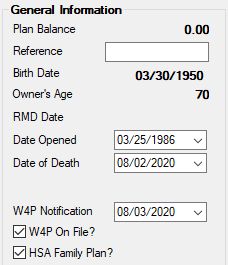

Navigation: Deposits > Deposit Screens > Retirement Screen Group > Retirement Plan Screen > Plan Owner Information tab >

General Information field group

Use this field group to view and edit general information about the retirement account owner.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: N/A |

This field contains the sum of all retirement account balances for the customer. The customer's retirement accounts are all listed on the Plan Accounts tab. |

|

Mnemonic: RPREF |

Use this field to indicate the retirement plan number that was used for the customer prior to your institution's conversion to GOLDPoint Systems (if unique numbers were being used for retirement plans before the conversion). |

|

Mnemonic: N/A |

This field contains the birth date of the account owner. |

|

Mnemonic: WKAGE |

This field contains the age of the account owner. |

|

Mnemonic: N/A |

This field contains the date the account owner begins receiving their Required Minimum Distribution. |

|

Mnemonic: RPDTOP |

This field displays the date the account was opened. This field should not be changed. You can set field-level security on this field to restrict users from making changes to this field. See the Security topic for more information. |

Date of Death / Payout Start/End Date

Mnemonic: RPDTDT |

The name of this field changes if the Beneficiary box is checked.

•If the Beneficiary box is not checked, the name of this field is Date of Death. Use this field to indicate the account owner's death date (if applicable). Once you enter a death date, the system displays a message stating "Click Create 5498 if you wish to create the IRS Form 5498." If you do not click <Create 5498> at the bottom of this tab, the 5498 form will not be created. Saving without creating a 5498 form will update the Retirement Plan record with the death date, but it will not create a 5498 form. If a death date is deleted and then re-entered, and <Create 5498> is clicked again, another 5498 form will be created for this account (and the Date the form was created will appear in the field adjacent to the button). It is the responsibility of your institution to check for and delete any 5498 forms that are not needed. Form 5498 will be created using the current CIF information (based on the account owner's information) with a zero fair market value. See FPSDR174, Retirement 5498 Report/Notices Year-end Reporting for more information.

•If the Beneficiary box is checked, the name of this field changes to Payout Start Date. This allows future dates to be present in this field. The system automatically calculates the Payout End Date below based on the entry in this field. You are not required to file a 5498 form for beneficiary payouts. If the Beneficiary box is checked, you should also enter information on the Beneficiaries tab as well. |

|

Mnemonic: RPDTW4 |

Use this field to indicate the W4P form notification date for the customer account. When this field is changed on this tab, all CIM fields containing this information will automatically be updated. |

|

Mnemonic: RPW4FL |

Use this field to indicate whether a W4P form is on file for the account owner. |

|

Mnemonic: RPFAMP |

Use this field to indicate whether the retirement plan is for a family Health Savings Account (HSA). |