Navigation: »No topics above this level«

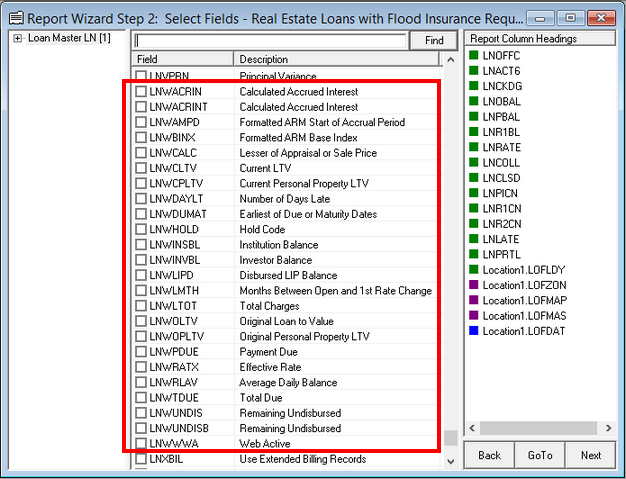

GOLDPoint Systems has created special loan "work" fields (mnemonics). The fields eliminate the need for you to create work fields to obtain the data. Most of these work fields begin with LNW (see example below). The following table explains the fields. Note: These fields (mnemonics) would be used in Report Wizard Step 2: Select Fields.

Field |

Description |

||

|---|---|---|---|

LNWACRIN |

Calculated accrued interest. This GOLDWriter and Variable screen mnemonic will accrue loan interest either to or through today. The calculation is the same calculation that the Payoff screen uses. The mnemonic uses the same institution option as the one used for payoffs to determine if the calculation is to or through today (institution option OPTD I1DY).

|

||

LNWACRINT |

See LNWACRIN above. |

||

LNWAMPD |

Formatted ARM start of accrual period. |

||

LNWBINX |

Formatted ARM base index. |

||

LNWCALC |

Lesser of appraisal or sale price. If the Selling Price (LNSELL) is zero, the this uses the appraisal amount (LNAPAM). If the appraisal amount is 0, then this is the selling price. If neither is zero, then the lesser of the appraisal amount or selling price is used. |

||

LNWCLTV |

Current LTV (loan to value). If either the principal balance (LNPBAL) or LNWCALC are zero, then this is 0. Otherwise, this is the principal balance plus secondary balance (LNBAL2) times 100000 times 1000 divided by LNWCALC (see definition above). The calculation looks as follows:

LNPBAL = 0 or LNWCALC = 0, then 0.

or else:

(LNPBAL + LNBAL2) * 100000 * 1000 / LNWCALC |

||

LNWCPLTV |

Current personal property LTV. This is calculated using the LNWCLTV calculation (see below) from LNVAL macro on FPLW record. |

||

LNWDAYLT |

Number of days late. This work field calculates the number of days a loan is past due. The calculation is:

Today - Due Date (for the loan)

If the loan due date is in the future, the field will be zero (0). |

||

LNWDUMAT |

Earliest of the due date or maturity date. LNWDUMAT returns the earlier of the loan due date (LNDUDT) and the loan maturity date (LNMATD). If one of the dates is blank, it uses the date with information in it. This mnemonic should be helpful in auditing regulatory reports. |

||

LNWHOLD |

Searches for data in hold code 1 and 2. |

||

LNWINSBL |

Institution balance. This is the principal balance (LNPBAL) minus LNWINVBL (see definition below). |

||

LNWINVBL |

Investor balance. This is the principal balance (LNPBAL) times the percent sold (LNISLD) rounded to three decimal places. |

||

LNWLIPD |

Disbursed LIP balance. If the LIP Method Code (LNLMTH) is 103, then this is the same as the principal balance (LNPBAL). Otherwise, this is the principal balance minus the LIP balance (LNLBAL). |

||

LNWLMTH |

Months between open and first rate change. This calculates the number of months between the loan open date and the first rate change date. This calculation is also displayed on the ARM Detail screen (Months Between Open and 1st Rate Change field). |

||

LNWLTOT |

Total charges. If the LIP Method Code (LNLMTH) is 0, then this is 0. Otherwise, this is the LIP Charge Amount (LNLCGA) plus the LIP Prior Unpaid Billing amount (LNLPCG). |

||

LNWOLTV |

Original loan to value ratio. This is the original balance (LNOBAL) divided by the lesser of the appraisal amount or the selling price (LNCALC) rounded to three decimal places. If either the appraisal amount or the selling price is zero, it uses the field with the amount in it. |

||

LNWOPLTV |

Original personal property value. This is calculated using the LNWOLTV calculation (see above) from LNVAL macro on FPLW record. |

||

LNWPDUE |

Payment due. This is the CALCPMT calculation from INTCA macro. But if this is a line-of-credit loan (payment method 5) and the Remaining Unpaid fields (LNRLP1,2,3,4,5) are all zero (0), then LNWPDUE is zero as well. |

||

LNWRATX |

LNWRATX is the loan effective rate. This mnemonic will return the effective rate based on the status of the loan. The accrual rate on adjustable rate loans will use LNAMRT, LIP will use LNLRAT, and all other loans will use LNRATE. |

||

LNWRLAV |

Average daily balance.

If this is a line-of-credit loan (payment method 5), then:

Use the later of the date of last transaction (LNTRAN) or date of last finance charge (LNRLFD). Take the difference in days between this date and today's date. This is called WORK1. Now take the difference in days between the date of last finance charge (LNRLFD) and today, and this is called WORK2. If WORK2 is equal to zero, then use value of 1 for WORK2. Then, LNWRLAV is equal to the principal balance (LNPBAL) * WORK1/WORK2. If the resulting amount of LNWRLAV is zero, then the system uses loan principal balance.

If not a line-of-credit loan:

Do Work call to FPSAVAB0 and use balance returned. |

||

LNWTDUE |

Total due. Calculated from the LNVAL macro. |

||

LNWUNDIS and LNWUNDISB |

Undisbursed Balance

•For LIP loans, the mnemonic will display the LIP undisbursed balance by reading the Undisbursed Balance field on the Account Construction Detail screen, Balances, Rates & Billing tab. The LIP method code must be greater than 0.

•For payment method 5 loans, the undisbursed amount is calculated as follows: Credit Limit - Principal Balance = Undisbursed (for revolving LOCs), or Credit Limit - Credit Used = Undisbursed (for non-revolving LOCs).

|

||

LNWWWA |

Web active. |

||

Lienholder and Property Mnemonics |

Lienholder and property records mnemonics are IL for lienholder and IP for property records. There can be several properties per loan and also several lienholders per property.

These fields work similarly to LIP or reserve disbursements and act as the master when read with loans. Lienholders are the master if read with properties. |

||

"LNC" instead of "LN" |

If you change the "LN" part of a loan mnemonic to "LNC", the loan dates will be displayed with four-digit years, in MMDDCCYY format. For example, to have four-digit years displayed for the loan due date, use the mnemonic "LNCDUDT" instead of "LNDUDT." Note that this is only available for LN mnemonics. The RD (reserve), IN (insurance), etc. do not have this capability. |

||

LNRINF |

LNRINF displays the last interest rate and the date the rate went into effect. The data is all displayed on one line and appears with the date first, then the rate. For example, 0401130875000 would be:

Date: 04-01-13 Rate: 08.75000 |

See also:

Appendix A - Special Work Field Calculations

Report Wizard Step 2: Select Fields