Navigation: Loans > Loan Screens > Line-of-Credit Loans Screen > Line Of Credit Information tab >

Options field group

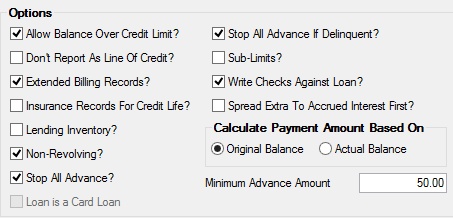

Use this field group to view and edit options for the customer line-of-credit (LOC) loan account.

To learn more about how LOC loans function, see the Line-of-Credit Loan Information help page.

The fields in this field group are as follows:

Field |

Description |

||

Allow Balance Over Credit Limit?

Mnemonic: LNRLOC |

Use this field to indicate whether the system allows transactions to increase the credit balance on the customer loan account even if a transaction would exceed the credit limit.

|

||

Don't Report As Line Of Credit?

Mnemonic: LNDLOC |

Use this field to indicate whether the customer loan account will be reported as a line-of-credit loan on the TFR CC Report (FPSRP171), lines 410, 420, 430, or 435. |

||

|

Mnemonic: LNRLLI |

Use this field to indicate whether the customer loan account uses lending inventory.

Lending inventory allows your institution to track individual collateral items that make up a line of credit. Your institution can enable Sub-Limits (see below) or lending inventory, but not both. |

||

|

Mnemonic: LNNLOC |

Use this field to indicate whether the customer loan account is a revolving loan. |

||

|

Mnemonic: LNRLST |

Use this field to indicate whether principal increases are allowed on the customer loan account.

Two institution options are available for use on payment method 5 loans.

•Institution Option DRAL will stop HELOC or line-of-credit advances over an institution-defined amount. For example, if your institution limit is $5,000, a draft of $5,000 or higher will be rejected.

•Institution Option NDLA will stop HELOC or line-of-credit advances if the date of the last advance is either blank or greater than (or equal to) the number of days defined by your institution. For example, if your option is 180 days, any advances on loans with a Date of Last Advance 180 days or more in the past will be rejected.

For both options, rejected transactions will appear on the Afterhours Exception Report (FPSRP013) and the Auto Entry Register (FPSRP028). Send a work order to GOLDPoint Systems to request these options.

An additional option is also available that automatically changes this field when the principal portion of a payment is calculated based on a predetermined date. For this option to be enabled, update function 76 must be set to "daily" via a work order. |

||

|

Mnemonic: N/A |

Use this field to indicate whether the customer loan account is a card loan. See the Loans > Cards and Promotions screen for more information about cards. |

||

Stop All Advance If Delinquent?

Mnemonic: LNRLDS |

Use this field to indicate whether principal increases are allowed on the customer loan account if the account is in a state of delinquency. The system calculates an account' delinquency status by calculating the due date plus the grace days. If the date is less than or equal to the present date or past the maturity date and this field is marked, the system will reject any advance against the loan.

The account will appear on the Afterhours Processing Exception List (FPSRP013) showing the account number, the attempted advance amount, and the exception description, "DELINQUENT LOAN - NO ADVANCES" if an advance is attempted with this feature enabled.

If a loan is past the maturity date, a principal advance (increase) will not be allowed regardless of the status of this field. The error message "LOAN PAST MATURITY, ADVANCES NOT ALLOWED" will be displayed both in the GOLDTeller System and the GOLD ExceptionManager for line-of-credit loans. If there is no maturity date, advances will continue to process. This applies for all payment methods. |

||

|

Mnemonic: LNSUBL |

Use this field to indicate whether the customer loan account uses sub-limits. Your institution can enable sub-limits or Lending Inventory (see above), but not both. |

||

|

Mnemonic: LNRLWC |

Use this field to indicate whether the customer loan account is allowed to be increased by check drafts. If this field is not marked, any checks that attempt to clear against the loan will be rejected. They will appear on the Afterhours Exception Listing (FPSRP013). Use the account number and add "70" to the check digit on the draft for inclearing checks.

Use the Minimum Advance Amount field below to indicate the minimum value your institution allows for checks written against the loan.

Loan Rejects Line-of-credit checks that are rejected due to insufficient funds in the loan account are processed through GOLD ExceptionManager. Two teller transaction codes are associated with this: Tran code 700 will return the LOC check, and tran code 708 is the correction. In addition, as checks are returned, you can assess a fee at the same time. The system defaults to your institution options for the Service Fee amount.

GOLD ExceptionManager allows file maintenance to the defaulted amount through a chargeback item. Review the GOLD ExceptionManager User's Guide on DocsOnWeb for more information on how to create a chargeback. The return of checks using GOLD ExceptionManager will also write to loan history identifying the date, time, teller number, and the check number. If a fee is assessed, it will also appear in history. |

||

Spread Extra To Accrued Interest First?

Mnemonic: LNACFR |

Use this field to indicate whether excess funds on the customer loan account should should be placed in accrued interest before any other location. |

||

Calculate Payment Amount Based On

Mnemonic: LNOORA |

Use these radio buttons to indicate whether payment amounts for the selected customer loan account should be calculated based on the account's Original or current (Actual) balance. |

||

|

Mnemonic: LNRLMA |

Use this field to indicate the minimum value your institution allows for checks written against the customer loan account. The Write Checks Against Loan field above must be marked in order for this field to be available. |