Navigation: CIM GOLD What's New > What's New in Version 7.9.10 >

Enhancement |

Description |

|---|---|

New Interest Change Verification Dialog on Account Detail Screen

CMP: 5541

CIM GOLD Version 7.9.10 |

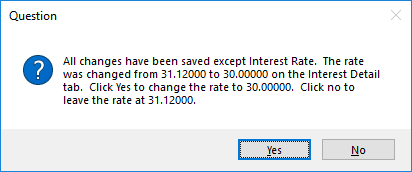

If the Interest Rate for a customer account has been changed on the Interest Detail tab of the Loans > Account Information > Account Detail screen, a dialog now appears when <Save Changes> is clicked. This dialog informs the user that all information changes except the interest rate have been saved, and invites the user to either save or discard the interest rate change.

This change was implemented to cut down on instances of accidental interest rate changes. An example of this dialog is shown below:

|

|

CMP: 6661

CIM GOLD Version 7.9.10 |

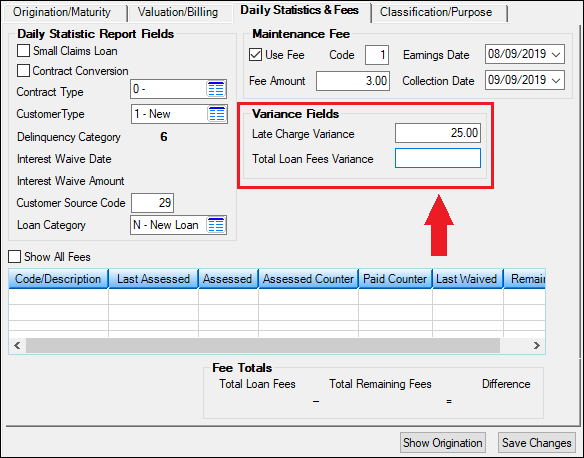

The Variance Fields field group has been added to the Daily Statistics and Fees tab of the Loans > Account Information > Additional Loan Fields. This field group contains two fields: Late Charge Variance and Total Loan Fees Variance. These fields are only used for interest-bearing loans (payment method 6). Additionally, Institution Option OP01 ILF6 (Use Amount Paid When Rolling Due Date) must be set up for your institution in order for the system to update the information in these fields.

These fields keep track of the spread of payments when the Payment Application designates that late charges and/or total loan fees are satisfied first.

•The Late Charge Variance is the amount of the payment that was not paid because of late charges. This field will be zero or a positive number. It is increased when part of the payment is not paid because of late charges being paid. This field can be reduced if the payment amount is enough to cover the P/I Constant, late charges, and fees.

•The Total Loan Fees Variance works the same way as the Late Charge Variance.

If option OP01 ILF6 is turned on, each time a late charge is paid, the Late Charge Variance field increases by the amount of the late charge.

Once the amount in the Late Charge Variance field is equal to or greater than the payment due (P/I Constant), a late charge will not be assessed.

Once the amount in the Late Charge Variance field drops below the payment due, late charges will resume being assessed. (This stops late charges from being assessed on prior late charges.)

Due Date Roll Option

Institution option OP01 ILF6 allows the Due Date to roll based on an amount paid rather than principal and interest being satisfied. The variance fields are used when late charges and/or loan fees are paid first and, as a result, the full principal and interest is not satisfied. They store the amount of the payment that was not paid because of either late charges or loan fees.

Example: A payment of $600.00 is due on a loan, $150.00 to principal and $450.00 to interest. Owing on the loan is $100.00 to loan fees and $150.00 to late charges. The Payment Application is set to apply first to late charges, then loan fees, then interest, then principal (Payment Application code is 4721). The customer brings in the regular payment amount of $600.00. $150.00 of that amount is applied to late charges, and the Late Charge Variance field is increased by $150.00. $100.00 is applied to loan fees, and the Total Loan Fees Variance field (LNVPRN) is increased by $100.00. The remaining $350.00 is applied to Principal and Interest. |

Loans > Account Information > Additional Loan Fields Screen > Daily Statistics & Fees Tab

Enhancement |

Description |

|---|---|

Changes to CVV Options in EZPay

CMP: 11453, 10707

CIM GOLD Version 7.9.10 |

New options pertaining to the indication of CVV numbers while making card payments in EZPay are available in CIM GOLD. These new options will need to be set by your GOLDPoint Systems account representative who manage your institution's EZPay options.

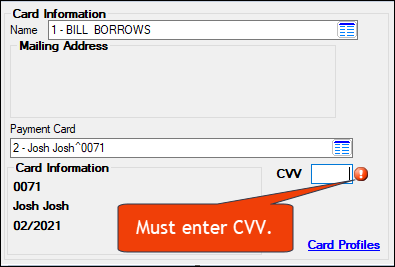

The Don't Require CVV option has been replaced with a Require CVV Options selection field (EZDRCC/EZRCVV), which allows your institution to choose one of the three options. The bullet points below explain these options and how they affect the payment submission process:

•Don't Require CVV: CVV entry will not be required for saving Card Profiles or processing card payments.

•Require CVV: CVV entry will be required for saving Card Profiles.

•Require CVV to be entered when using tokens: CVV entry will not be required for saving Card Profiles; however, CVV entry will be required each time a card payment is processed. If this option is enabled, a mandatory CVV field will appear in the Card Information field group, as shown below:

These options are set up by your GOLDPoint Systems account manager on the EZPay IMAC table. The EZPay Options topic explains all the available options. |

Ability to Edit Existing Card Profile Addresses

CMP: 11660 Work Order: 56469

CIM GOLD Version 7.9.10 |

The EZPay Card profiles dialog now allows you to edit the billing address information for existing card profiles. Select a card profile that has already been entered on an account on the EZPay screen to edit that profile’s billing address information in the provided fields. Note: The EZPay option called "CIM GOLD AVS Level" must be set to "A - All Fields Open." If that option is set, the Billing Address field will be open for users to change address information, as shown in the example below.

Note that only billing address information can be changed for existing card profiles. If you need to edit name, card number, or expiration date information for a profile, you will need to delete the profile and create it again. |

Enhancement |

Description |

|---|---|

Update to Bankruptcy Detail Screen

CMP: 5250

CIM GOLD Version 7.9.10 |

The Relief/Lift of Stay radio button on theBankruptcy Detail screen appears regardless of whether the Display Reaffirmation Dates Only checkbox field is marked on the Bankruptcy Options screen. Previously, if the Display Reaffirmation Dates Only option was not selected, the Relief/Lift of Stay radio button was hidden in the Actions and Dates field group on the Bankruptcy Detail screen. |

Improved Account Identifier Screen Navigation

CMP: 5834

CIM GOLD Version 7.9.10 |

Previously, multiple Save dialogs were appearing if information was changed on the Loans > Account Information > Account Identifiers screen and the user then attempted to switch customer accounts. Navigating between accounts now only prompts the appearance of a single Save dialog. |

Update to Loan Disclosure History Screen

CMP: 3099

CIM GOLD version 7.9.10

|

Functionality enhancements to the Loan Disclosure History screen now show a more complete history of transactions to ensure the inclusion of backdated transactions.

Past versions would potentially exclude backdated transactions from the Loan Disclosure History screen, although this information would be included on the Loans > History screen.

|

Enhancement |

Description |

|---|---|

Lienholder Setup Screen Updated

CMP: 359 Work Order: 508002

CIM GOLD Version 7.9.10 |

Users were experiencing issues with the search, create, and save functions on the Loans > System Setup Screens > Lienholder Setup screen. These issues have been corrected. |

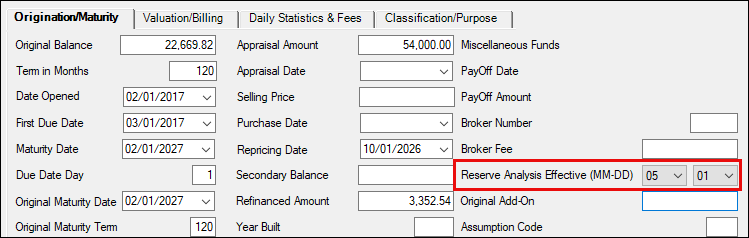

Update to the Reserve Analysis Field on the Additional Loan Fields Screen

CMP: 1484 Work Order: 39256

CIM GOLD Version 7.9.10 |

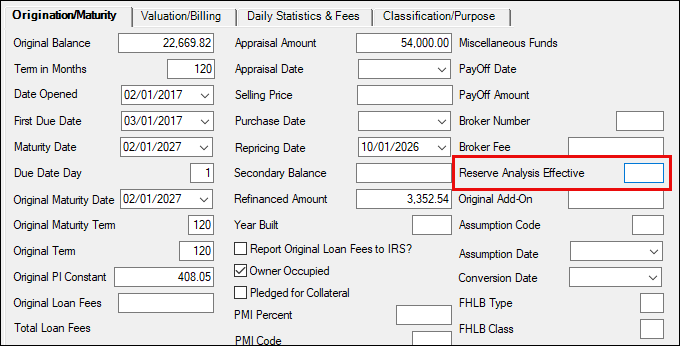

The Reserve Analysis Effective (LNANAL) field on the Loans > Account Information > Additional Loan Fields screen has been updated to reflect the same information as entered on the Reserve Analysis screen (under Loans > Account Information > Reserves > Reserve Analysis screen > Options, Limits & Loan Fields screen). The field used to be one field, and now it is two fields for entering the month and day reserve analysis should be run each year (see before and after below). Additionally, if you update that field from either screen (Reserve Analysis or Additional Loan Fields) the change is saved to both screens. |

Before:

Loans > Account Information > Additional Loan Fields Screen > Origination Maturity Tab

After:

Loans > Account Information > Additional Loan Fields Screen > Origination Maturity Tab

Enhancement |

Description |

|---|---|

Account Reserve Detail Error Resolved

CMP: 1488 Work Order: 44238

CIM GOLD Version 7.9.10 |

We have resolved an error that would show if institution option RSNI was set and users attempted to make and save changes to field information on the Account Reserve Detail screen. The error read, "Error adding/updating interest on Negative Reserve record. Record not on file." This error has been resolved, and now users should not get that error whether or not the RSNI option is on.

Note: The RSNI option indicates that your institution wants interest to be charged when the reserve balance goes negative. |

Dealer Names Added to Payoff Quote

CMP: 2562 Work Order: 506488

CIM GOLD Version 7.9.10 |

Dealer names now appear on payoff quotes alongside their dealer number. This change was implemented for additional clarification on payoff quotes, particularly for institutions who purchase and/or service loans from a large number of dealers. |

Fixes to Commercial Loan Screens

CMP: 9950 Work Order: 45674

CIM GOLD Version 7.9.10 |

Users were experiencing issues with the functionality of the new Loans > Commercial Loans screens. These issues have been corrected. |

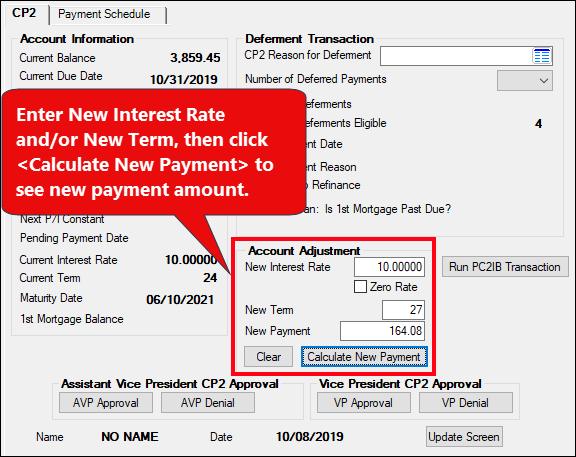

CP2 Screen Now Calculates for Different Loan Frequencies

CMP: 8340

CIM GOLD Version 7.9.10 |

It was found that when calculating an account adjustment on the CP2 screen that if the account had a different frequency other than monthly (1), then the results of the new payment were not calculating correctly. The system was calculating the New Payment amount as if the loan payment frequency was monthly.

In this release of CIM GOLD, this has been corrected. Now regardless of what the Payment Frequency is, the system will correctly total a new payment based on an adjustment to the Interest Rate or New Term, as shown below. Payment Frequency can be changed using the Loans > Account Information > Payment Information screen.

Note: The CP2 screen is not used by all institutions. Its purpose is to help borrowers catch up on delinquent payments. It's similar to the Account Adjustment screen but has more options. See the CP2 help for more information and contact your GOLDPoint Systems account manager if your institution is interested in using this screen. |

Loans > Transactions > CP2 Screen in CIM GOLD

Enhancement |

Description |

|---|---|

EZPay Field-level Security Adjustment

CMP: 11245

CIM GOLD Version 7.9.10 |

Testing discovered an issue where the EZPay screen was not properly reading certain field-level security settings when accessed as a pop-up (for example, from the Options menu on the CIM GOLD main menu bar). This issue has been corrected.

Remember that field-level security for EZPay fields can be found in the FPFS - Loan Miscellaneous Security record. |

Small Correction to Loan Disclosure History Screen

CMP: 840 Work Order: 508456

CIM GOLD version 7.9.10 |

We fixed an error that was introduced in CIM GOLD version 7.5.15 that caused some LIP 510 transactions (Field Credits) not to display an amount in the Transaction Amount column on the Loan Disclosure History screen.

Note: For 510 transactions when a loan is opened to show in Loan Disclosure History, the following option must be set under Options > User Preferences in the top CIM GOLD menu:

|

Cards and Promotions Screen Updated

CMP: 10585

CIM GOLD version 7.9.6 |

We have updated the Cards and Promotions screen to read branch numbers correctly. When one institution tried boarding loans through the API, the line-of-credit loans would cause CIM GOLD to crash because the field type for branch numbers was an integer, when the field mapping to it was longer than the provided fields.

This version of CIM GOLD updates that field to successfully read these accounts. |

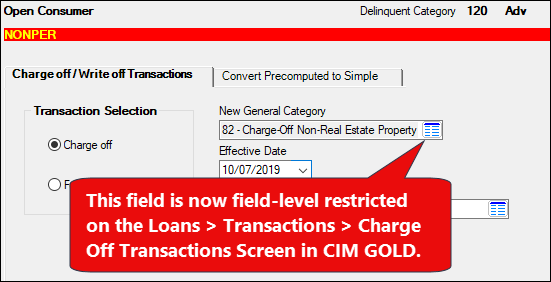

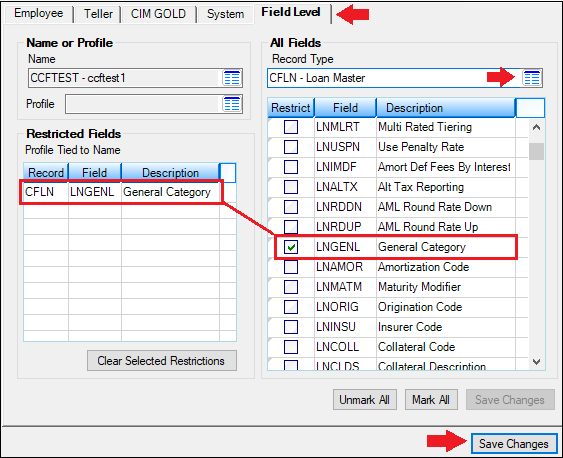

Field-level Security Added to General Category for Charge-offs

CMP: 5895 Work Order: 35648

CIM GOLD version 7.9.10 |

We have added field-level security for the General Category field on the Loans > Transactions > Charge-off screen. You can now restrict users or profiles from changing the General Category field on the Charge-off screen (see Figure 1 below).

To restrict a user or profile from changing this field, complete the following steps:

1.Access the Security > System > Setup tab. 2.Select the user or profile for which you want to restrict the General Category field. 3.Make sure the Display Effective Security box is not checked. 4.Click the Field Level tab and select "CFLN – Loan Master" from the Record Type field. 5.Scroll down to the General Category (LNGENL) setting and check the box. The system will move that field under the Restricted Fields list. 6.Click <Save Changes>. See Figure 2 below. |

Figure 1: Loans > Transactions > Charge Off Transactions Screen

Security > Setup Screen > Field-level Security Tab

Enhancement |

Description |

|---|---|

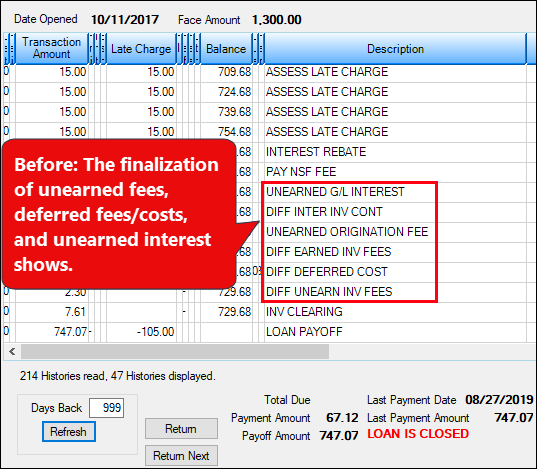

Unearned Amortizing Fees Removed from Loan Disclosure History Screen

CMP: 8296

CIM GOLD Version 7.9.10 |

We have removed any amortizing unearned fees or deferred fees and interest from showing on the Loan Disclosure History screen. The Loan Disclosure History screen is used to give a general overview of payments and miscellaneous fees and late charges that have been applied to an account. When the amortization of unearned fees/costs, deferred fees/costs, and unearned interest shows on this tab (especially when the fees and interest are nonrefundable), it can be confusing to the teller and customer, if the teller is discussing loan history with the customer.

This information would show on this screen if institution option GLFL was set for the institution. This option designates that final payoff trues all amortization on the loan, rather than waiting until monthend when amortization of fees and interest to the G/L usually takes place. See before and after examples below. |

Before:

Before: Loan Disclosure History Screen

After:

After: Loan Disclosure History Screen

Enhancement |

Description |

|---|---|

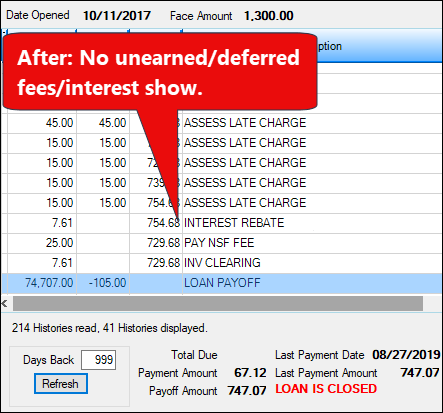

Deferment Reason Added to Deferments List-view Table

CMP: 8891

CIM GOLD Version 7.9.10 |

The Reason column has been added to the Deferments list-view table on the Loans > Deferments screen. This column displays the reason for the deferment, as selected when running the Deferment with Reason transaction (tran code 2600-35).

See the following example of this new column below. |

Loans > Deferments Screen in CIM GOLD

Enhancement |

Description |

|---|---|

Update to Initialize Loan Pattern for Extensions

CMP: 8894, 11706 Work Order: 43380

CIM GOLD Version 7.9.10 |

The Initialize Loan Pattern screen has been updated slightly to not allow setting up the Deferments screen unless institution option IUEX (institution uses extensions) is set.

•If that option is not set, then Deferments will not be available to be selected. See Figure 1 below.

•If that option is set, then Deferments will be one of the screens that can be selected on the main page of the Initialize Loan Pattern screen. See Figure 2 below.

If option IUEX is set, the only fields that can be set on the Deferments screen are the extension fields, as shown in Figure 3 below. See the Extension field group help for more information concerning these fields.

Loan patterns are used in loan origination to set up specific fields for loan types, so information can be set once and be applied for every loan opened with that loan type. See the Loan Pattern Setup help for more information. |

Enhancement |

Description |

|---|---|

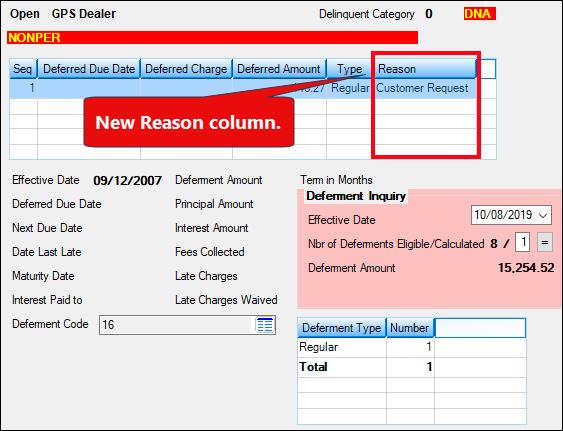

Account Number Now Included in Tran Log for Funding Checks

CMP: 9177 Work Order: 55296

CIM GOLD Version 7.9.10 |

We have added the account number to be included with G/L credit transactions (tran code 1810) as part of printing funding checks. This is similar to how the G/L reports checks printed from GOLDTrak PC or checks printed from CIM GOLDTeller as part of an overpayment during payoff.

Now when funding checks are created and printed through the Loans > Check Printing > Checks screen, they will reflect the account number in the G/L history item, as shown below. This change only applies to funding check printing going forward; it does not apply retroactively. |

Enhancement |

Description |

|---|---|

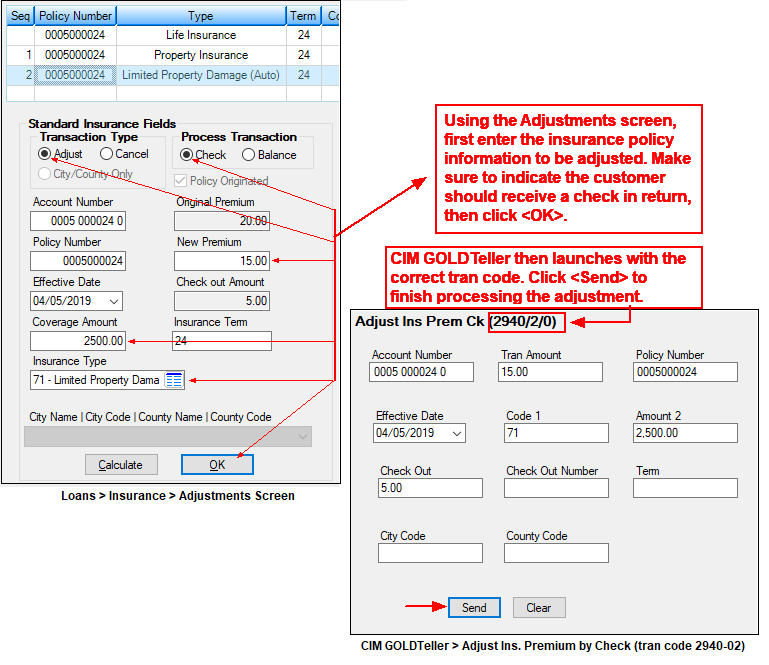

Code Removed so Insurance Adjustments via Check Can Process

CMP: 9827

CIM GOLD version 7.9.10 |

We have updated the Insurance Adjustments screen in CIM GOLD, so that when a user adjusts an insurance policy with a check back to the customer, the system brings up the correct transaction modifier in CIM GOLDTeller. This only occurred if a user was adjusting the following insurance types:

71 - Limited Property Damage (Auto) 90 - VSI Insurance 91 - Non-file Insurance 97 - Homegard Insurance 98 - Flood Insurance 99 - Fire Insurance

When users would try to adjust those insurance types via check, tran code 2940-00 (Adjust Insurance Premium by Balance) would be displayed in CIM GOLDTeller, instead of the needed 2940-02 (Adjust Insurance Premium by Check). This has been corrected and now the correct transaction is displayed when the transaction is initially set up using the Loans > Insurance > Adjust Insurance screen. The following examples show this process: |

Enhancement |

Description |

|---|---|

Enhancements to Inter-Office Move Screen

CMPs: 2217, 2620, 4794, 5107, 3326, 10685 Work Orders: 44666, 49703, 506601, 508200, 508927, 50956

CIM GOLD version 7.9.10 |

We have improved the Inter-Office Move screen in CIM GOLD. We have done significant backend programming so moving loans is more efficient and faster. Additionally, the following processes have been enhanced:

•The Report to Credit Bureau field (LNCRBU) has been added to the services moved. •Fields in the Loan Tax and Statistics record (FPLT) are now working correctly when moving loans. •Reserve (Escrow Account Analysis records (FPAD)) are now moved successfully. •The Loan Released flag (LNRLSD) has been updated to show “Y” on the old account and “N” on the new account. •Alert messages now move when the old account moves to the new account number (e.g., from one branch to another branch). |

Correction to Daily Version Error in CIM GOLD Caused by Alerts

CMP: 11946 Work Order: 56202

CIM GOLD version 7.9.10 |

Some users found that when they tried to make any changes to the Actions/Holds/Event Letters screen, they would get the following error message:

Version Error. Please refresh the screen and try again. Record to update is wrong version nbr.

We discovered that this strange error only occurred if the account had a client-defined alert pop-up screen, where the user needed to acknowledge the alert before closing it. And even more strangely, it only occurred the first time of the day per account.

This has been corrected and that error message should no longer display. |

Enhancement |

Description |

|---|---|

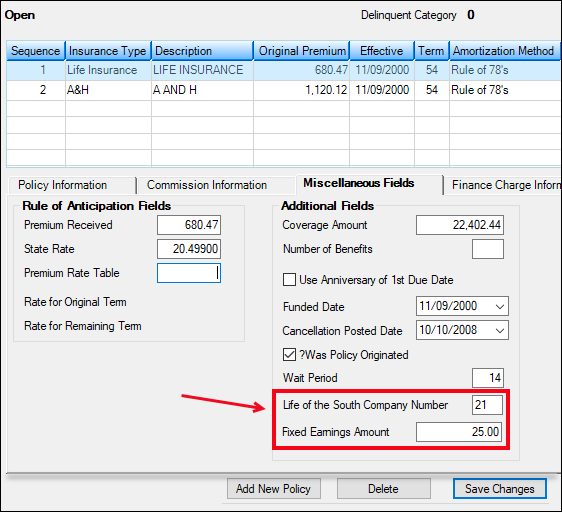

New Fields for Insurance Amortization

CMPs: 9988, 9989, 10852

Work Orders: 44666, 49703, 506601, 508200, 508927, 50956

CIM GOLD version 7.9.10 |

Two new fields have been added to the Insurance Policy Detail screen > Miscellaneous Fields tab (under Loans > Insurance) in CIM GOLD. The new fields are:

Fixed Earnings Amount (INFXEA): This option causes the system to look at the amount in this field before determining any insurance premiums returned to the borrower. For example, if this field is "50.00" and the insurance policy is canceled or paid off early and the borrower is due back $75.00 in unearned insurance premiums, then the system will subtract the 50.00 from 75.00 and return $25.00 to the borrower. Of course, if the Return All option is selected and the policy is paid off or canceled within the range set in Within _ Days, then the entire amount is still returned to the borrower.

This field was released to the host in January. Additionally, we created new GOLDTrak PC transfer fields. See these CMPs in earlier versions of the Update for more information: CMP 9988, 9989, and 10678

Life of the South Company Number (INCOMP): This is the company number associated with the Life of the South insurance company. This number is boarded during loan origination. You can make changes or adjustments to the information in this field if you have proper security clearance. This field will be blank if the insurance policy is not associated with Life of the South.

See the following example of these fields: |

Loans > Insurance > Policy Detail Screen > Miscellaneous Fields Tab

Enhancement |

Description |

|---|---|

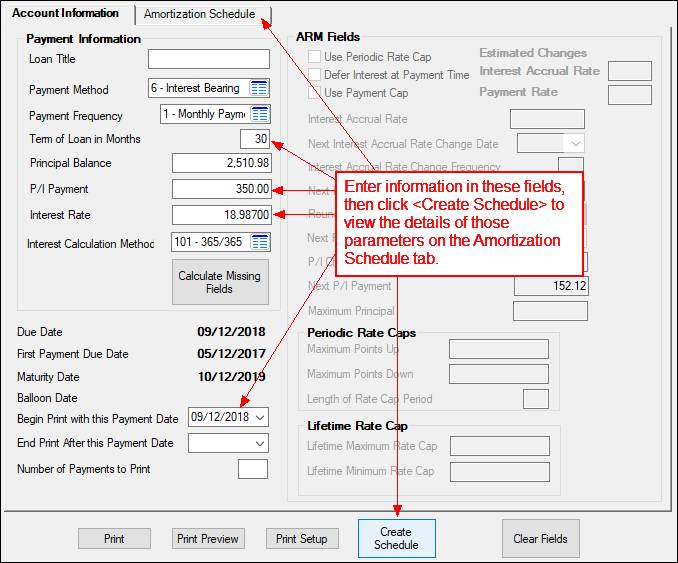

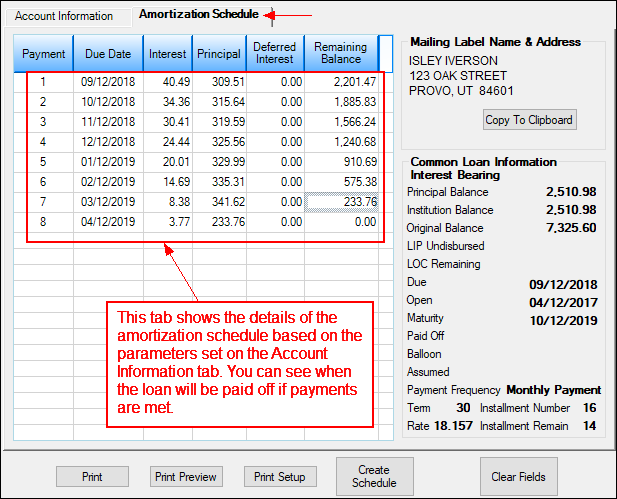

New Amortization Schedule Screen

CMPs: 6678, 6698 Work Order: 39560

CIM GOLD version 7.9.10

|

A new Amortization Schedule screen (shown below) is available in the Loans > Account Information section of CIM GOLD.

This screen can be used to calculate, create, and print a theoretical amortization schedule for a specific account. You can also use the screen to create a schedule not related to an actual account, or to calculate unknown pieces of information, such as hypothetically determining what an interest rate, P/I payment, or loan term on an account would be.

Changes made to account information fields on this screen do not permanently affect the loan. When a user exits this screen, all fields default to their values on the actual loan as indicated on other Loans screens.

For more information about how this screen works, see the Amortization Schedule Screen help manual in DocsOnWeb or press <F1> while viewing the screen in CIM GOLD. |

Loans > Account Information > Amortization Schedule Screen > Account Information Tab

Loans > Account Information > Amortization Schedule Screen > Amortization Schedule Tab