Navigation: Loans > Loan Screens > IRS Form 1099-C Screen >

1099-C Entry Fields field group

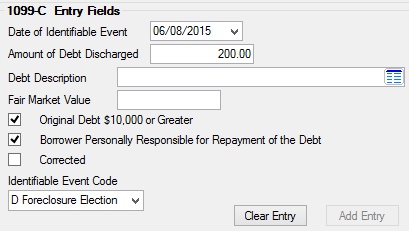

Use this field group to view and edit information for IRS Form 1099-C (Cancellation of Debt) before forwarding it to IRS GOLD.

Once information has been entered in these fields, click <Add Entry> to submit the information to IRS GOLD. Once this happens, data in these fields cannot be deleted.

Institution Option T99C automatically causes a 1099-C to be created when a loan is fully written off (tran code 2510-05) or partially written off (tran code 2510-00). The 1099-C will be created only for the customer's Social Security number. The write-off amount must be $600 or more and the account must not be in bankruptcy (hold code 4 or 5). If the write-off or partial write-off transaction is corrected, the 1099-C associated with the customer's SSN and account will be deleted.

The fields in this field group are as follows:

Field |

Description |

|

|

Mnemonic: IRAADT |

Use this field to indicate the date of the event selected in the Identifiable Event Code field below. |

|

|

Mnemonic: IRPAF2 |

Use this field to indicate the amount of the debt your institution is canceling on the customer loan account. |

|

|

Mnemonic: IRPROP |

Use this field to indicate a description of the debt that your institution is canceling on the customer loan account. You must choose a value in this field before <Add Entry> can be clicked. Debt descriptions must first be set up on the Loans > System Setup Screens > Debt Description screen before they can be used in this field.

If your institution wants the loan open date to appear in this field, a debt description can be set up using special descriptor "^LNOPND." For example, if you enter the description “Note Dated ^LNOPND” on the Debt Description screen, the dept description will show “Note Dated MM-DD-YYYY” (where the “MM-DD-YYYY” is the loan open date) on the form. |

|

|

Mnemonic: IRPAF7 |

Use this field to indicate the fair market value of the collateral item on the customer loan account.

The following instructions are given to the customer by the IRS for Form 1099-C:

"If, in the same calendar year, a foreclosure or abandonment of property occurred in connection with the cancellation of the debt, the fair market value (FMV) of the property will be shown, or you will receive a separate Form 1099-A, Acquisition or Abandonment of Secured Property. Generally, the gross foreclosure bid price is considered to be the FMV. For an abandonment or voluntary conveyance in lieu of foreclosure, the FMV is generally the appraised value of the property. You may have income or loss because of the acquisition or abandonment. See Pub. 544, Sales and Other Dispositions of Assets, for information about foreclosures and abandonments." |

|

Original Debt $10,000 or Greater

Mnemonic: IRDDIB |

Use this field to indicate whether the original debt on the customer loan account was $10,000 or higher. If this field is marked, any account co-owners or co-signers will also be selected and highlighted in green in the Borrower Information list view. |

|

Borrower Personally Responsible for Repayment of the Debt

Mnemonic: IRBPLR |

Use this field to indicate whether all borrowers on the customer loan account for whom the 1099-C form is being set up will be marked as being personally liable for the repayment of borrowed debt. This information is also passed through to IRS GOLD and the transmission program. |

|

|

Mnemonic: N/A |

Use this field to indicate whether the IRS form for this loan has been corrected from a previous version. This information is passed through to IRS GOLD and then transmitted to the IRS by GOLDPoint Systems. |

|

|

Mnemonic: IRCL01 |

Use this field to indicate an event code pertaining to your institution canceling the customer's debt. See below for more information.

|