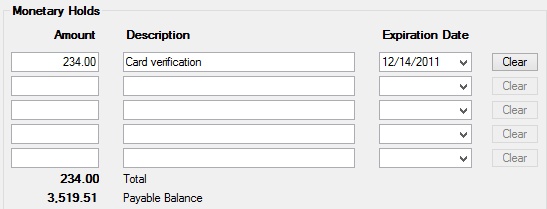

Navigation: Deposit Screens > Account Information Screen Group > Restrictions & Warnings Screen > Monetary Holds tab >

Monetary Holds field group

Use this field group to create and edit monetary holds on the customer deposit account. Up to five holds can be set up on this screen.

Monetary holds can also be added by processing teller transaction 1830 (Add Monetary Hold), using Institution Option MHEA (place monetary holds on E-ACH batches), or processing ATM or debit card authorizations that are sent through online ATM vendors.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: DMMHAM |

Use these fields to indicate the dollar amount of each monetary hold on the customer account. Once a hold is set up on this tab, the system will not allow the customer account balance to be drawn to less than the total amount of all monetary holds (as shown in the Total field). This safeguard can be overridden depending on the user's transaction condition override level. All holds placed by ATM or debit card purchase authorizations are added together into one daily amount that displays in this field. |

|

Mnemonic: DMMHDS |

Use these fields to indicate a reason or description for each corresponding monetary hold on the customer account. For holds placed by ATM or debit card purchase authorizations, this field will contain the acronym "POS*" followed by the last ATM address or merchant name entered for that day. |

|

Mnemonic: DMMHEX |

Use these fields to indicate the date each corresponding monetary hold amount will expire. If this field is left blank, the corresponding hold will never expire.

To control the expiration of holds placed by ATM or debit card purchase authorizations, Institution Option MHLD (number of days monetary holds for POS authorizations) can be used. This option can only be used if GOLDPoint Systems is not processing the match-and-hold feature for your institution. Otherwise, holds placed by ATM or debit card purchase authorizations will never be dropped by the system.

The expiration date for monetary holds is normally calculated on business days. However, Institution Option OPTN - CDAH (Use calendar days for POS money authorization $$ holds) allows the calculation of expiration dates to include weekends and holidays. |

|

Mnemonic: N/A |

The total dollar value of all of monetary hold Amounts set up on the customer account. |

|

Mnemonic: WKPYBL |

The customer account's Payable Balance from the Deposits > Account Information > Account Information screen. |