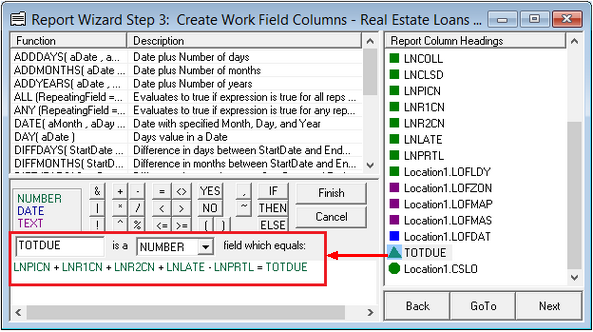

| TOTDUE | = LNPICN (P/I Payment) |

| + LNR1CN (Reserve 1 Payment) |

| + LNR2CN (Reserve 2 Payment) |

| - LNPRTL (Partial Payments) |

|

Next Payment Due

This will work in all cases except when the Next Payment Due involves a P/I or a reserve payment change, or if a Subsidy Payment amount is used, or on a payment method 5 (line-of-credit) loan with payment types 2-7. See the following variations in the next rows.

|

| TOTDUE | = LNPICN (P/I Payment) |

| + LNR1NX (Next Reserve Payment) |

| + LNR2CN (Reserve 2 Payment) |

| - LNPRTL (Partial Payments) |

|

Next Payment Due (2)

Use this when there is a next Reserve 1 payment pending (usually after a Reserve Analysis) that will become effective with the next payment due.

Note: If you do not use either of the reserve accounts or the Partial Payment field, they may be omitted from the calculation.

|

| TOTDUE | = LNPINX (Next P/I Payment) |

| + LNR1CN (Reserve 1 Payment) |

| + LNR2CN (Reserve 2 Payment) |

| - LNPRTL (Partial Payments) |

|

Next Payment Due (3)

Use when there is a pending next P/I payment that will become effective with the Next Payment Due (ARM only).

Note: If you do not use either of the reserve accounts or the Partial Payment field, they may be omitted from the calculation.

|

| DAYS | = TODAY (today's date)

B LNRLFD (Date of 1st finance charge) |

|

Finance Charges Due To Date

This calculates a finance charge plus any outstanding late charges, from the date of the last finance to today, on payment method 5 loans (line-of-credit) that are using a daily interest (D) calculation.

Note: You can also add the mnemonics LNRLP1 through LNRLP5, after the LNLATE (late charges), to include any unpaid billed amounts.

|

| * LNPBAL (principal balance) |

|

Institution Balance

This is only for sold loans. This calculation will compute the institution's portion of the balance. If the loan is 100% sold, the result will be 0.

|

| RMTERM | = LNMATD (maturity date) |

| B LNDUDT (payment due date) |

|

Remaining Term

This calculation does a comparison between the current payment due date on file and the maturity date to determine the amount of time (in months) left on this loan. See the other RMTERM description below for a variation of this same calculation.

|

| RMPMTS | = LNMATD (maturity date) |

| B LNDUDT (payment due date) |

| ÷ LNFREQ (frequency of payments) |

|

Remaining Number of Payments

The use of the frequency in the calculation allows for loans with other than monthly payments.

|

| RMTERM | = LNMATD (maturity date) |

| FACTOR | = LNPBAL (princ bal) |

|

Weighted Average Remaining Term

Uses two separate calculations to arrive at the desired result. First, the calculation for remaining term (see RMTERM above) and then the calculation to compute the average, itself requiring two steps to complete. Notice the "@" used in the result mnemonic. This is the mnemonic you will print on your report.

|

| FACTOR | = LNPBAL (principal balance) |

| * LNTERM (term in months) |

| ÷ LNPBAL (principal balance) |

|

Weighted Average Term

This is the same as the previous calculation, weighted average remaining term, except that it uses the full term instead of the remaining term.

|

| LTV | = LNPBAL (principal balance) |

| ÷ LNCALC (appraisal amount/selling price) |

|

Loan-to-Value Ratio

The special mnemonic, LNCALC, is used to determine the lesser of the appraisal amount or the selling price.

|

| FACTOR | = LNPBAL (principal balance) |

| * LNRATX (effective rate) |

| ÷ LNPBAL (principal balance) |

|

Weighted Average Rate

The special mnemonic, LNRATX, is used to determine the rate in effect on any loan pulled for your report. There is a different rate used on an ARM than on a fixed rate or an LIP. Notice the use of the "@" in the result mnemonic to determine the weighted average. See below for a variation of this calculation.

|

| LINSTBAL | = 100

- LNISLD (percent sold)

* LNPBAL (principal balance)

÷ 100

Round 2 |

|

Weighted Average Rate (2)

The same calculation as above with the "institution portion of balance" calculation added in and used instead of the principal balance. May be used if part or all of your loans are sold to investors.

|

| DLPMTS | = TODAY (today's date) |

| B LNDUDT (payment due date)

÷ 30.4

T 0 |

|

Number of Past Due Payments

This is a comparison of the date you run your report and the payment due date on file. The result is truncated to "zero" number of decimal places to provide for a whole number. If you need a more accurate result, increase the "0" to a "1" (or more if desired).

For example: If the loan is 3 1/2 months delinquent, the calculation at the left will show the loan as being only 3 months delinquent. Whereas, if the "0" were changed to a "1," the answer would be 3.5. You can also round to the nearest month by replacing the "T" with an "R."

|