Navigation: Loans > Loan Screens >

The Loans > Competitor Inquiry screen provides at-a-glance information concerning the selected loan account. You can use this information to quickly assess the account and how to market additional loans or payment plans to the account owner.

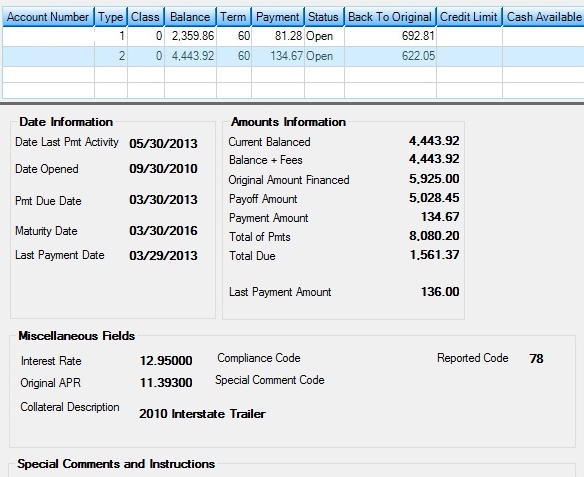

The list view at the top of this screen displays all accounts tied to the borrower. If you select one of these accounts, the fields below the list view will be populated with information for that account. This list view displays general account information, such as the account number, the loan type, loan classification, principal balance, balance, term, payment, and status of the loan (open, closed, etc.). See below for more information about the columns in this list view.

The Back to Original column is calculated as follows:

•If the loan is not a precomputed loan (payment method 3): Original Balance - Payoff Amount - Prepaid Interest - Insurance Premiums - Reserve Coverage Amount - Total Fees = Back to Original

•If the loan is a precomputed loan: Total Payment - Original Interest Add-on - Interest on Insurance - Payoff Amount - Prepaid Interest - Insurance Premiums - Reserve Coverage Amount - Total Fees = Back to Original. If a Tennessee loan, then also subtract Extension Interest

Some institutions use the Back to Original column for marketing purposes. This amount can give users the lending authority to lend customers additional funds back to the original amount without needing approval.

The Credit Limit column is set up for the account using the Overall Credit Limit field on the CIF tab of the Loans > Marketing and Collections screen.

Cash Available is for line-of-credit loans. It displays the remaining line-of-credit that can be borrowed for this account owner. It is pulled from the Remaining Line field on the Loans > Line-of-Credit Loans screen.

The cs1 and cs2 columns display the credit score for this borrower. This information is pulled from GOLDTrak PC at the time of funding. However, you can manually change or enter a credit score using the Edit Credit Score link on the CIF tab the Loans > Marketing and Collections screen.

|

Loans > Competitor Inquiry Screen

The field groups on this screen are as follows:

Amounts Information field group

Miscellaneous Fields field group

Special Comments and Instructions field group

|

Record Identification: The fields on this screen are stored in the FPLN record (Loan Master). You can run reports for this record through GOLDMiner or GOLDWriter. See FPLN in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |