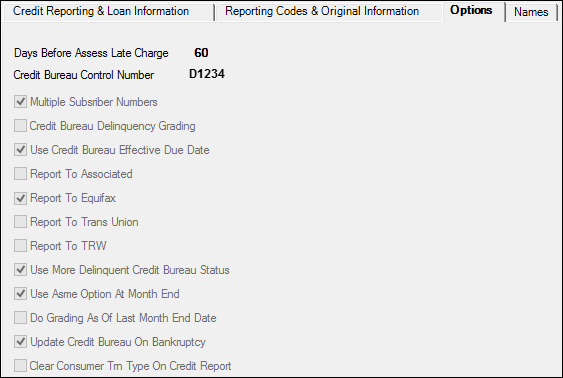

The Options tab of the Credit Reporting screen displays all the institution options set up for your institution. This gives you a quick-at-a-glance to let you know which Credit Reporting options your institution subscribes to. You cannot make changes to the institution options from this tab; they are only here for reference. If you would like any options altered (turned on or off), you must contact your GOLDPoint Systems account manager.

See the following example of this tab, followed by a brief description of each of the options.

Loans > Credit Reporting Screen > Options Tab

Option |

Description |

||

|---|---|---|---|

Days Before Assess Late Charge

(LTCB) |

This option allows you to delay 60 days prior to reporting acquired loans to the credit repositories. |

||

Credit Bureau Control Number

(CBCT) |

This is the number assigned to GOLDPoint Systems by Credit Bureaus. |

||

Multiple Subscriber Numbers

(OP02 MLSR) |

This option will specify whether or not an institution is using multiple subscriber numbers for credit reporting. If this option is on, then each office will have its own subscriber number. |

||

Credit Bureau Delinquency Grading

(OP12 CBDG) |

If this option is set, then the calculation for the delinquency category is as follows: If Partial Payment is not equal to zero, then add one to the due date making the delinquency category act one month less delinquent. |

||

Use Credit Bureau Effective Due Date

(OP11 CBED) |

If this option is on, the system uses the effective due date (based on lifetime late charges and partial payments).

OPA4-UDQG (Use Delinquency Grading) must also be on in order for this option to work. And if this option is on, the Credit Bureau Delinquency Grading option (OP12 CBDG) cannot be used.

See Loans in CIM GOLD > Loan Screens > Account Information Screen Group > Account Detail Screen > Special Delinquency Calculations for Consumer Loans for more information on the UDQG option. |

||

Report To Associated

(CBYT CCA2) |

This option is on if the Credit Report and transmission (FPSRP184) is sent to Associated. |

||

Report To Equifax

(CBYT EQFX) |

This option is on if the Credit Report and transmission (FPSRP184) is sent to Equifax. |

||

Report To Trans Union

(CBYT TRAN) |

This option is on if the Credit Report and transmission (FPSRP184) is sent to Trans Union. |

||

Report To TRW

(CBYT TRW1) |

This option is on if the Credit Report and transmission (FPSRP184) is sent to Experian. |

||

Use More Delinquent Credit Bureau Status

(OP22 UDCB) |

At monthend when GOLDPoint Systems reports to the credit bureaus, we will report the customer based on their delinquent status at monthend. If this option is on, we will report the delinquent status of the customer based on their most delinquent status throughout the month. |

||

Use Asme Option At Month End

(OP17 USME) |

This option must be on in order to use the Do Grading As of Last Month End Date option (see below). |

||

Do Grading As Of Last Month End Date

(DOPT ASME) |

This option is on if your institution wants to grade loans based on the last monthend date. |

||

Update Credit Bureau On Bankruptcy

(OP28 CCTT) |

If this option is used, the Consumer Information Indicator code (CIID) from the bankruptcy record will be sent in the Base Segment (Field 38) of the Credit Report and transmission (FPSRP184).

|

||

Clear Consumer Trn Type on Credit Report

(OP28 CCTT) |

If this option is on, the Consumer Tran Type field will be cleared. The transaction type will also not appear on the Credit Report and transmission (FPSRP184) and will therefore not be reported to Credit Bureaus.

|