Navigation: Loans > Loan Screens > Insurance Screen Group > Tracking Insurance Screen > Tracking Insurance Screen: Homeowners >

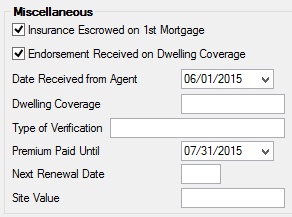

Miscellaneous field group

Use this field group to view and edit detailed information about insurance for the collateral item being tracked on the customer loan account.

These fields only appear on the Homeowners version of the Tracking Insurance screen.

The fields in this field group are as follows:

Field |

Description |

Insurance Escrowed on 1st Mortgage

Mnemonic: REIE1M |

Use this field to indicate whether the insurance policy for the collateral item being tracked on the customer loan account is in escrow for the first mortgage.

Mortgage escrow accounts ensure that homeowners' property taxes, fire and hazard insurance premiums, mortgage insurance premiums, and other escrow items are paid in a timely fashion. They are a guarantee that there is always adequate funds to pay these bills when they are due so the homeowner avoids the risk of lapsed insurance coverage or delinquent taxes. |

Endorsement Received on Dwelling Coverage

Mnemonic: REETLC |

Use this field to indicate whether the indicated insurance Company has received an endorsement for the insurance property being tracked on the customer loan account.

An endorsement is an amendment to a contract (such as an insurance policy) by which the original terms are changed. For example, if a homeowner makes significant improvements to his or her house, he or she could apply for an endorsement from the insurance company to increase the homeowner's insurance coverage. Endorsements can also be created annually that adjust the homeowner's insurance policy to account for increases in rebuilding costs, as determined by the industry's inflation statistics. |

|

Mnemonic: REDRFA |

Use this field to indicate the date information about the insurance policy for the collateral item being tracked on the customer loan account was received by your institution (from the indicated insurance Agent). |

|

Mnemonic: REDCMT |

Use this field to indicate the amount (in dollars) needed to rebuild the insurance property being tracked on the customer loan account (if the property were completely destroyed).

Dwelling coverage does not reflect the property purchase price. It reflects the estimated current costs to rebuild the property. A simple way to estimate this amount is to multiply the square footage of the property by the local building cost per square foot. A local insurance agent or real estate agent can provide the local building cost figure.

Your institution designates how much dwelling coverage is required for a home loan. |

|

Mnemonic: REIDOC |

Use this field to indicate the type of documentation used to verify that the insurance policy for the collateral item being tracked on the customer loan account is valid. Valid types of documentation include a letter from the insurance company, an insurance card, a phone call or fax, etc. |

|

Mnemonic: REPPUD |

Use this field to indicate the future date up to which premiums have been paid for the insurance property being tracked on the customer loan account. Premiums are generally paid in advance on a yearly basis. |

|

Mnemonic: RDRNEW |

Use this field to indicate the next renewal date of the insurance policy for the collateral item being tracked on the customer loan account. Most homeowner insurance policies are renewed automatically on a yearly basis. |

Site Value

Mnemonic: RESTVL |

Use this field to indicate the current appraised value of the insurance property being tracked on the customer loan account. |