Navigation: Loans > Loan Screens > Account Information Screen Group > Consumer Line-of-Credit Screen > Information tab >

Balance Information field group

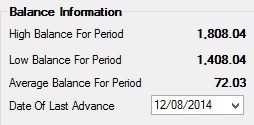

This field group displays balance information for the selected customer line-of-credit (LOC) loan account.

To learn more about how LOC loans function, see the Line-of-Credit Loan Information help page.

The High and Low Balance for Period fields display the highest and lowest balances on the loan from the specified Date Last Finance Charge to the current date (mnemonic LNRLHG/LNRLLW).

The Average Balance for Period is a daily average calculated each time this screen is accessed (mnemonic LNWRLAV). This balance will appear in the history as "RAV." This balance is the balance used to calculate interest when the Finance Charge Code begins with "0." This field is calculated as follows:

{(LNPBAL X DAYS 1) + LNRLAV} ÷ DAYS 2 = AVERAGE BALANCE FOR PERIOD

LNPBAL = Loan principal balance

DAYS1 = Inquiry date* minus date of last transaction

LNRLAV = Sum of daily loan balance up to the date of last transaction

DAYS2 = Inquiry date* minus date of last finance charge

* The system uses the bill date in the calculation when generating billing statements.

|

Note: If the last transaction date is before the last finance charge date, the last finance charge date is used for calculating the average balance for inquiries and billing statements. |

|---|

This field group also displays the Date of Last Advance for the loan (mnemonic LNRLAD).