Navigation: Deposit Screens > Account Information Screen Group > Roll Schedules screen >

Use this tab to set up a schedule of up to 10 roll events to automatically take place on the customer deposit account once certain conditions are met (for example, the conversion of an interest-free checking account to an interest-bearing checking account after a specified number of months have passed).

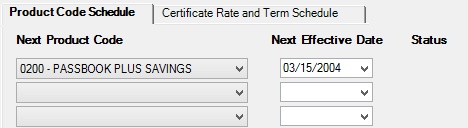

Deposits > Account Information > Roll Schedules Screen, Product Code Schedule Tab

This tab can be used for any type of customer account. It can be used to eliminate obsolete products by changing one product to another based on the Effective Date. File initializations can also be created for a specified range of accounts for manual rolls. Using this tab prevents the use of the Certificate Rate and Term Schedule tab on certificate accounts (the Certificate field on the Deposits > Account Information > Account Information screen is marked).

The fields on this tab are as follows:

Field |

Description |

|

Mnemonic: DMNXPC |

Use these fields to indicate the product code numbers and descriptions to which the customer account will roll on the Next Effective Date. Only valid product codes that have been entered through the Deposits > Definitions > Product Codes screen will be available to select in these fields. |

|

Mnemonic: DMNXEF |

Use these fields to indicate the dates the products specified in the Next Product Code fields will roll into the customer account.

When a new account is opened with a product schedule, this date will default to the account's Maturity Date (from the Deposits > Account Information > Additional Fields screen) if the customer account uses the certificate feature. Also, when the customer account is rolled, renewed, or matured, this date will default to the Maturity Date. If more than one schedule is used, the Maturity Date will be placed in this field for the first schedule and will remain blank for subsequent schedules. |

|

Mnemonic: N/A |

The status of the corresponding roll event. These fields indicate whether the event is current ("CURR") or complete ("DONE"). |

Retirement accounts (as designated on the Account Information screen) cannot be rolled to non-retirement accounts, and non-retirement accounts cannot be rolled to retirement accounts. If you roll an active customer overdraft account into a customer checking account that does not have the Overdraft feature (as designated on the Account Information screen) set, the overdraft feature will remain on the customer checking account that was rolled into. Unwanted overdraft features must be removed manually on this screen. Overdraft features can be adjusted for individual customer accounts on the Deposits > Account Information > Overdraft & Secured Loans screen. For the transaction, institution, and CIM GOLD features that pertain to the use of the overdraft feature, see the Overdrafting Conditions and Options help page.