Navigation: Deposit Reports > Deposit Reports - Numerical Order >

CONTENTS |

This report must be set up to process daily. It can only be set up once per institution. There are 11 different sections in the report for 11 different records that are screened against the OFAC file. Based on the data screened, the report will process either every day, or when the OFAC database is updated.

There are some prerequisites to begin using this new OFAC screening:

•Clients must be on Sierra.

•Clients must be on the newest account number conversion program (Institution Option NRCV; contact your GOLDPoint Systems account manager if you do not know).

•Institution Option DFFN (Bank Uses Consolidated OFAC) must be turned on for your institution.

•This report must be set up for your institution. All OFAC screening reports will be combined into this one new report. It will be printed in sections based on the records being checked. Reports FPSDR169, FPSDR213, FPSDR216, and FPSDR226 are obsolete and should not be processing for your institution. Your internal audit procedures will need to be modified to incorporate all of the reports created for OFAC screening.

GOLDPoint Systems automatically checks every two hours from 6:00 a.m. to 4:00 p.m. daily to see if there are new files.

Combined OFAC Files

The combined OFAC list consists of these files:

•Specially Designated Nationals (SDN), published by OFAC. Persons in this list are blocked from doing financial transactions in the U.S.

•Foreign Sanctions Evaders (FSE), published in the consolidated sanctions list by the U.S. Treasury - OFAC. Persons in this list are blocked from doing financial transactions in the U.S.

•Sectoral Sanctions Identifications (SSI), in the consolidated list. Directives in the individual entries describe the prohibitions on dealing with the names in this list.

•Palestinian Legislative Council (NS-PLC), in the consolidated list. Those in this list are blocked from doing financial transactions in the U.S.

•List of Foreign Financial Institutions Subject to Part 561 (Part 561), in the consolidated list. Persons on this list may not be subject to sanctions after October 18, 2015. Banks will need to refer to the U.S. Treasury website for specific sanction waivers.

•Non-SDN Iranian Sanctions Act (NS-ISA), in the consolidated list. Banks will need to refer to the U.S. Treasury website for specific sanction waivers.

•Financial Crimes Enforcement Network (FinCEN 314a), a list published only to banks and not accessible to GOLDPoint Systems. This list never blocks transactions; instead, banks must report any activity within the last six months or any accounts on file within the last year for people on this list.

This report compares individual, company, and trust names against the OFAC (Office of Foreign Assets Control) lists.

The records that are screened are as follows:

•ACH records—Deposit accounts incoming ACH records (processes daily based on transactions)

•Accounts Payable checks and ACH records (processes daily based on transactions)

•Accounts Payable vendor list (processes with OFAC file changes)

•Bill Payment records (processes daily based on transactions)

•Check Reconciliation records (processes daily based on transactions)

•CIM GOLD Check Writer records—Teller system online OFAC check

•CIF Person, Organization, Trust records (processes with OFAC file changes)

•E-ACH records (processes daily based on transactions

•International ACH records (processes daily based on transactions)

There are no options or sorts available on this report setup.

|

Note: A companion screen in CIM GOLD is available where you can quickly run OFAC searches. It's called the OFAC Search Screen and it is found under the Miscellaneous system. See the OFAC Search Screen topic for more information. You can also quickly run a name against OFAC by clicking the <Search OFAC> button on the Customer Relationship Management > Households screen > Names tab > Detailed Personal Information tab. |

|---|

Additionally, when loans are originated, users can verify names against the OFAC database in GOLDTrak PC by clicking the <Search OFAC> button on the application screen.

The OFAC SDN list and the OFAC consolidated list are matched against customer names using the same criteria. Older OFAC matching schemes used by GOLDPoint Systems as well as the OFAC Internet pages were analyzed to come up with this adjusted matching version. In analyzing matching schemes, the scheme described here and employed by this system seems to provide the fewest false positives while catching names with slight spelling variations that may be misspellings of one of the sanctioned names. The proximity is set at 80% and the confidence level at 70%. We also use a variable confidence level, as shown in section 3b below.

For each name, both the customer name and the sanctioned name are converted to Soundex representations. The following steps explain how Soundex works on this sample text:

“Ben Franklin was born on January 17, 1706.”

1.The name or phrase we want to use Soundex for is converted to uppercase letters, and all special characters and numbers are removed. The result looks like the following example:

BEN FRANKLIN WAS BORN ON JANUARY

2.The first letter of each word is kept, and all the following letters are eliminated: A, E, I, O, U, W, and Y:

BN FRNKLN WS BRN ON JNR

3.Each word is converted to a six-letter Soundex code by keeping the first letter and replacing the remaining letters with numeric values until the code is six digits long or until the end of the word is reached. The replacement digit is not added if it is the same as the previous digit. If the end of the word is reached and the code isn’t six digits long, enough zeros are added to the end to make it six digits.

4.The letters are replaced according to the list below:

•B, F, P, and V are replaced by a “1.”

•C, G, J, K, Q, S, X, and Z are replaced by a “2.”

•D and T are replaced by a “3.”

•L is replaced by a “4.”

•M and N are replaced by a “5.”

•R is replaced by a “6.”

The result for the example text above is as follows:

B50000 F65245 W20000 B65000 O50000 J56000

When the matching process takes place, the following steps are used to evaluate the match:

1.For each six-letter Soundex code in the phrase, we look up any words on the sanctioned list that contain the same code.

2.We look at each code within the sanctioned item and compare how many of the sanctioned codes are within a certain number of words in the original phrase, to the current position in the phrase. By matching words within a certain proximity, we can avoid matching a word found at the beginning of a customer name with a word at the end of sanctioned name. For most names, the entire name is matched, but the proximity matching helps to have fewer false positives for names containing several words. If a word in the phrase has already been matched, it will not be matched again when we process the next customer name word. Several customer names and sanctioned names have the same word twice in the name or similar words that map to the same Soundex code. The process ensures that we treat each occurrence of a word uniquely and do not match one word in the customer name to two words in the sanctioned name or vice versa.

3.Once the matches have been determined we determine the confidence of the match as follows:

a.If there is only one word in the sanctioned name, the customer name must also have only one word, and they must have a Soundex match.

b.When there is more than one word in the sanctioned name, the name is considered to be a suspect match as shown in the table below.

Number of Words Matched |

Total Number of Words in the Phrase |

Variance Percentage |

1 |

1 |

100 |

2 |

2 |

100 |

3 |

3 |

100 |

3 |

4 |

75 |

4 |

5 |

80 |

5 |

6 |

83 |

6 |

7 |

85 |

6 |

8 |

75 |

7 |

9 |

77 |

8 |

10 or more |

80 |

Once a customer name has been determined to match a sanctioned name based on the Soundex matching described above, two additional options (explained below) can be applied to help reduce the number of false positives for persons. If these options are set, they will be used on every OFAC person search you process.

•OFL1–OFAC: Only exact last names 1st word? If this option is set, an individual will not be matched if the first word of the customer's last name is not identical to the first word of the sanctioned last name. This option is ignored when the customer name may be either an individual or an entity, or when the sanctioned name is not an individual.

•OFLA–OFAC: Only exact last names all words? If this option is set, an individual will not be matched if the entire customer's last name is not identical to the entire sanctioned last name. This option is ignored when the customer name may be either an individual or an entity, or when the sanctioned name is not an individual.

These options are set up by your GOLDPoint Systems account manager in the Organization Options (also known as Institution Options). However, additional OFAC options are available from the Options > User Preferences screen accessed from the top main menu bar in CIM GOLD. See the OFAC tab under User Preferences in the CIM GOLD User's Guide for more information concerning these additional options. Also see Skip OFAC Testing on Individual Records below for information on how to stop OFAC for specific accounts.

Skip OFAC Testing on Individual Records

Sometimes certain names appear on the report when you know that they should not. This generally happens because the Soundex matches a name in the OFAC file. You can prevent a name from appearing on the report by selecting the Skip OFAC Testing? field on the following screens:

Deposits > Account Information > Incoming ACH tab in CIM GOLD. This will stop specific deposit incoming ACH account information from being screened by OFAC. Note: If multiple ACH transactions are presented with the same individual name, you must select the Skip OFAC Testing? field on each of the individual ACH items.

Deposits > Customer Directed Transfers > Account Payees screen in CIM GOLD. This will stop deposit Bill Payer Customer Directed Transfers to specific payees from being screened by OFAC. For example, a deposit account owner has a monthly payment set up on the Customer Directed Transfers screen to send a monthly payment to someone whose name is always flagged as suspect by OFAC. You've extensively researched the name and it has been verified as not a threat. To avoid having the account flagged in the future, you would go to the Account Payees screen and check the Skip OFAC Testing box for that payee.

|

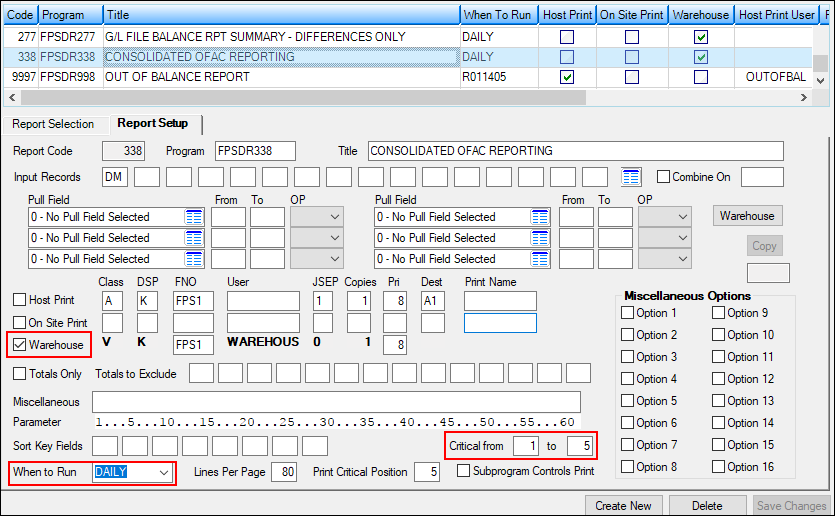

GOLDPoint Systems Only: The report should be set up as follows:

When to Run: Daily

See the following example of the Deposit Reports Setup screen:

GOLDPoint Systems > Report Setups > Deposit Reports Screen |

|---|

ACH

The following table explains the columns in the ACH OFAC MATCHES section of the report. If this section is included on this report, an OFAC suspect name was found originating from either deposits (see the Deposits > Account Information > Incoming ACH tab) or loans (loan payment made using ACH).

Column Heading |

Description |

Account Number |

This is the account number where the suspected ACH transaction was debited or credited. |

Company Name |

This column displays the company name from the ACH transaction detected as suspect in OFAC. |

Last Amount |

This column displays the amount of the ACH transaction detected as suspect in OFAC. |

Individual Name |

This is the individual name of the ACH transaction that has been flagged as suspect in OFAC. |

(no heading) |

This last column lists any names and aliases that matched the Soundex of the Individual Name (see above). |

Accounts Payable Checks and ACH

The following table explains the columns in the ACCOUNTS PAYABLE CHECKS AND ACH section of the report. If this section is included on this report, an OFAC suspect name was found in the Accounts Payable system. Accounts Payable checks are created through Invoice Posting (function 29/30) and check printing (see section 5.6, Print Checks). ACH payments are also created through Invoice Posting (function 29/30) and then verified through function 13 (see section 5.5, ACH Verification) in the Accounts Payable system in GOLDVision.

Column Heading |

Description |

Client |

This is the client number where the check or ACH transaction originated. |

Bank |

This is the bank number the check or ACH was issued from. |

Chk/ACH# |

This is the check number or ACH Control Statement Number that was issued. |

Created |

This is the date the check or ACH was created. |

Effective |

This is the date the check or ACH is effective. |

Status |

This is the status of check or ACH. If it is blank, then the check or ACH is paid. A "V" will show in this column if the check or ACH was voided. |

Check/ACH Amnt |

This is the amount of the issued check or ACH transaction. |

Vendor # |

This is the vendor number assigned to the payee name that is an OFAC match or suspect. |

Payee Name |

This is the Payee name screened against the OFAC file. |

Accounts Payable Vendors

The following table explains the columns in the ACCOUNTS PAYABLE VENDORS section of the report. If this section is included on this report, an OFAC suspect name was found originating from the Accounts Payable Vendor List (see section 2.5, Vendor Screens, in the A/P manual).

Column Heading |

Description |

Client |

This is the client number where the vendor master record that has been matched in OFAC is located. |

Vendor # |

This is the vendor number assigned to the payee name that is an OFAC match or suspect. |

Payee Name |

This is the Payee name screened against the OFAC file. |

Name Type |

This is either "regular payee" or "alternate payee." Regular vendors are set up using the Vendor Master screen (function 17/18) in Accounts Payable. Alternate payees are set up using the Vendor Master Screen 2 (function 17/18, then <F1>) in Accounts Payable. |

Bill Payer

The following table explains the columns in the BILL PAYER PAYEES section of the report. If this section is included on this report, an OFAC suspect name was found originating from the Deposits > Customer Directed Transfers > Customer Directed Transfers screen using Distribution Type of "B - Bill Payer" (see Distribution Type in the Deposits in CIM GOLD manual).

Column Heading |

Description |

Account Number |

This column shows the account number from the Bill Payment record that has been matched in OFAC. |

Xfer Nbr |

This is the sequence number for the Bill Payment record that was matched in OFAC. |

Transfer Amount |

This column displays the amount of the Bill Payment transaction that was matched in OFAC. |

Payee Name |

This is the payee name where the Bill Payment was sent, and who the OFAC record matched. |

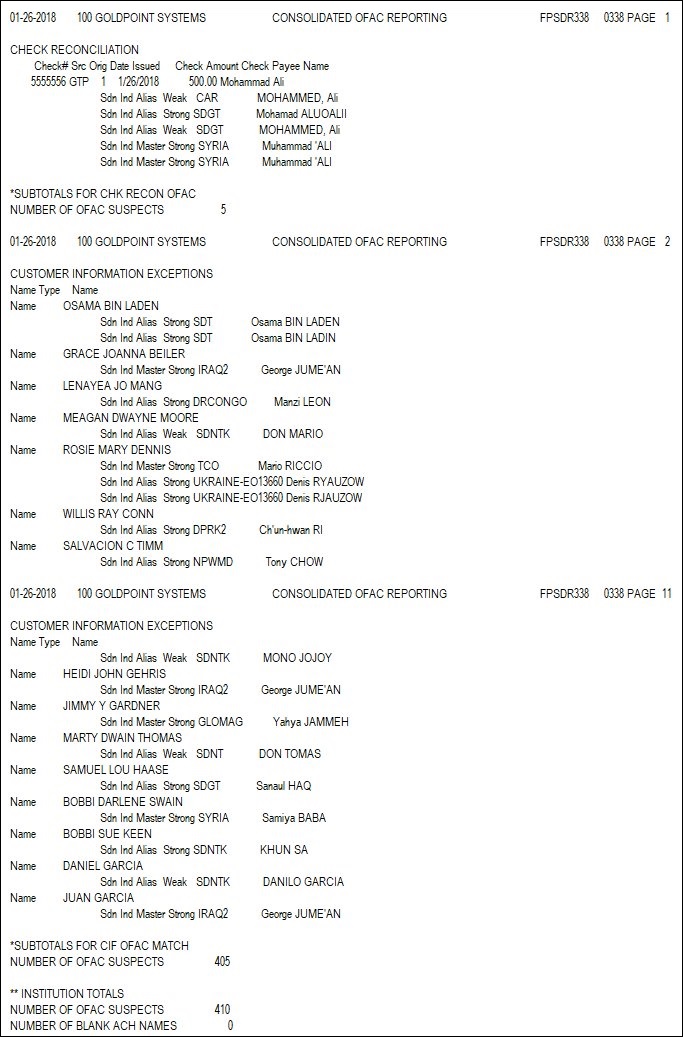

Check Reconciliation

The following table explains the columns in the CHECK RECONCILIATION section of the report. If this section is included on this report, an OFAC suspect name was found in Check Reconciliation.

Column Heading |

Description |

Check Number |

This is the check number from the Check Reconciliation record (CRCHK#) where an OFAC match was detected. |

Src |

This is the source the check was created from (CRSRCE). Valid entries for this field are as follows:

A/P - Accounts Payable-originated checks

ADM - Administrative checks (manually entered or voided checks added by the system)

CCK - Cashier’s checks

CDT - Customer Directed Transfer checks (Bill Payer)

CKW - GOLDTeller (Check Writer), tran code 1965, or GOLDTrak (Check Writer)

EXT - External posting check reconciliation check

GTP - Checks from GOLDTrak PC to CheckWriter

IMM - Immediate (Check Printing function in both the Loan and Deposit systems)

INT - Interest checks

LIP - Loans-in-process disbursement checks, tran codes 430 or 431

M/O - Money Orders

MAT - Maturing CD checks

RET - Retirement distribution checks

RSD - Reserve disbursement checks, tran codes 440 or 640 (from both the Loan system or GOLDTeller system)

TLR - Online teller checks

XCS - Excess checks from Reserve Analysis |

Orig |

This is the originating office (CRBORG) where the check was created. |

Date Issued |

This is the date the check was issued (CRDTCK). |

Check Amount |

This is the amount the check was issued for (CRCKOT). |

Check Payee |

This is the name on the Check Reconciliation record screened in the OFAC file (CRPYNM). |

E-ACH

The following table explains the columns in the E-ACH OFAC MATCHES section of the report. If this section is included on this report, an OFAC suspect name was found originating from an eACH payment made from your website.

Column Heading |

Description |

Company Nbr |

This is the company number assigned to the business customer by your institution. |

Paid Date |

This is the date of the E-ACH batch. |

Batch Nbr |

This is the batch number assigned by the system or entered by the business customer. |

Seq Nbr |

This is the sequence number of the E-ACH batch. |

ACH Account Nbr |

This is the account number at the destination financial institution. |

ACH Account Name |

This is the name of the account owner at the destination financial institution. |

IAT

The following table explains the columns in the INTERNATIONAL ACH section of the report. There are five agenda records on each IAT transaction that are checked against OFAC:

1.10 (receiver's name)

2.11 (originator name)

3.12 (country)

4.13 (originating OFI name)

5.18 (correspondent info)

If any of these fields are suspects, they will be shown on the report in the match results.

Column Heading |

Description |

Entry Desc |

This is the name on the IAT transaction that was matched in OFAC. |

Account# |

This is the account number that was sent for the transaction. |

Orig DFI |

This is the Originating Deposit Financial Institution's name (Addenda Record 13). |

Batch# |

This is the batch number for the IAT transaction. |

IACH Amount |

This is the amount of the transaction. |

IACH Account Nbr |

This is the account number at the destination financial institution. |

Field Description |

This is the description of the field matched for the IAT transaction. |

Originator Name |

This is the Originator Name (Addenda Record 11). |

Customer Information File

The following table explains the columns in the CUSTOMER INFORMATION EXCEPTIONS section of the report. If this section is included on this report, an OFAC suspect name was found originating from CIF. CIF information can be entered on the following screens in CIM GOLD:

•Customer Relationship Management > Households screen

•Customer Relationship Management > Customer Profile screen

•Loans > Marketing and Collections screen > CIF tab

|

Note: Users can immediately check for OFAC compliance when new names are entered in CIF on the Households screen by clicking <Search OFAC> on the Names tab > Detailed Personal Information tab. |

|---|

Column Heading |

Description |

Name Type |

This field displays "Name," "Organization," or "Trust." |

Full Name |

This is the name of the person, organization, or trust from the CIF file that was matched in OFAC. |

Consolidated OFAC Report