Navigation: Loans > Loan Screens > Insurance Screen Group > Tracking Insurance Screen > Tracking Insurance Screen: Homeowners >

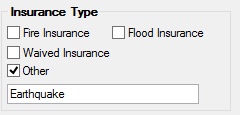

Insurance Type field group

Use this field group to indicate the types of coverage included in the insurance policy for the collateral item being tracked on the customer loan account.

These fields only appear on the Homeowners version of the Tracking Insurance screen.

Use this field group to indicate the types of coverage included in the insurance policy being created/edited for the customer loan account. Possible selections in this field group are Fire Insurance, Flood Insurance, and Other (mnemonic REFIRE/REFLOD/REIOTH/REIOTD). Mark the checkbox fields to indicate which types of coverage are included. Mark Waived Insurance if the customer has waived insurance for any reason (mnemonic REWAIV).

In addition to the checkbox field, the Other selection provides a text box to indicate a basic description of any additional coverage included in the policy.

Typically, there are six main types of homeowner's insurance currently used. Homeowners with mortgages are required by lenders to have homeowner's insurance. Homeowner's policies are classified by the types of coverage they include. These six main types are:

•HO-1. This is basic coverage for home and personal property. This policy covers losses from 11 perils: fire, lightning, windstorm, hail, explosion, riot or civil commotion, damage from aircraft or vehicles, smoke, vandalism or malicious mischief, theft, glass breakage, and volcanic eruption.

•HO-2. This broad-form policy covers home and personal property against losses from the same disasters as HO-1 plus additional perils: falling objects (ice, snow, or sleet) and building collapse caused by maintenance issues (pipes bursting from heat/cold; overflow of water from hot water heater; heating and air-conditioning systems; and electrical surge damage).

•HO-3. This policy is referred to as extended or all-risk coverage. HO-3 covers all perils except those excluded in the policy: flood, earthquake, war, and nuclear accident. Mold damage is now being excluded in some HO-3 policies.

•HO-4. This policy is referred to as renter's coverage. It covers only personal property from 17 listed perils similar to HO-2 policies (except glass breakage).

•HO-6. This type of coverage is for condominiums. It also covers personal property from the 17 listed perils plus the interior walls that are not covered by the condominium's insurance policy.

•HO-8. This covers older homes that may not be up to current codes. It covers home and personal property from the 11 perils listed in HO-1 policies. This policy is different from HO-1 in that it covers repair costs. It does not cover rebuilding costs.