Navigation: Deposit Screens > Account Information Screen Group > Additional Fields Screen >

Use this tab (which appears on both the Deposits > Account Information > Additional Fields screen and the Deposits > Retirement > Retirement Plan screen) to view and edit information about retirement distribution for the customer deposit account. These fields are only file maintainable for customer accounts that use the retirement feature (the Retirement field on the Deposits > Account Information > Account Information screen is marked). Features for individual customer retirement accounts can also be adjusted in the Retirement fields on the Deposits > Account Information > Customer Directed Transfers > Customer Directed Transfers screen.

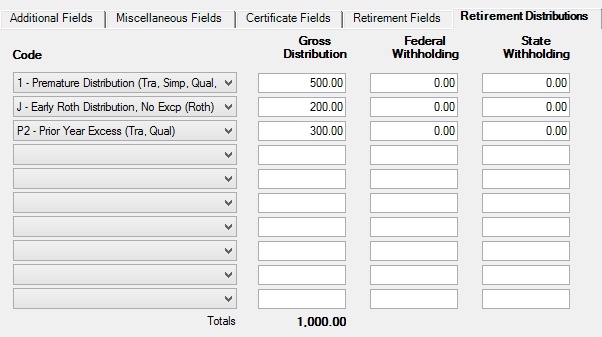

Deposits > Account Information > Additional Fields screen, Retirement Distributions tab

Up to ten distribution codes can be set up using the fields on this tab (as shown in the example screenshot above). The total sum of the fields in the Gross Distribution, Federal Withholding, and State Withholding column must remain the same before and after changing individual field amounts, or one of several error messages will appear and the record will not be updated. Possible error messages, depending on the column where the error occurs, are as follows:

UPDATE NOT ALLOWED - DISTRIBS DO NOT BALANCE

UPDATE NOT ALLOWED - FEDWHS DO NOT BALANCE

UPDATE NOT ALLOWED - STAWHS DO NOT BALANCE

AMOUNT MUST BE GREATER THAN FED/STA WH

The fields on this tab are as follows:

Field |

Descriptions |

|

Mnemonic: DMDSCA |

Use these fields to indicate why money was withdrawn or distributed from the customer account. The Gross Distribution fields (explained below) contain the year-to-date amounts for the corresponding distribution categories. The codes used in this field are regular IRS distribution codes. See the IRS Distribution Codes help page to learn more. |

|

Mnemonic: WKTOT9 |

Use these fields to indicate the amounts withdrawn or distributed from the customer account during the present calendar year for the corresponding distribution Code. |

|

Mnemonic: DMFWHD |

Use these fields to indicate the amount of federal withholding on the customer account for the corresponding distribution Code. |

|

Mnemonic: DMSWHD |

Use these fields to indicate the amount of state withholding on the customer account for the corresponding distribution Code. |