Navigation: CIM GOLD What's New > What's New in Version 7.20.3 >

Report to Credit Bureau Field Added to Account Detail Screen |

Future Payments No Longer Allowed with Other Payment Account |

Enhancement |

Description |

|---|---|

Operations Secured F/M Data Navigation Error Corrected

CMP: 6280

CIM GOLD version 7.20.3 |

An error was preventing users from navigating between accounts using the arrow buttons at the top of CIM GOLD on the Loans > Operations Secured F/M Data screen. This error has been corrected. |

|

CMP: 10065

CIM GOLD version 7.20.3 |

Previously, the Loans > Account Adjustment screen would only display a zero rate on the account (in the Current Interest Rate field) after pressing the <Zero Rate> button if the screen was refreshed. Now, the zero rate displays on the screen instantly once the <Zero Rate> button is pressed. |

Cancel Payment Button for ACH Payments

CMP: 12786, 13821

CIM GOLD version 7.20.3 |

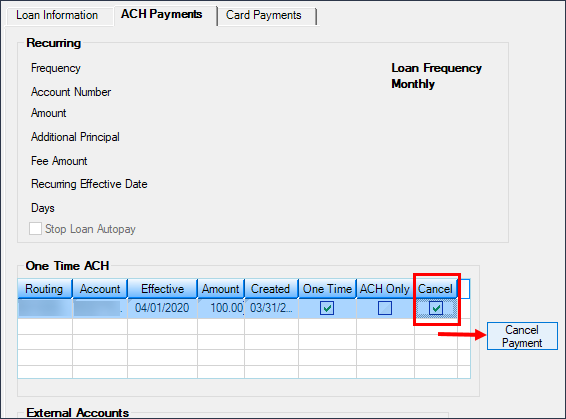

We have added a button to the Loans > Account Information > Payment Information screen > ACH Payments tab that allows users to cancel one-time ACH payments that appear in the list on that tab (as shown below). Using this button also deletes the payment record in the system. See Figure 1 below.

To use this button, simply select the desired payment in the list, mark the checkbox in the new Cancel column, then click the button (if you have proper security, as explained below).

Security

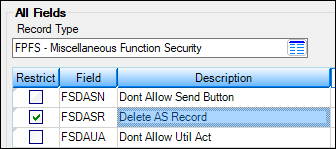

Field-level security for this button can be turned on/off for employees using mnemonic FSDASR (Delete AS Record) in record type FPFS (Miscellaneous Function Security, see below) on the Security > Setup > Field Level tab. Use this security to restrict the use of this button to specific employees at your institution.

|

Figure 1: Loans > Account Information > Payment Information Screen

Enhancement |

Description |

|---|---|

|

CMP: 14147

CIM GOLD version 7.20.3 |

The Physical Address field on the CIF tab of the Loans > Marketing and Collections screen is programmed to display an error icon

The field has been adjusted so error icons now display properly without being cut off. |

Format Phone Number Option for Auto Dialer

CMP: 14455

CIM GOLD version 7.20.3 |

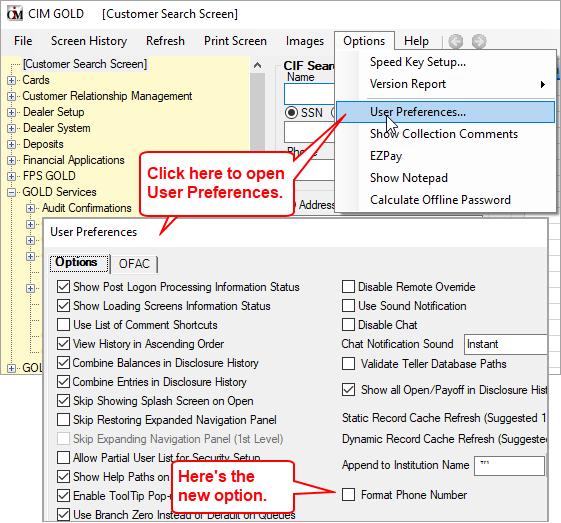

A new option is available in the CIM GOLD Options > User Preferences > Options menu for choosing how phone numbers are formatted when they are used in Auto Dialer (accessed from the Phone Information list view on the Loans > Marketing and Collections screen).

•If the new Format Phone Number checkbox field is marked (see below), phone numbers selected in the Auto Dialer dialog will transfer to your institution's Auto Dialer without any spaces or dashes (xxxxxxxxxx).

•If Format Phone Number is left blank, phone numbers will transfer to Auto Dialer with a space and a dash (xxx xxx-xxxx). Leaving this option blank is the default setting for most institutions.

This option was implemented to help certain institutions who were experiencing errors when their third-party Auto Dialers weren't accepting CIM's default phone number formatting.

Regardless of the status of this field, using the <Ctrl> + C method of copying a phone number from the Auto Dialer dialog will always result in the format xxx xxx-xxxx when the number is pasted (<Ctrl> + V). |

Under the Options menu at the top of CIM GOLD, select "User Preferences"

Enhancement |

Description |

|---|---|

Enhanced Payoff Quote Details in Comments

CMP: 2664 Work Order: 47387, 51178

CIM GOLD version 7.20.3 |

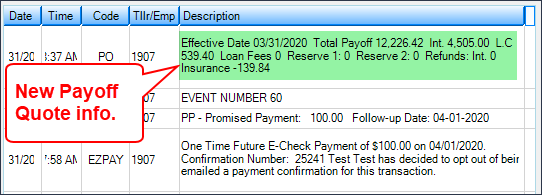

When a user clicks the <Quote to Comment> button on the bottom of the Loans > Payoff screen, payoff quote information for the selected effective date is sent to the Collection Comments, which can be viewed on the Contact tab of the Loans > screen. We have updated the payoff quote message sent to the Collection Comments to include interest (Int.), late charge (L.C), loan fees, reserve, and interest/insurance refund amounts in addition to the Effective Date and Total Payoff amount.

Previously, if a payoff quote was processed, the resulting comment would simply appear as:

Payoff Quote for <amount> With Effective Date <date>

The new enhanced payoff quote comments appear as shown below.

Note: This change is retroactive, meaning no matter what version of CIM GOLD you are currently using, the Payoff Quote will show accordingly in the Collection Comments. |

Loans > Marketing and Collections Screen > Contact Tab

Enhancement |

Description |

|---|---|

Payment Banner Added to Contact Tab

CMP: 13717, 14304 Work Order: 57953

CIM GOLD version 7.20.3 |

We have added a payment alert banner to the top of the Contact tab on the Loans > Marketing and Collections screen (see below). This banner shows any time payments were made today, payments set up to be paid in the future (one-time future payments), or recurring payments were set up. This banner will show payment information whether the payments are made from the EZPay screen, Make Payments screen, or CIM GOLDTeller payment transactions.

This is the same banner found on the Payments Due field group and the EZPay screen.

•If a payment was made today, this banner will display: "A Payment Was Made Today." •If recurring payments are set up, the banner will display: "Recurring payments." •If future one-time payments are setup, the banner will display: "One-time Auto-payment: NNNN Date: MM/DD/YYYY" |

Enhancement |

Description |

|---|---|

Collateral Filing Status Error Correction

CMP: 14701 Work Order: 58835

CIM GOLD version 7.20.3 |

An error was preventing the Collateral Information list view on the Loans > Marketing and Collections screen from being properly updated with the Filing Status as indicated on the Loans > Collateral Information screen. This error has been corrected. |

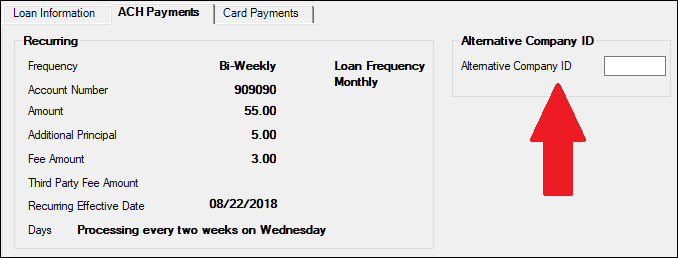

Alternative Company ID Field on Payment Information Screen

CMP: 14705

CIM GOLD version 7.20.3 |

The Alternative Company ID field (AUACID) is now available on the ACH Payments tab of the Loans > Account Information > Payment Information screen. This field can be used to store an additional company ID number. This information is usually entered for certain institutions when the loan is originated and boarded into CIM GOLD for loan servicing. The field is for an alternative company (third-party) responsible for processing ACH automatic payments, instead of GOLDPoint Systems.

Note: For the Alternative Company ID to function properly some set up must be done behind-the-scenes by GOLDPoint Systems. Additionally, the Cycle Code (LNACYC) should be set to "0," and the EZPay option eCheck Process Type (EZCHCR) must be set to "3 - 3rd Party." Your GPS account manager can set up the EZPay option for you on the EZPay IMAC Table. |

Loans > Account Information > ACH Payments Tab

Enhancement |

Description |

|---|---|

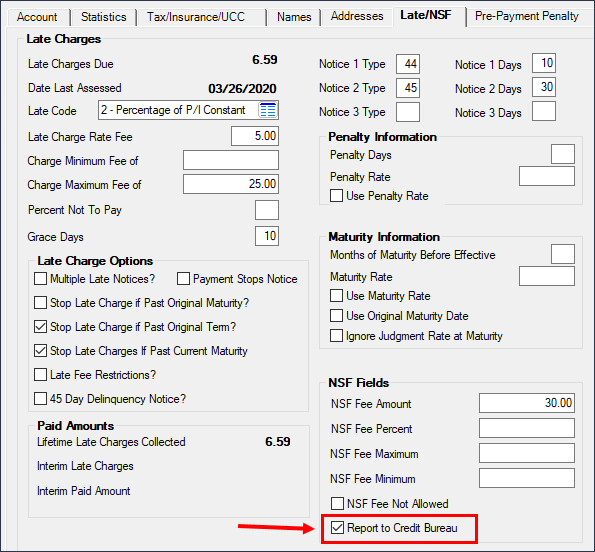

Report to Credit Bureau Field Added to Account Detail Screen

CMP: 8648

CIM GOLD version 7.20.3 |

The Report to Credit Bureau checkbox field has been added to the NSF Fields field group on the Late/NSF tab of the Loans > Account Information > Account Detail screen. This checkbox is used to indicate whether information about the customer loan account should be reported to the Credit Bureau. See Credit Reporting for more information.

We also added this field to this screen so it can be part of your Loan Patterns. Loan Patterns are applied to loans when they are originated (either through formulas set up in GOLDTrak PC; through Gateway; GOLDAquire Plus; or Galaxy). Loan Patterns establish common fields for all loan types. See the Loan Patterns topic for more information.

The following example shows where the Report to Credit Bureau field has been added to the Late/NSF tab. |

Loans > Account Information > Account Detail Screen > Late/NSF Tab

Enhancement |

Description |

|---|---|

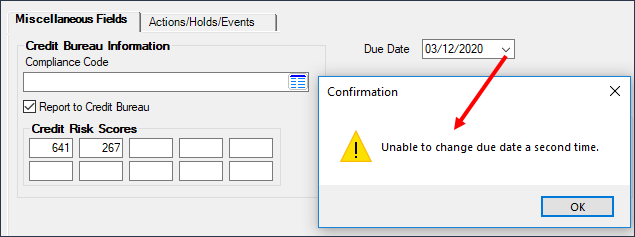

New Options for Due Date Restrictions

CMP: 14124, 11282 Work Order: 55467

CIM GOLD version 7.20.3 |

UPDATE: We advertised this CMP in the February 2020 Update document. At that time, we released the new institution options to core services (host). In CIM GOLD version 7.20, we are advertising the last part of this project, as described below.

Two new institution options have been created for restricting adjustment of the Due Date field on the Miscellaneous Fields tab of the Loans > Misc Secured F/M Data screen. These options only affect the Due Date field on that screen; however, changing the Due Date there affects all Due Dates. These options restrict how far in the future the Due Date can be changed, as well as how many times the Due Date can be changed on an account, as described below.

CDUR, Use Restrictions When Changing Due Date: If this option is enabled, the Due Date field can be changed once during the life of the loan. The system checks to see what the current Due Date Day (LNDUDY) is. If the current Due Date Day is the same as the day portion of LN1DUE (the first Due Date on the loan), the user will be allowed to make changes to the Due Date. If they are different, the following message will appear: “Unable to change due date a second time.”

For example, a loan account has a Due Date Day of the 2nd of every month. The customer calls to request their Due Date Day be near the end of the month—the 25th. The user would go to the Misc Secured F/M Data screen and change the Due Date to be the 25th. But if that Due Date was already adjusted previously, they would not be able to change it (if option CDUR was set). See example A below.

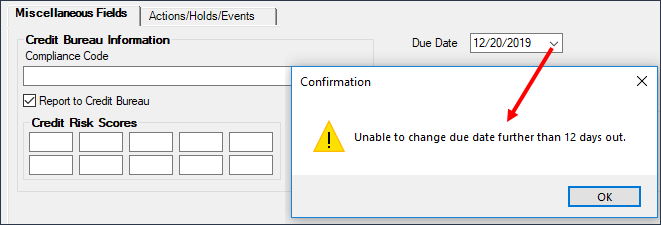

DDCD, Due Date Change Days Maximum: Use this option to indicate the maximum number of days forward a user will be able to change the Due Date. If a user attempts to change the Due Date to a date that is further out than the number of days indicated in this option, the action will not be allowed, and an error message will appear. See example B below. (Updated 07/20/2020 - This institution option used to be named CDMD, but we are now using DDCD for this option.)

Remember that Due Date changes in CIM GOLD are sent to the Critical File Maintenance Report (FPSRP122). |

A: Error message that appears when trying to change the Due Date and it’s already been changed before, and institution option CDUR is set.

Loans > Misc Secured F/M Data Screen in CIM GOLD

B: Error message that appears when trying to change the Due Date further out than the number of days in institution option CDMD.

Loans > Misc Secured F/M Data Screen in CIM GOLD

Enhancement |

Description |

|---|---|

|

CMP: 12476 Work Order: 56755

CIM GOLD version 7.20.3 |

It was reported by a client that the Date Last Marketed field at the top of the Marketing and Collections screen stopped showing data after CIM GOLD version 7.9.7 was released. This has been corrected, and now the Date Last Marketed shows the date an employee last marketed to the account owner to renew their loan (see below).

The Date Last Marketed field gets updated anytime an employee selects "MK - Marketed for Renewal" from the Comment Code field on the Loans > Marketing and Collections screen > Contact tab. |

Enhancement |

Description |

|---|---|

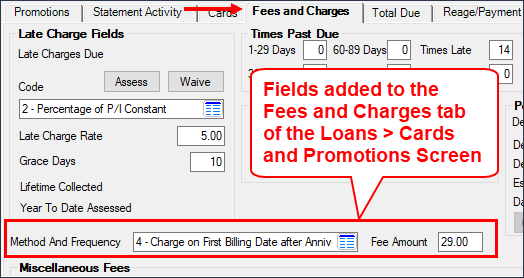

Fields Added to Cards and Promotions Screen

CMP: 13289 Work Order: 13288

CIM GOLD version 7.20.3 |

The Method And Frequency (LNRLSM) and Fee Amount (LNRLSA) fields, which were previously only displayed on the Finance Charge Information tab of the Loans > Line-of-Credit Loans screen, now appear on the Fees and Charges tab of the Loans > Cards and Promotions screen.

This change was implemented to provide institutions more options for viewing information about the annual service fees charged to customer credit accounts.

See help for these fields on the Line-of-Credit Loans screen to learn more about their purpose and function.

|

Loans > Cards and Promotions Screen > Fees and Charges Tab

Enhancement |

Description |

|---|---|

UCC/Title Info Link Added to Home Improvement Collateral

CMP: 14964

CIM GOLD version 7.20.3 |

We have added the UCC/Title Info link for Home Improvement collateral (Collateral Type 6). As you know, the Collateral Detail screen changes depending on which Collateral Type you have selected. We added the UCC/Title Info link at the request of one institution that had the need to record UCC and title information with home improvement collateral (see below).

See the Collateral Detail and UCC/Title help for more information. |

Enhancement |

Description |

|---|---|

|

CMP: 14499 Work Order: 58716

CIM GOLD version 7.20.3 |

For those institutions that show Converted History (institution option TOCH is set), the Converted History tab on the Loans > History screen has been improved to quickly show archived Converted History for accounts that were converted from one institution to another institution.

Previously, if users were viewing archived data and attempted to go to the Converted History tab, they would receive the following error message:

"Missing GPS Servicing url. Please contact GPS."

Users would then need to delete their cache (File > Delete Cache Files); switch to production set (File > Change Working Set); change back to archived set; and then go to the Converted History tab and they'd be able to view the data.

This has been improved, so now whether the user is in a production set or archived set, they will be able to view the data on the Converted History tab without needing to delete their cache.

Note: Institution option TOCH must be set to view the Converted History tab on the Loans > History screen. |

Enhancement |

Description |

|---|---|

EZPay Enhancements Made for LOC Loans

CMP: 15038

CIM GOLD version 7.20.3 |

We have made some modifications to the EZPay screen to allow recurring payments to revolving line-of-credit loans (payment method 5). The screen will also allow more regular recurring payments than just monthly, such as weekly, bi-weekly, and semi-monthly. Recurring payments via a checking/savings account or credit/debit card payments are allowed for these types of loans. Your GOLDPoint Systems account manager will need to set up some EZPay options if your institution currently doesn't allow for credit/debit card payments or more regular recurring payments. Contact your GOLDPoint Systems account manager if you would like to implement these features, as they will need to turn on some options for you.

Recurring Payment Amount

Because the minimum payment required on LOC loans changes from month-to-month (usually based on a percentage amount of either the outstanding balance or original balance), significant back-end programming has been done to automatically calculate the payment amount when setting up recurring payments for LOC loans. The recurring payment amount will be calculated by the system at the time the payment is pulled.

The Minimum Payment Due is determined by many factors including the Payment Type, Payment Percent of Balance, and whether the calculation is based on the Original Balance or Actual Balance as of the Billing Date. These fields are found on the line-of-credit screens, depending on which type of LOC the account is: Cards and Promotions screen (for LOC revolving card loans), Consumer Line-of-Credit (for consumer or overdraft LOC), or Line-of-Credit Loans (non-revolving LOC). See the Payment Details topic for more information.

For example, if a user sets up recurring payments on an LOC loan, they should leave the payment amount fields blank, then click <Submit Payment>. A message will be displayed informing the user that the payment amount will be automatically calculated at the time the payment is pulled (each frequency), as shown below:

Note: Users can override the amount calculated by the system by entering a specific amount in the Other field on the EZPay screen, and the system will use that Other amount to process the recurring payment each frequency (weekly, bi-weekly, semi-monthly, monthly). Users will need to use caution using this method, as they will want to ensure that a full payment is made by the Due Date + Grace Days or a late charge may incur.

Convenience fees and third-party fees can also be applied to these types of recurring payments, if your institution is set up appropriately.

Zero-balance Accounts

Recurring payments will eventually pay the account to zero. Once the account reaches zero, recurring payments are disabled. Should the account principal increase again after reaching zero (another purchase is applied to the account), recurring payments will need to be set up again through the EZPay screen should the customer want recurring payments. (Or the customer can set up recurring payments themselves through your institution's payment website (GAC).)

Note: LOC loans are not closed when the account reaches a zero balance. However, we do have an option to automatically close zero-balance LOC loans once the loan reaches maturity. See the documentation for institution option CLZB (Close Payment Method 5 at Maturity).

Core Services Part

A core services release (host) is also required before this functionality will be completely operational. The host release part will be released in May 2020, and we will notify you via the monthly Update document in DocsOnWeb. |

Enhancement |

Description |

|---|---|

New Option Waives Convenience Fees if Late Charges Exist

CMP: 14590, 14599, 14600

CIM GOLD version 7.20.3 |

We have added a new option to the EZPay Convenience Fee table (under Loans > System Setup Screens). The EZPay Convenience Fee table allows institutions to set up a fee amount based on loan type and state (classification), as some states allow fees or different amounts of allowed fees. See Figure 1 below showing this new option.

When this new option (Waive Late Fee if Late Charge Present) is set, loans that have had a late charge at any time since the Date Opened will not be assessed a convenience fee when running transactions from the EZPay screen. The Fee amount will be cleared on the EZPay screen, as shown in Figure 2 below.

If a late charge does exist on the loan, the Fee amount will show. See Figure 3 below.

Note: The Convenience Fee table does not work unless the Use Convenience Fee Table EZPay IMAC option is set up for your institution. Your GOLDPoint Systems account manager can help you set up that option. See the Fees topic in DocsOnWeb for more information.

Core Services Release: The core services (host) part of this project was advertised in the March Update (see CMP 14599, 14600). |