Navigation: Customer Relationship Management Screens > Households Screen > Names tab > Credit Rating and IRS B Notices tab >

IRS B Notices field group

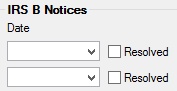

Use this field group to view and edit IRS B Notice information for the household member selected in the Household Names list view. IRS B Notices are used to inform your institution's customers about problems with their tax identification number (TIN). A report (CIF Exception Report - FPSDR085) is available that displays all accounts with invalid or missing TINs. If your institution wants to use this report, submit a work order to GOLDPoint Systems.

Use the Date fields to indicate the dates IRS B notices were created and sent to the IRS. Mark the corresponding Resolved fields if the problem indicated in the IRS B notices have been resolved.