Navigation: Loans > Loan Screens > Line-of-Credit Loans Screen > Finance Charge Information tab >

Service Fee field group

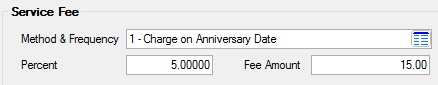

Use this field group to view and edit service fee information for the customer line-of-credit (LOC) loan account.

To learn more about how LOC loans function, see the Line-of-Credit Loan Information help page.

Fields in this field group are as follows:

Field |

Description |

||||||||||||||

|

Mnemonic: LNRLSM |

Use this field to indicate if, when, and how service charges are applied to a loan. Service fees do not replace late charge fields. As service fees are charged, the loan's principal balance is increased by the fee amount.

OPTIONS AND UPDATE FUNCTIONS Update function 56 – To use this field, submit a work order requesting that the service fee charge option (update function 56) be enabled.

Update function 75 – If the loan has a zero balance and a service fee is assessed on the same night the billing statement is generated, nothing will be billed and afterhours update function 75 will advance the loan due date an additional frequency. This will prevent a late charge from being assessed prematurely.

Transaction Origination Code 101 needs to be mapped in the Autopost prior to the assessment or payment of service fees.

Possible selections in this field are:

|

||||||||||||||

|

Mnemonic: LNRLSP |

Use this field to indicate a percentage that will be used to calculate service fees as defined in the Method & Frequency field, rather than an amount. |

||||||||||||||

|

Mnemonic: LNRLSA |

Use this field to indicate an amount that will be used to calculate service fees as defined in the Method & Frequency field, rather than a percent. |