Navigation: Loans > Loan Screens > Insurance Screen Group > Policy Detail Screen >

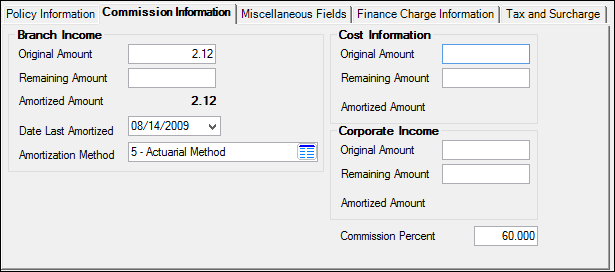

The Commission Information tab on the Insurance Policy Detail screen is used to view and edit commission information for the selected insurance policy on the customer loan account.

On this tab, commissions can be amortized and automatically posted to the General Ledger on a monthly basis (This is similar to how deferred fees, costs, etc. function). Use the GOLD Services > General Ledger > Setup G/L and Commissions screen to store General Ledger numbers for insurance premiums, taxes, surcharges, and commissions.

This monthly amortization uses transaction codes 100 (commission debit) and 110 (commission credit). The commission amortization uses the term and the amortization method of the insurance.

Insurance commissions will not amortize if any of the following conditions exist on the loan:

| 1. | The loan is non-performing. |

| 2. | The General Category is 80 or greater. |

| 3. | The Asset Classification is "Doubtful" or "Loss." |

| 4. | Action Code 39 (Stop Deferring Fees/Premiums) stops fees and premiums from amortizing up to the action date. On or after the action date, the fees/premiums will amortize. This action code will also stop the insurance commissions from amortizing until the action date. |

| 5. | If an insurance policy is canceled by a payoff, write off, charge off, death claim, etc., the commission rebate will be calculated as follows: |

| Original Commission Amount / Original Premium = Commission Percentage Refund Amount X Commission Percentage = Commission Rebate |

| Any remaining commissions after the rebate will be earned by the institution. |

|

GOLDPoint Systems Only: Imbedded in tran codes 100 and 110 is the insurance type. The "branch" and "corporate" commissions use amount field L-22 (credit) and posting field 23 (insurance policy type) during the amortization transaction, while the "cost" uses amount field L-23 (debit) and posting field 23 (insurance policy type). Be sure the G/L Autopost is set up to handle this transaction.

Update function 80 must be set to "CYC31B" to amortize the commissions properly. |

|---|

Loans > Insurance > Policy Detail Screen, Commission Information Tab

The field groups on this tab are as follows: