Navigation: Customer Relationship Management Screens > Households Screen > Names tab > Credit Rating and IRS B Notices tab >

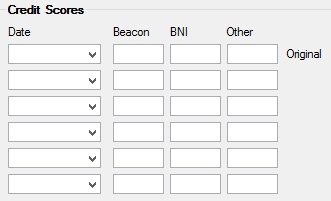

Credit Scores field group

Use this field group to view and edit credit rating information for the household member selected in the Household Names list view.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: N/A |

These fields display up to six credit score dates, starting with the household member's first loan at your institution (or the oldest available). |

|

Mnemonic: CIBCNO, CIBCNS |

These fields display the Beacon scores recorded for the household member on the corresponding Dates. The Beacon score is a credit score generated by the Equifax Credit Bureau to rank an individual's credit-worthiness. Beacon scores are determined through a complex algorithm. |

|

Mnemonic: CIBNIS, CIBNIO |

These fields display the Bankruptcy Navigator Index score generated by Equifax for the household member on the corresponding Dates. The BNI score is a way of predicting the likelihood that a borrower will file for Chapter 7 liquidation or a Chapter 13 repayment plan. BNIs range from 1 to 300. The higher the score, the lower the predicted risk. Most lenders use both credit scores and bankruptcy scores to help assess loan risk. |

|

Mnemonic: CIOTSO, CIOTCS |

These fields display any other type of credit score for the household member on the corresponding Dates. This could include:

•A credit-risk score from FICO •A response score (which predicts the likelihood a consumer will respond to an offer of credit) •An attrition-risk score (the likelihood a user will stop using a card) •Any type of custom credit score used by your institution (imported from fields in GOLDTrak PC, such as the Other CBR Score (OTHER_CBR_SCORE_PM)). |