Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Account tab > Payment and Classification field group > Payment Method 0: Conventional Loans >

As discussed in the P/I Constant and Interest Calculation topic, the interest amount on conventional (payment method 0) loans is calculated each month according to the Principal Balance, Interest Rate, and Interest Calculation Method. The Interest Calculation Method determines the number of days used in calculating that month’s interest. Once the Interest Calculation Method is set up on the loan, it should not be changed. Loan disclosures require your institution to inform borrowers about the method by which their interest is calculated.

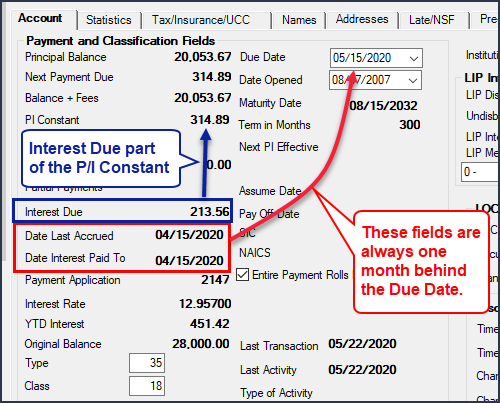

•The Date Last Accrued (LNDLAC) will be exactly one month of payment behind the Due Date. Interest for a payment is calculated from the Date Last Accrued to the Due Date.

•The Date Interest Paid To (LNPDTO) is the date up to which interest has been paid on the loan. This date is not used for interest calculation purposes, but it is shown on the Loans > Account Information > Account Detail screen for loan servicing convenience. The Date Interest Paid To is updated when a payment is made and is usually the same date as the Date Last Accrued.

•The Interest Due field shows the amount of calculated interest due each month.

See the following example of these fields on the Account Detail screen:

For conventional loans, the five possible interest calculation methods are:

1.365/365 days per year

2.360/360 days per year

3.365/360 days per year

4.360/365 days per year

5.366/366 days in a leap year

|

Note: For method 5, if the interest period crosses over from a leap year to a regular year (or vice-versa), the period from December 15 to January 15 will use the 365-day basis and the period from January 15 to February 15 will use the 366-day basis. |

|---|

See below for brief descriptions of each method code:

Interest Calculation Method 1 calculates monthly interest for the P/I Constant as follows:

Principal Balance amount as of last payment x Interest Rate = N N / 365 x days difference from last Due Date to current Due Date = the amount of payment that goes towards interest

The rest of the P/I Constant, after paying interest, goes to principal.

Example: P/I Constant = $200 Principal Balance as of last payment date = $25,000 Interest Rate = 5.75% Last Due Date to this Due Date = 31 days

Interest calculation: 25,000 x .0575 / 365 X 31 = $122.09 — This is the amount of interest paid from the P/I Constant. 200.00 – 122.09 = $77.97 — This is the amount applied to principal from the P/I Constant. |

Interest Calculation Method 2 considers every month as having 30 days, which makes for an easy calculation:

Principal Balance x Interest Rate / 365 x 30 = the amount of P/I Constant that goes towards interest

The rest of the P/I Constant, after paying interest, goes to principal.

Example: P/I Constant = $200 Principal Balance as of last payment date = $25,000 Interest Rate = 5.75%

Interest calculation: 25,000 x .0575 / 360 x 30 = $119.79 — This is the amount of interest paid from the P/I Constant. 200.00 – 119.79 = $80.21 — This is the amount applied to principal from the P/I Constant. |

When using Interest Calculation Method 3, the annual interest rate is divided by 360 to get the daily interest rate, and then multiplied by the days in the month:

Principal Balance amount as of last payment x Interest Rate = N N / 360 x days difference from last Due Date to current Due Date = the amount of payment that goes towards interest

The rest of the P/I Constant, after paying interest, goes to principal.

Example: P/I Constant = $200 Principal Balance as of last payment date = $25,000 Interest Rate = 5.75% Due Date to current Due Date = 31 days

Interest calculation: 25,000 x .0575 / 360 X 31 = $123.78 — This is the amount of interest paid from the P/I Constant. 200.00 – 123.78 = $76.22 — This is the amount applied to principal from the P/I Constant. |

Interest Calculation Method 4 functions like Method 1 (see above) but calculates assuming each month has 30 days. Like Method 1, this method calculates interest accruals every day using a daily per diem interest amount:

Principal Balance amount as of last payment x Interest Rate = N N / 360 x 30 = the amount of payment that goes towards interest

The rest of the P/I Constant, after paying interest, goes to principal.

Example: P/I Constant = $200 Principal Balance as of last payment date = $25,000 Interest Rate = 5.75%

Interest calculation: 25,000 x .0575 / 365 X 30 = $118.15 — This is the amount of interest paid from the P/I Constant. 200.00 – 118.15 = $81.85 — This is the amount applied to principal from the P/I Constant. |

Interest Calculation Method 5 functions like Method 1 (see above) but also considers leap years. In a leap year, this method calculates using 366. In a regular year, this method calculates using 365:

Principal Balance amount as of last payment x Interest Rate = N N / [366 if leap year, 365 if regular year] x number of days from Due Date to Due Date = the amount of payment that goes towards interest

The rest of the P/I Constant, after paying interest, goes to principal.

Example: P/I Constant = $200. Principal Balance as of last payment date = $25,000 Interest Rate = 5.75% Last Due Date is 02/15/2020 and next Due Date is 03/15/2020 (a leap year) = 29 days

Interest calculation: 25,000 x .0575 ÷ 366 X 29 = $113.90 — This is the amount of interest paid from the P/I Constant. 200.00 – 113.90 = $86.10 — This is the amount applied to principal from the P/I Constant. |