Navigation: Loans > Loan Screens > Commercial Loans Screen Group > Property Management Screen >

Commercial Loans screens in CIM GOLD are used to handle your institution's property management needs for commercial loans. Use this tab to view and edit appraisal and Brokers Price Opinion (BPO) information about the commercial loan property (as well as view basic loan information).

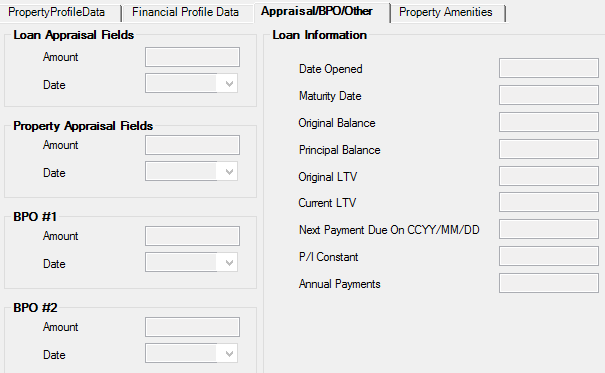

Loans > Commercial Loans > Property Management Screen, Appraisal/BPO/Other Tab

The Loan Appraisal fields (mnemonic LNAPAM/LNAPRS) display the original appraisal Amount and Date for the commercial loan as set when the loan was created.

Use the Property Appraisal fields (mnemonic PZAPA2/PZAPD2) to indicate the most recent appraisal Amount and Date for the commercial loan property.

Use the two BPO field groups (#1 and #2) to indicate two Amounts and Dates for BPO valuations on the commercial loan property. BPO refers to the probable sales price of the property based on an "as is" value with a 120-day marketing time (mnemonic PZ1BPV/PZ1BPD/PZ2BPV/PZ2BPD).

The fields in the Loan Information field group on the right side of this tab display basic information about the loan. This information is as follows: