Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Tax/Insurance/UCC tab >

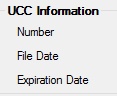

UCC Information field group

This field group on the Tax/Insurance/UCC tab of the Account Detail screen displays basic Uniform Commercial Code (UCC) information for the account.

This field group displays the UCC Number, File Date, and Expiration Date for the account (mnemonic MLUCC#/MLUCCD/MLUCCX). This information is usually entered when the loan is originated and is tied to any collateral on the loan. This information can also be entered by clicking the UCC/Title link on the Loans > Collateral Detail screen.

See below for more information about UCC.

Revised Article 9, Secured Transactions

Article 9 of the the Uniform Commercial Code provides the rules governing any transaction (other than a finance lease) that couples a debt with a creditor's interest in a debtor's personal property. It also provides a method of giving notice of a security interest in personal property to interested third parties. If the debtor defaults, the creditor may repossess and sell the property (generally called collateral) to satisfy the debt. The creditor's interest is called a "security interest."

There are two key concepts in creating a "security interest:" "attachment" and "perfection." These terms describe the two key events in the creation of a "security interest."

Attachment generally occurs when the security interest is effective between the creditor and the debtor, and that usually happens when their agreement provides that it take place.

Perfection occurs when the creditor establishes his or her "priority" in relation to other creditors of the debtor in the same collateral. Filing a financing statement in the appropriate public record is the dominant way to perfect a security interest in most kinds of property. Filing a financing statement will perfect a security interest, even if there is another method of perfection.

Other methods of perfection are "control" and "possession." "Control" is the method of perfection for letter of credit rights and deposit accounts, as well as for investment property. A creditor has control when the debtor cannot transfer the property without the creditor's consent.

"Possession," as an alternative method to filing a financing statement, is the only method for perfecting a security interest in money that is not proceeds of sale from property subject to a security interest.

Automatic perfection for a purchase money security interest is 20 days in Revised Article 9. Attachment of a purchase money security interest is perfection, at least for the 20-day period. Then another method of perfection is necessary to continue the perfected security interest. However, a purchase money security interest in consumer goods remains perfected automatically for the duration of the security interest.

Choice of Law: In interstate secured transactions, it is necessary to determine which state's laws apply to perfection, the effect of perfection, and the priority of security interests. It is particularly important to know where to file a financing statement. The 1999 revisions to Article 9 makes the law of the state that is the location of the debtor the law that governs perfection. Further, if the debtor is an entity created by registration in a state, the location of the debtor is the location in which the entity is created by registration. If an entity is a corporation, for example, the location of the debtor is the state in which the corporate charter is filed or registered.

The Filing System: Improvements in the filing system in the 1999 revisions to Article 9 include centralized filing—one place in every state in which financing statements are filed. Under Revised Article 9, the only local filing of financing statements occurs in the real estate records for fixtures. Fixtures are items of personal property that become physically part of the real estate, and are treated as part of the real estate until severed from it.

The office that files financing statements has no responsibility for the accuracy of information on the statements and is fully absolved from any liability for the contents of any statements received and filed.

Lien information on any person or business may be obtained from searching UCC filings. Such information may be used to determine whether a lender would be interested in extending credit to the small business owner to, for example, provide capital for purchasing equipment or raw materials. The small business owner may, in turn, access the Section's records to determine whether to extend credit to customers by taking a security interest in the finished product to be sold.