Navigation: Loans > Loan Screens > Insurance Screen Group > Policy Detail Screen > Tax and Surcharge tab >

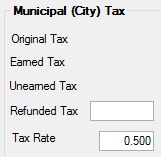

Municipal (City) Tax field group

Use this field group to view and edit information about any city taxes that apply to the selected insurance policy.

Not all insurance policies require a city tax. Most of the fields on this screen are populated when insurance policies are placed or canceled on loans during loan origination, through the Force Place Insurance screen, or through GOLDTeller transactions (e.g., Force Place VSI Insurance, tran code 2870-00 or Cancel VSI Insurance, tran code 2910-00). However, some fields are file maintainable on this screen.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: INMORG |

This field displays the original municipal tax charged when the selected insurance policy was issued on the customer loan account. |

|

Mnemonic: INBLMUTE |

This field displays the amount of the Original Tax that has been earned by your institution over the life of the selected insurance policy. The Original Tax amount is amortized and charged to the customer as part of the insurance policy premium payment. This field is calculated as follows: Original Tax - Unearned Tax = Earned Tax |

|

Mnemonic: INBLMUTU |

This field displays the amount of the municipal tax that is eligible to be rebated back to the customer if a loan payoff or policy cancellation occurs. |

|

Mnemonic: INMRFD |

This field displays any city taxes that are eligible to be refunded when the selected insurance policy is canceled or paid off. |

|

Mnemonic: INMUTR |

This field displays the city tax rate for the selected insurance policy. |