Navigation: GOLD Services Screens > Check Reconciliation Screen Group >

Voiding checks is a manual process that must be performed by someone at your institution. If you have Institution Option OPT CKRC turned on, the system adds two voided records when GOLDPoint Systems prints your institution's checks. Checks can be voided or deleted one at a time though the GOLD Services > Check Reconciliation > Check Detail screen, or you can use the Mass Void/Delete screen to void or delete a large number of Check Recon records.

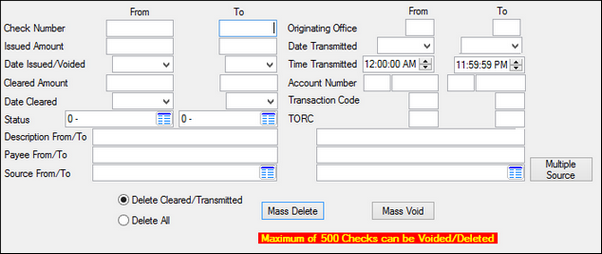

The following is an example of the Mass Void/Delete screen:

GOLD Services > Check Reconciliation > Mass Void/Delete Screen

To delete or void check records:

1.Enter information in the search fields for the checks that should be dropped or voided. Only 500 records can be deleted or voided at a time, so you may need to enter more information in more fields to limit the results. When the results are less than 500, the message "Maximum of 500 Checks Can be Voided/Deleted" will go away.

2.Select either the Delete Cleared/Transmitted radio button or the Delete All radio button.

3.Click <Mass Delete> or <Mass Void> and the system will automatically drop (or void) the checks that match the criteria.

| For voided checks, the system will change the Status for the check to be "V - Voided" and a voided date will be added to the record. The system will create a voided check record for each check number within the range, whether or not the number has been issued. Note: Cleared checks cannot be voided. |

|

WARNING: Do not give security to this screen until you are ready to delete check records. |

|---|

|

Note: As you void checks and a replacement check is to be issued, you have the ability to cross-reference both checks by using the Cross Reference field on the Check Detail screen. This must be done manually by someone at your institution. In addition, you may want to cross-reference both checks to each other.

Example: Check 127 was issued. The number “127” appears in the Check Number field. The check was lost and your institution voided it. You issued a new check to your customer. The new check number is 563.

For the first check (#127), the Check Number field is "127" and the Check Number field is "563." For the second check (#563), the Check Number field is "563" and the Check Number field is "127." |

|---|

Checks are voided for several reasons, such as being lost or stolen, being made payable to the wrong name, having check printing errors where the incorrect check number was used (e.g., the computer check number doesn't match the real number of the check), or having printing equipment problems where checks jam or don't line up correctly.

Regardless of the reason checks are voided, you must consider how it affects the accounting and general ledger areas of your business. Some items to consider and internal procedures to be developed could include:

1.If a replacement check is issued, what G/L should be used? The same one, a different one, etc.?

2.If a replacement check is not issued, what do you do with the money? Should it be credited back to an account (savings, checking, loan, etc.) or to a G/L? If you credit back to an account, which G/L do you debit?

3.If a replacement check is issued, do you debit the same G/L and reissue the check, or do you credit the deposit/loan account and redisburse from it? This procedure may be determined based on why the check was voided.

GOLDPoint Systems often prints checks in our offices during the afterhours process for items such as deposit interest checks or CD maturities. Occasionally, a printing error will occur where the checks don't line up correctly, the checks jam in the printer, or the wrong check number is used. With these cases, your GOLDPoint Systems customer service representative will contact you the next morning and notify you of the error. You can then void the checks using any of the previously mentioned processes. The actual checks with the errors will be marked "VOID" at GOLDPoint Systems and returned to your institution.

|

Note: If an issued check is voided after it has been transmitted to a third-party processor, then the system will not update the transmitted check with a void status. Instead it will update the original sequence with "D" (Duplicate) status and create a new sequence with the same check number and the void status. This is so the check will be re-transmitted to the processor. This creates two records in check reconciliation for the same check number. The Check Reconciliation Detail, Summary, and Register reports will consider the two records one check. Both sequences will be printed on the report, but only the voided sequence will be added into the totals. The sequence that is not added into the totals will be marked with a "&" sign on the report. |

|---|

Checks from Multiple Sources

You can search for multiple check source codes by clicking the <Multiple Source> button. This brings up the Search Selected Source dialog, which you can use to select all the sources you want to display in the results.

The fields on this screen are as follows:

Field |

Description |

|

Mnemonic: CRCHK# |

These fields are used to enter parameters for check number. |

|

Mnemonic: CRCKOT |

These fields are used to enter parameters for issued amount. |

|

Mnemonic: CRDTCK |

These fields are used to enter parameters for date issued. |

|

Mnemonic: CRCKIN |

These fields are used to enter parameters for cleared amount. |

|

Mnemonic: CRDTPT |

These fields are used to enter parameters for date cleared. |

|

Mnemonic: CRTPC1 |

These fields are used to enter parameters for status. |

|

Mnemonic: CRDSCR |

These fields are used to enter alphabetical parameters for description. |

|

Mnemonic: CRPYNM |

These fields are used to enter alphabetical parameters for payee names. |

|

Mnemonic: CRSRCE |

These fields are used to enter alphabetical (by code) parameters for source. |

|

Mnemonic: CRBORG |

These fields are used to enter parameters for originating office number. |

|

Mnemonic: CRXMDT |

These fields are used to enter parameters for date transmitted. |

|

Mnemonic: CRXMTM |

These fields are used to enter parameters for time transmitted. You can type the time into the pre-formatted field (HHMMSS), or select a time using the up and down arrow buttons on the right side of the field. You can also use the up and down arrow keys on your keyboard to change the time, and you can navigate within the field using the left and right arrow keys on your keyboard. Use AM or PM to designate morning or evening. |

|

Mnemonic: CRACTA |

These fields are used to enter parameters for the GOLDPoint Systems account number. |

|

Mnemonic: CRTCOD |

These fields are used to enter parameters for transaction code number. |

|

Mnemonic: CRTORC |

These fields are used to enter parameters for TORC number. |

Select this radio button if you want to delete only cleared or transmitted checks. |

|

Select this radio button if you want to delete all checks within the parameters set in the fields on this screen. |

See also:

Check Detail screen

|

Record Identification: The fields on this screen are stored in the FPCR record (Check Reconciliation). You can run reports for this record through GOLDMiner or GOLDWriter. See FPCR in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPCR record on the Field Level Security screen/tab. |