Navigation: Deposit Screens > Definitions Screen Group > Teller Information Screen > Teller Detail field group >

Security Group Examples

The following is an example of how security groups work:

Security Group |

Beginning Deposit Teller |

Experienced Deposit Teller |

Loan Teller |

Security Group 1: Savings Inquiries |

Yes |

Yes |

No |

Security Group 2: Savings-Low Level Transactions |

Yes |

Yes |

No |

Security Group 3: Savings-High Level Transactions |

Yes |

Yes |

No |

Security Group 4: Retirement Transactions |

No |

Yes |

No |

Security Group 5: Loan Transactions |

No |

No |

Yes |

Security Group 6: New Accounts |

No |

Yes |

No |

Security Group 7: General Ledger Transactions |

No |

Yes |

No |

Security Group 8: Not Used |

No |

No |

No |

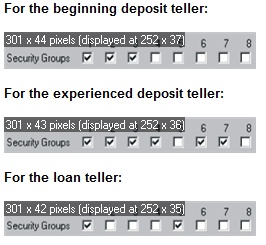

In this example, the loan teller is restricted to only performing savings inquiries and loan transactions. The beginning deposit teller is able to perform savings inquiries, low-level savings transactions, and high-level savings transactions, but is restricted from performing any transactions in the other groups. The experienced deposit teller can perform all deposit transactions, but not loan transactions.

This information would be set up on the screen in the Security Groups fields 1 through 8, as shown below.

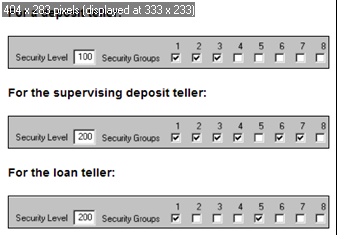

Note: Security within security groups can be further restricted with the security level.

The following example explains the security level in reference to the security groups.

Security Group |

Beginning Deposit Teller |

Experienced Deposit Teller |

Loan Teller |

Security Group 3: Savings-High Level Transactions Open Deposit Loan Transaction (Security Level 200) |

Yes |

Yes |

No |

Example: The security level associated with the Open Deposit Loan transaction is 200, and this transaction is placed in security group 3. The deposit teller would not be able to perform this transaction because, although he or she has access to security group 3, his or her security level of 100 is not equal to or greater than that of the transaction.