Navigation: Deposit Reports > Deposit Reports - Numerical Order >

|

WARNING: We are phasing out of using this OFAC report. Instead, use the OFAC Report (FPSDR338). This new report will help your institution be in compliance with government regulations. Certain institution options must be set up to use this report. See OFAC Report (FPSDR338) for more information. |

|---|

Availability

This report can be run either daily or monthly. The daily reports list the OFAC test results of payee names on Check Reconciliation records that were created on the processing day; the monthly reports list the OFAC test results of payee names created during the processing month.

This report can be run multiple times with different proximity and confidence levels.

Purpose

The Check Reconciliation OFAC Match and Suspect Report lists any matches found when the payee names on Check Reconciliation records are compared with OFAC (Office of Foreign Assets Control) names. If the payee name is blank, it is ignored.

In order for the payee name to be added to Check Reconciliation, you must turn on the GOLDTeller option Update Check Reconciliation Record on Host (found in CIM GOLD under Teller System > GOLDTeller > Functions menu > Administrator Options > PC Institution Settings > Settings Page Two > Check Writer field group).

The payee name of a Check Reconciliation record is only 30 characters long, so the entire name is used in the OFAC search. A Soundex match is used on each word (name) in the field. The number of hits a name may get in OFAC is dependent upon the Proximity and Confidence levels that are set for you by GOLDPoint Systems in the report setup screen. The higher these levels are, the narrower the search will be. The default levels are Proximity of 80 percent and Confidence of 70 percent, or Confidence of 00 percent and Variable Confidence of 22334455. See below for an explanation of Variable Confidence.

See the following links for more information about this process:

Report Column Information

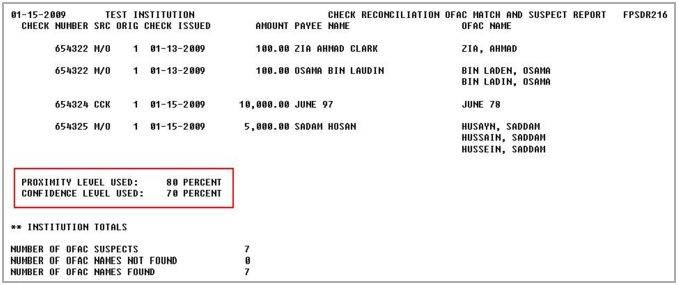

Below is an example of the Check Reconciliation OFAC Match and Suspect Report sample showing Proximity 80% and Confidence level 70%:

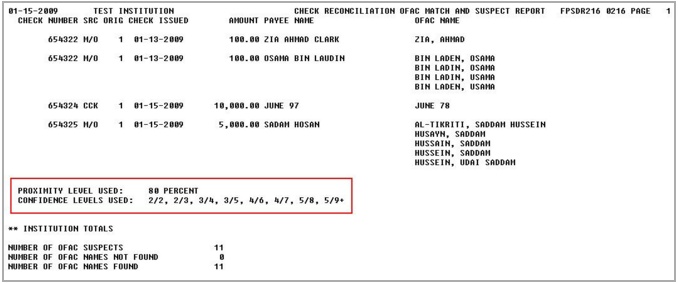

Below is an example of the Check Reconciliation OFAC Match and Suspect Report sample showing Proximity 80% and variable Confidence levels:

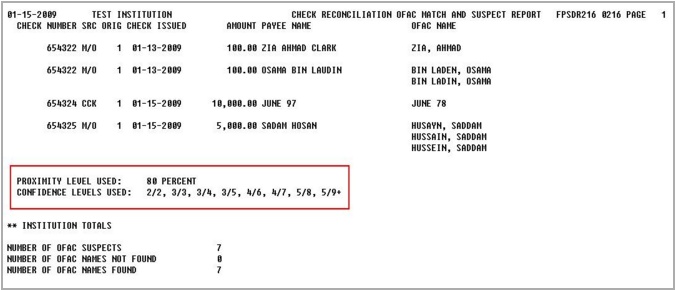

Below is an example of the Check Reconciliation OFAC Match and Suspect Report sample showing Proximity 80% and variable Confidence levels. Note that the only difference between the second sample report and this sample is the second confidence level (3/3 versus 2/3 in the second sample), but the results show 7 hits instead of 11:

The columns in this report are as follows:

Column Heading |

Description |

|---|---|

Check Number |

This is the check number from the Check Reconciliation record (CRCHK#). |

SRC |

This is the source the check was created from (CRSRCE). |

ORIG |

This is the originating office (CRBORG). |

Check Issued |

This is the date the check was issued (CRDTCK). |

Amount |

This is the amount the check was issued for (CRCKOT). |

Payee Name |

This is the name on the Check Reconciliation record that is tested in the OFAC file (CRPYNM). |

OFAC Name |

This is the list of names and aliases that matched the Soundex of the Payee name. |

|

GOLDPoint Systems Only: Misc Opts 1 is used to override the default Proximity level.

Misc Opts 2 is used to override the default Confidence and Variable Confidence levels.

Misc Parm is where the Proximity, Confidence and Variable Confidence levels are set. It must always be in the format P=XX, C=XX, V=XXXXXXXX, where XX = the percent level to set. The lower these levels are, the more hits you will get on the Soundex of the individual name. The percent should never be below 50. Recommended levels are between 60 and 80 percent.

The Variable Confidence levels are used only if Misc Opts 2 is set and the Confidence Level is zero, C=00.

The Variable Confidence level is tested according to the number of names in the OFAC name and the number of names in the Source (Payee Name). The default value indicates that if the OFAC name has two names, it must match two names in the Source (Payee Name).

|

|---|