Navigation: Loans > Loan Screens >

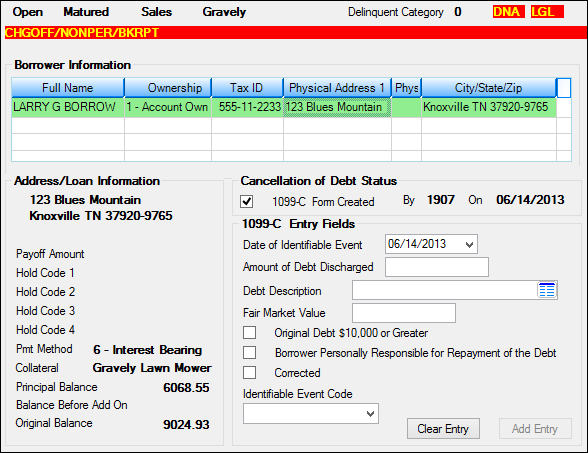

Use this screen to view and edit IRS 1099-C (Cancellation of Debt) information for customers at your institution.

This list view at the top of this screen displays basic information about the name, address, and ownership status of the customer. Once information is entered in the other fields on this screen and added to this list view (when <Add Entry> is clicked), this information cannot be deleted on this screen. IRS GOLD must be used to delete any previously entered information. However, information can be edited using the fields on this screen (and marking the Corrected field). All customers are displayed in the list view regardless of ownership status. However, 1099-C forms will only be created for the IRS owner, account co-owner, or co-signers of the loan. The IRS owner is selected by default and will be highlighted in green. If Original Debt $10,000 or Greater is marked, any account co-owners or co-signers will also be selected and highlighted green.

Loans > IRS Form 1099-C Screen

After data has been entered on this screen, use IRS GOLD to view and print 1099-C forms. The data is stored until your institution's IRS forms are transmitted to the IRS via GOLDPoint Systems (Refer to IRS GOLD documentation for more details). Once the 1099-C data has been added from this screen, any Corrections or deletions to the data should be performed in IRS GOLD. Note:

|

Note: 1099-C information can also be set up directly in IRS GOLD. |

|---|

The address information sent to IRS GOLD when creating a 1099-C will be the Physical Address associated with the csutomer (if applicable) or the mailing label address associated with the account (if no Physical Address is present).

|

WARNING: Your institution is responsible for determining which data should be reported to the IRS, and for whom it is reported. |

|---|

|

Note: The Bankruptcy field displayed on Box #6 on the IRS form will be automatically updated if applicable bankruptcy hold codes are present on the customer account, or if the Identifiable Event Code field on this screen is set to “Bankruptcy (A).” |

|---|

Institution Option T99C automatically causes a 1099-C to be created when a loan is fully written off (tran code 2510-05) or partially written off (tran code 2510-00). The 1099-C will be created only for the customer's Social Security number. The write-off amount must be $600 or more and the account must not be in bankruptcy (hold code 4 or 5). If the write-off or partial write-off transaction is corrected, the 1099-C associated with the customer's SSN and account will be deleted.

Click <Clear Entry> to clear information from the 1099-C Entry Fields field group before it is submitted to IRS GOLD. To submit the information in these fields, click <Add Entry>.

The fields groups on this screen are as follows:

Address/Loan Information field group

Cancellation of Debt Status field group

1099-C Entry Fields field group

See also:

|

Record Identification: The fields on this screen are stored in the FPLN and FPIR records (Loan Master, IRS Information Returns). You can run reports for these records through GOLDMiner or GOLDWriter. See FPLN and FPIR in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |