Navigation: Customer Relationship Management Screens > Households Screen > Names tab > Detailed Personal Information tab >

Consumer Information Indicator fields

Entry: User, selection list

F/M: Yes

Mnemonic: NDCIID

Screen: Customer Relationship Management > Households > Names > Detailed Personal Information tab

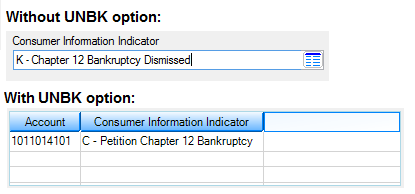

This field is usually maintained by the system when a Bankruptcy transaction is run on the account. However, if you have proper security, you can make changes to this field. This field indicates the customer information (CIID) code that applies to the household and is used in Credit Reporting. This field appears differently if your institution uses the new Bankruptcy system (institution option UNBK), as shown below:

The Consumer Information Indicator is used to adjust the Credit Bureau Account Status relative to bankruptcy proceedings. It also provides a means to indicate to the repositories if there is a problem locating the borrower. It is reported in Base Field 38, Consumer Information Indicator, on the Credit Report transmission (FPSRP184). These codes further clarify the status of an account relative to a bankruptcy of the primary borrower. File maintenance to this field writes to loan history.

If the loan has a Hold Code 4 (bankruptcy–chapter 7 or 11) or 5 (bankruptcy–chapter 13) and nothing in this field, a warning will appear on the Credit Report (FPSRP184).

Valid codes on the drop-down list are as follows:

Code |

Description |

|---|---|

Blank |

No information for this account |

A |

Petition for Chapter 7 Bankruptcy |

B |

Petition for Chapter 11 Bankruptcy |

C |

Petition for Chapter 12 bankruptcy |

D |

Petition for Chapter 13 Bankruptcy |

E |

Discharged through Bankruptcy Chapter 7 |

F |

Discharged through Bankruptcy Chapter 11 |

G |

Discharged through Bankruptcy Chapter 12 |

H |

Discharged through Bankruptcy Chapter 13 |

I |

Chapter 7 Bankruptcy Dismissed |

J |

Chapter 11 Bankruptcy Dismissed |

K |

Chapter 12 Bankruptcy Dismissed |

L |

Chapter 13 Bankruptcy Dismissed |

M |

Chapter 7 Bankruptcy Withdrawn |

N |

Chapter 11 Bankruptcy Withdrawn |

O |

Chapter 12 Bankruptcy Withdrawn |

P |

Chapter 13 Bankruptcy Withdrawn |

Q |

Removes Bankruptcy indicator previously reported (A-P) |

R |

Reaffirmation of Debt |

S |

Removes Reaffirmation of Debt and Reaffirmation of Debt Rescinded indicators previously reported (R, V, W, X, Y) |

T |

Credit grantor cannot locate consumer. To indicate a borrower cannot be located, check the Cannot Locate Consumer box on the Loans > Marketing and Collections screen > CIF tab. They will be reported to credit repositories with this CIID code for one month. This code take last precedence, so if any other CIID code exists for the account owner, this code will not be reported. |

U |

Consumer now located (removes previously reported T indicator). To indicate a borrower was located, check the Consumer Now Located box on the Loans > Marketing and Collections screen > CIF tab. They will be reported to credit repositories with this CIID code for one month. This code take last precedence, so if any other CIID code exists for the account owner, this code will not be reported. |

Y |

Chapter 13 Reaffirmation of Debt Rescinded |

In summary, the following codes related to the status and bankruptcy chapter can be entered:

Chapter 7 |

A, E, I, M; Q, R, S, T, U |

Chapter 11 |

B, F, J, N; Q, R, S, T, U |

Chapter 13 |

D, H, L, P; Q, R, S, T, U |

Note: If your institution is using the old Bankruptcy system (UNBK is not on) and you want to restrict certain users from changing this field, you can restrict users (or profiles) using the Field-level Security screen, selecting the employee or profile you want to restrict, then selecting "FPND - CIF Name" from the Record Type field, and checking the Restrict box for NDCIID (Consumer Information Indicator).

See also: Consumer Information Indicator on the Loans > Bankruptcy and Foreclosure > Bankruptcy screen and Bankruptcy Detail screen.