Navigation: Loans > Loan Screens > Account Information Screen Group > Dealer Information Screen >

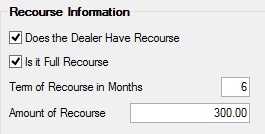

Recourse Information field group

The following information defines fields found in the Recourse Information field group of the Loans > Account Information > Dealer Information screen.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LNDLRC |

This field is used by your institution to determine if the dealer has recourse for this loan. If this field has a checkmark, it indicates that the dealer does have recourse. The default, a blank checkbox field, indicates the dealer does not have recourse. |

|

Mnemonic: MLFURC |

This field is used by your institution to determine if the dealer has full or partial recourse. If this field is checked, it indicates that the dealer does have full recourse. The default, a blank checkbox field, indicates the dealer has a partial recourse. However, if the Does the Dealer Have Recourse field above is not checked, then it does not matter if this field is checked or not; the dealer has no recourse. |

|

Mnemonic: MLTERC |

This field displays how long the recourse will be effective. After this term expires, the loan will be treated as if it has no recourse on it at all. Also, if the Does the Dealer Have Recourse field above does not have a checkmark, the loan will be treated as if it has no recourse. |

|

Mnemonic: MLRECB |

This field is used to indicate the amount of dealer recourse, if the Does the Dealer Have Recourse field above is checked. |