Navigation: Loans > Loan Screens > Commercial Loans Screen Group > Property Management Screen > Financial Profile Data tab >

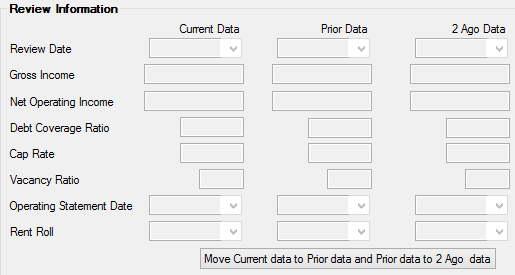

Review Information field group

Commercial Loans screens in CIM GOLD are used to handle your institution's property management needs for commercial loans. Use this field group on the Financial Profile Data tab to view and edit financial profile information about the property.

Each field in this field group has 3 displayed values: The field's Current Data, Prior Data, and 2 Ago Data. When entering information in this field group for the first time, use the Current Data fields. If you want to update the information in these fields, click the <Move Current data to Prior data and Prior data to 2 Ago data> button. All Current field values will move into the Prior Data fields and the Current fields will become available to enter the updated information. Remember to click the button every time you need to enter new information in the Current Data fields so the previous data can be retained for informational purposes in the Prior Data and 2 Ago Data fields.

The Calculated Fields field group displays values that can be helpful in filling out Current Data information in this field group.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: PZRVD1/PZRVD2/PZRVD3 |

Use this field to indicate the date the financial information entered on this tab was reviewed. |

|

Mnemonic: PZGINC/PZGIN2/PZGIN3 |

Use this field to indicate the property's gross income or gross potential income. Gross income is the total of rental revenues of the property, while gross potential income is the total amount in rent that would be received if the property were fully rented.

Gross operating income can be calculated by subtracting vacancy amounts from the total gross income. Gross operating income is used in calculating a property's Net Operating Income (see below).

This field can be used in calculating a property's Fair Market Value. The system calculates this value and displays it in the Income field in the Calculated Fields field group.

A breakdown of the property's income sources can be viewed on the Loans > Commercial Loans > Property Income/Expense/Units screen. |

|

Mnemonic: PZNINC/PZNIN2/PZNIN3 |

Use this field to indicate the property's net operating income, which can be determined by subtracting the property's operating expenses from its gross operating income (see Gross Income above).

Operating expenses include (but are not limited to) advertising, insurance, maintenance, property taxes, property management, repairs, supplies, and utilities.

Example: Gross rents possible 35,000 + Other income + 2,000 ---------------- Total gross income 37,000 - Vacancy amount - 3,000 ---------------- Gross operating income 34,000 - Operating expenses - 10,000 ---------------- Net operating income = 24,000

This field can be used in calculating a property's Fair Market Value. The system calculates this value and displays it in the Calculated Fields field group.

A breakdown of the property's income sources can be viewed on the Loans > Commercial Loans > Property Income/Expense/Units screen. |

|

Mnemonic: PZDCRT/PZDCR2/PZDCR3 |

Use this field to determine the property's debt coverage ratio, which can be determined by dividing the property's Net Operating Income (see above) by its total debt service (the principal and interest payment on the loan). The system calculates this value and displays it in the Calculated Fields field group. |

|

Mnemonic: PZCAPR/PZCAP2/PZCAP3 |

Use this field to indicate the property's cap rate (or Capitalization Ratio), which is a percentage used to estimate the value of income-producing properties. The cap rate is determined by dividing the property's Net Operating Income (see above) divided by the property sale price.

Example: A property has a Net Operating Income (NOI) of $155,000.00 and the sales price is $1,200,000.00. $155,000.00 / $1,200,000.00 X 100 = 12.9, which is is the cap rate.

Example of Using Cap Rate To Estimate Property Value: A property has an NOI of $155,000.00 and a Cap Rate of 12.9. $155,000.00 / .129 = $1,201,550.00, which is the property's estimated value.

This field can be used in calculating a property's Fair Market Value. |

|

Mnemonic: PZOCCP/PZOCC2/PZOCC3 |

Use this field to indicate the vacancy ratio of the property. This value is calculated by either:

•Dividing the rented square footage by total rentable square feet,

or

•Dividing the rental income net of vacancies by the gross potential income. |

|

Mnemonic: PZLIS1/PZLIS2/PZLIS3 |

Use this field to indicate the statement date for income and expense statements for the property. |

|

Mnemonic: PZLLR1/PZLLR2/PZLLR3 |

Use this field to indicate the most recent date a rent roll was generated for the property.

Rent rolls are lists of tenants and their spaces, rental terms, and rent amounts. |