Navigation: Loans > Loan Screens > Cards and Promotions Screen >

Use the Reage/Payment Schedule tab on the Cards and Promotions screen to bring the account current. This tab is used to help an account owner catch up on their delinquent payments (bring the account status to current). Security is needed to use this tab.

Two functions are available on this tab to help the borrower catch up on payments:

1.Reaging

2.Scheduled Payments

1. Reaging

Reaging is the aYou can use this tab to roll the due date to the number of months selected. Any fees associated with reaging a loan will automatically process once you have completed the steps to reage a loan, as outlined below.

Note: If the loan is in default (the Default Rate is in effect), the loan cannot be reaged.

This tab is in the bottom tab group on this screen. The top and bottom tab groups display independently of each other. Any top tab can be viewed with any bottom tab simultaneously.

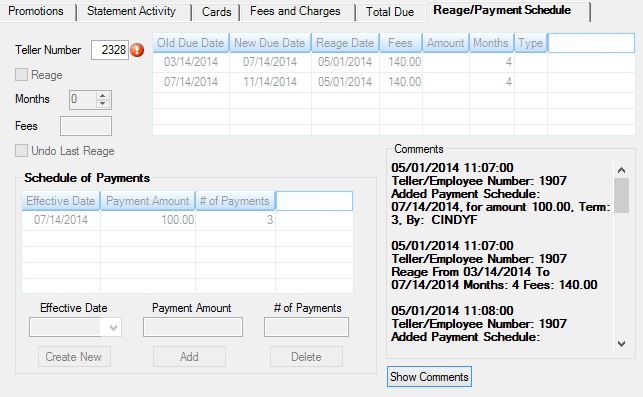

The list view on this tab displays information about all recent reages on the customer card loan account. This information includes the Old and New Due Dates on the account, the Date the reage occurred and the amount in fees assessed during the reage, and the number of Months the account was reaged, as well as the Amount in payments that were involved in the reage.

Loans > Cards and Promotions Screen, Reage/Payment Schedule Tab

To reage a card loan:

1.Mark the Reage field.

2.Use the Months field to indicate the number of months to reage the card in the future.

3.Click <Save Changes>.

For each month the loan is reaged, Fees will automatically calculate. When reage changes are saved, the information will display in the list view and Hold Code 120 will be set. A card reage is not a deferment, so it will not display on CIM GOLD deferment screens.

A card reage can be reversed. For more information, see help for the Undo Last Reage field below.

The fields on this tab are as follows:

Field |

Description |

|

|

Mnemonic: TLTLLR |

Use this field to indicate the the teller number of the employee at your institution who is reaging the card loan. Only tellers with proper security can reage a card loan. |

|

|

Mnemonic: N/A |

Use this field to indicate whether the customer card loan account is allowed to be Reaged. |

|

|

Mnemonic: RGMTHS |

Use this field to indicate the number of months in the future the customer card loan account will be reaged. |

|

|

Mnemonic: RGFEES |

This field displays the amount in fees that will be assessed on the customer card loan account once it is reaged. For each month the loan is reaged, fees will automatically calculate. |

|

|

Mnemonic: N/A |

Use this field to reverse the most recent customer card loan account reage performed. The loan will return to its status before the reage, and Hold Code 120 will be removed. This feature can only be used if there have been no monetary transactions or file maintenance on the loan since it was reaged. |

|

Use this field group to indicate alternate payment schedules and amounts on the customer card loan account, either permanently or temporarily. See below for more information.

|

||

Click <Show Comments> to view all teller comments about previous reage transactions on the customer card loan account in this field. |