Navigation: GOLDWriter Mnemonic Dictionary >

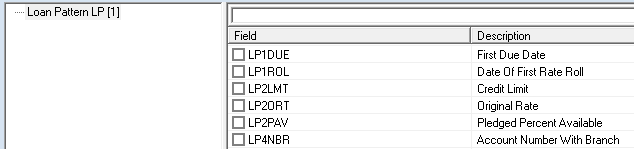

This section of the GOLDWriter Mnemonic Dictionary provides the CIM GOLD source location and entry details for GOLDWriter field mnemonics within the Loan Pattern LP master record category. Note that this record does not appear in main GOLDWriter record lists and must be accessed manually by entering the record code (CFLP) in the Master Record field (during the first step of the GOLDWriter Report Wizard process).

These mnemonics are not in use by current GOLDPoint software but can be viewed in legacy software like GOLDVision. For current loan pattern mnemonics, see Loan Pattern Header CJ.

Mnemonic |

Description |

CIM GOLD Field Location |

Details |

|---|---|---|---|

LP1DUE |

First Due Date |

|

|

LP1ROL |

Date Of First Rate Roll |

|

|

LP2LMT |

Credit Limit |

|

|

LP2ORT |

Original Rate |

|

|

LP2PAV |

Pledged Percent Available |

|

|

LP4NBR |

Account Number With Branch |

|

|

LP78AD |

GL Amortization Date |

|

|

LP78AF |

Use Anniversary of 1st Due Date |

|

|

LP78AM |

GL Amortization Method |

|

|

LP78AO |

Rule 78 Add On Rate |

||

LP78CD |

Rule 78 Unearned Dealer Rsrv At Date |

||

LP78CG |

Gl Unearned Interest |

||

LP78CI |

Rule 78 Unearned Int At Date Last Accr |

||

LP78CX |

Rule 78 Unearned Insur At Date Last Accr |

||

LP78DL |

Rule 78 Dealer Nbr |

||

LP78DR |

Rebate Rule Days |

||

LP78EC |

Rule 78 Extension Change Calc Code |

||

LP78EN |

Rule 78 Number Of Extensions Given |

||

LP78EX |

Rule 78 Extension Charge Amount |

||

LP78OD |

Rule 78 Original Unearned Dealer Reserve |

||

LP78OI |

Rule 78 Original Unearned Interest |

||

LP78OP |

Rule 78 Principal Before Add On |

||

LP78OX |

Rule 78 Original Unearned Insurance |

||

LP78PO |

Use Rule Days at Payoff Only |

||

LP78RD |

Rule 78 Rebated Dealer Reserve |

||

LP78RI |

Rule 78 Interest Rebated To Customer |

||

LP78RX |

Rule 78 Rebated Insurance |

||

LP78S1 |

PM3 Status Indicator 1 |

||

LP78SF |

Start With 1st Due Date |

||

LPA10C |

Action Code 10 |

||

LPA10D |

Action Date 10 |

||

LPA2CD |

Action Code 2 |

||

LPA2DT |

Action Date 2 |

||

LPA3CD |

Action Code 3 |

||

LPA3DT |

Action Date 3 |

||

LPA4CD |

Action Code 4 |

||

LPA4DT |

Action Date 4 |

||

LPA5CD |

Action Code 5 |

||

LPA5DT |

Action Date 5 |

||

LPA6CD |

Action Code 6 |

||

LPA6DT |

Action Date 6 |

||

LPA7CD |

Action Code 7 |

||

LPA7DT |

Action Date 7 |

||

LPA8CD |

Action Code 8 |

||

LPA8DT |

Action Date 8 |

||

LPA9CD |

Action Code 9 |

||

LPA9DT |

Action Date 9 |

||

LPABNK |

Autopayment Source Bank Rout |

||

LPACBL |

Accrued Int Billed Less Pmt |

||

LPACCD |

Action Code 1 |

||

LPACCK |

Account Is Savings |

||

LPACDT |

Action Date 1 |

||

LPACIN |

Accrued Interest |

||

LPACLS |

Asset Classification |

||

LPACST |

Non Accrual Status |

||

LPACTP |

Last Activity Type |

||

LPACTV |

Date Of Last Activity |

||

LPACYC |

Auto Payment Cycle Code |

||

LPADT1 |

Aml Next Rate Effective Date 1 |

||

LPADT2 |

Aml Next Rate Effective Date 2 |

||

LPADT3 |

Aml Next Rate Effective Date 3 |

||

LPADT4 |

Aml Next Rate Effective Date 4 |

||

LPADT5 |

Aml Next Rate Effective Date 5 |

||

LPADT6 |

Aml Next Rate Effective Date 6 |

||

LPADT7 |

Aml Next Rate Effective Date 7 |

||

LPADT8 |

Aml Next Rate Effective Date 8 |

||

LPADT9 |

Aml Next Rate Effective Date 9 |

||

LPADTA |

Aml Next Rate Effective Date 10 |

||

LPADTB |

Aml Next Rate Effective Date 11 |

||

LPADTC |

Aml Next Rate Effective Date 12 |

||

LPAHCD |

Auto Hold Code 11 |

||

LPAIPD |

Actual Interest Paid |

||

LPALTX |

Alt Tax Reporting |

||

LPAMAD |

AML Days Before Rate Change |

||

LPAMCC |

AML PI Const Change Counter |

||

LPAMCM |

AML Accr Rate Change Minimum |

||

LPAMDC |

AML Loan Has PI Const Decrease Limit |

||

LPAMDT |

AML Date Of Next Rate Change |

||

LPAMFQ |

AML Accrual Rate Change Frequency |

||

LPAMGI |

GPM Increases Percentage |

||

LPAMGN |

GPM Number Of Increases |

||

LPAMHI |

AML Accrual Rate Lifetime Ceiling |

||

LPAMID |

AML Days Before Payment Change |

||

LPAMIG |

AML Freq To Ignore PI Con Inc Limit |

||

LPAMLO |

AML Accrual Rate Lifetime Floor |

||

LPAMLP |

AML Length Of Rate Cap Period |

||

LPAMMX |

AML Maximum Principal Balance |

||

LPAMNA |

AML Next Accrual Rate Index |

||

LPAMNI |

AML Next Interest Rate |

||

LPAMOA |

AML Original Rate |

||

LPAMOF |

AML Accrual Rate Offset |

||

LPAMOR |

Amortization |

||

LPAMPC |

AML PI Constant Change Freq |

||

LPAMPD |

AML Start Of Accrual Period |

||

LPAMPL |

AML PI Constant Increase Limit |

||

LPAMPT |

AML Accrual Rate Pointer |

||

LPAMRD |

AML Accr Rate Max Pts Prd Down |

||

LPAMRT |

AML Accrual Rate |

||

LPAMRU |

AML Accr Rate Max Pts Prd Up |

||

LPAMSY |

AML Rate At Period Start |

||

LPAMUN |

Unused Percentage Points |

||

LPAMZ6 |

Reamortize Pl For Pmth 6 |

||

LPANAL |

Reserve Analysis Eff Date |

||

LPANBR |

Autopayment Source Account Number |

||

LPANR1 |

AML Next Accrual Rate 1 |

||

LPANR2 |

AML Next Accrual Rate 2 |

||

LPANR3 |

AML Next Accrual Rate 3 |

||

LPANR4 |

AML Next Accrual Rate 4 |

||

LPANR5 |

AML Next Accrual Rate 5 |

||

LPANR6 |

AML Next Accrual Rate 6 |

||

LPANR7 |

AML Next Accrual Rate 7 |

||

LPANR8 |

AML Next Accrual Rate 8 |

||

LPANR9 |

AML Next Accrual Rate 9 |

||

LPANRA |

AML Next Accrual Rate 10 |

||

LPANRB |

AML Next Accrual Rate 11 |

||

LPANRC |

AML Next Accrual Rate 12 |

||

LPAPAM |

Appraised Amount |

||

LPAPCD |

Asset Purpose Code |

||

LPAPIC |

Amortized PI Constant |

||

LPAPIN |

AML Previous Index Rate |

||

LPAPLY |

Stop Applied To Pmth 6 |

||

LPAPNO |

GOLDTrak Application Number |

||

LPAPP2 |

Payment Application Code Feb |

||

LPAPP3 |

Payment Application Code Mar |

||

LPAPP4 |

Payment Application Code Apr |

||

LPAPP5 |

Payment Application Code May |

||

LPAPP6 |

Payment Application Code Jun |

||

LPAPP7 |

Payment Application Code Jul |

||

LPAPP8 |

Payment Application Code Aug |

||

LPAPP9 |

Payment Application Code Sep |

||

LPAPPA |

Payment Application Code Oct |

||

LPAPPB |

Payment Application Code Nov |

||

LPAPPC |

Payment Application Code Dec |

||

LPAPPL |

Payment Application Code Normal |

||

LPAPRM |

Written Off |

||

LPAPRO |

Original APR |

||

LPAPRS |

Appraisal Date |

||

LPASCD |

Assumption Code |

||

LPASDT |

Assumption Date |

||

LPASIN |

AsOf Date Type Indicator |

||

LPASOF |

Sell Loan AsOf Date |

||

LPASTP |

Stop Auto Payments At Maturity |

||

LPASVC |

Annual Serv Fee Assessed |

||

LPATAX |

Loan Qualifies For Additional Tax |

||

LPBAL2 |

Secondary Loan Balance |

||

LPBCYC |

Bill Cycle Code |

||

LPBFEE |

Broker Fee |

||

LPBILL |

Bill Code |

||

LPBINX |

AML Base Index |

||

LPBRK# |

Broker Number |

||

LPBSIN |

AML Use Base Index Calculation |

||

LPBTAX |

Borrower Pays Own Taxes |

||

LPCACC |

Current Month Accrued Int |

||

LPCAMD |

Cost Date Last Amortized |

||

LPCBAL |

LIP Customer Balance |

||

LPCBAN |

Loan Assumed And Reported New |

||

LPCBAT |

Loan Assumed And Terminated |

||

LPCFEE |

Commitment Fee |

||

LPCGLP |

Cost GL Posting Field |

||

LPCINO |

Current Installment Number |

||

LPCKDG |

Check Digit |

||

LPCLAB |

Add Premiums To Billing |

||

LPCLAP |

Add Premiums To Balance |

||

LPCLAS |

Class Code |

||

LPCLAT |

Payoff Amount |

||

LPCLCA |

Credit Life Constant |

||

LPCLCY |

Credit Life Cycle |

||

LPCLDS |

Collateral Description |

||

LPCLDT |

Date Paid Off |

||

LPCLMC |

Credit Life Max Prin Coverage |

||

LPCLMD |

Credit Life Method |

||

LPCLPD |

Credit Life Premiums Due |

||

LPCLRP |

Credit Life Factor Pointer |

||

LPCLSD |

Account Closed |

||

LPCLTP |

Credit Life Type |

||

LPCLYT |

Credit Life YTD Paid |

||

LPCMET |

Cost Amortization Method |

||

LPCNCV |

Contract Conversion |

||

LPCNTR |

RECORD SUBTYPE COUNTER |

||

LPCOBL |

Charge Off Partial Balance |

||

LPCODT |

Charge Off Date |

||

LPCOLL |

Collateral Code |

||

LPCOMM |

Commercial Loan |

||

LPCORG |

Cost Original Amount |

||

LPCPR1 |

Capitalize Reserve One Balance |

||

LPCRBU |

Report To Credit Bureau |

||

LPCREM |

Cost Remaining Amount |

||

LPCRT1 |

Cost APR Rate 1 |

||

LPCRT2 |

Cost APR Rate 2 |

||

LPCRT3 |

Cost APR Rate 3 |

||

LPCSHN |

Override Cushion |

||

LPCSTA |

Cost Status Byte |

||

LPCTM1 |

Cost Amort Term 1 |

||

LPCTM2 |

Cost Amort Term 2 |

||

LPCTM3 |

Cost Amort Term 3 |

||

LPCTOR |

Collection Officer |

||

LPCVDT |

Date Loan Converted |

||

LPDAMD |

Discount Date Last Amortized |

||

LPDCAP |

AML Delay Rate Cap |

||

LPDCAT |

Delinquent Category |

||

LPDDRA |

Roll Due Date Amount |

||

LPDDRT |

Roll Due Date Type |

||

LPDEFI |

Deferred Interest |

||

LPDELQ |

Delinquency Pattern Field |

||

LPDEOM |

Defer Interest At Monthend |

||

LPDF78 |

Rule 78 Def Fees Amort |

||

LPDFIM |

Deferring Int Immediately |

||

LPDFTI |

Def Fees Not Taken when 100 Sold |

||

LPDGLP |

Discount GL Posting Field |

||

LPDLAC |

Date Last Accrued |

||

LPDLAD |

Dealer Date Last Amortize |

||

LPDLAM |

Amortize Dealer Interest |

||

LPDLCD |

Dealer Amortization Code |

||

LPDLOC |

Do Not Report As Line Of Credit |

||

LPDLRC |

Dealer Recourse |

||

LPDLRE |

Dealer Interest Earned |

||

LPDLRP |

Dealer Interest Prepaid |

||

LPDLRT |

Dealer Rate |

||

LPDMET |

Discount Amort Method |

||

LPDORG |

Discount Original Amount |

||

LPDREM |

Discount Remaining Amount |

||

LPDRT1 |

Discount Rate 1 |

||

LPDRT2 |

Discount Rate 2 |

||

LPDRT3 |

Discount Rate 3 |

||

LPDSTA |

Discount Status Byte |

||

LPDTLP |

Date Last Payment |

||

LPDTM1 |

Discount Term 1 |

||

LPDTM2 |

Discount Term 2 |

||

LPDTM3 |

Discount Term 3 |

||

LPDUDT |

Next Payment Due Date |

||

LPDUDY |

Due Date Day |

||

LPE040 |

AML Event 40 For PI Const Change |

||

LPEDUE |

Escrow Constant Due |

||

LPELN2 |

Event Letter 2 |

||

LPELN3 |

Event Letter 3 |

||

LPELN4 |

Event Letter 4 |

||

LPELN5 |

Event Letter 5 |

||

LPELNO |

Event Letter 1 |

||

LPEPMT |

Entire Payment Rolls Due Date |

||

LPEVD2 |

Event Date 2 |

||

LPEVD3 |

Event Date 3 |

||

LPEVD4 |

Event Date 4 |

||

LPEVD5 |

Event Date 5 |

||

LPEVDT |

Event Date 1 |

||

LPEVN2 |

Event Number 2 |

||

LPEVN3 |

Event Number 3 |

||

LPEVN4 |

Event Number 4 |

||

LPEVN5 |

Event Number 5 |

||

LPEVNT |

Event Number 1 |

||

LPEXPY |

Exception To Policy |

||

LPFAMD |

Fees Date Last Amortized |

||

LPFEES |

Total Loan Fees |

||

LPFGLP |

Fees GL Posting Field |

||

LPFHLC |

FHLB Collateral Class |

||

LPFHLT |

FHLB Collateral Type |

||

LPFIRS |

Report Orig Fees To IRS |

||

LPFMET |

Fees Amortization Method |

||

LPFORG |

Fees Original Amount |

||

LPFPRF |

FHA Risk Based Premium Factor |

||

LPFREM |

Fees Remaining Amount |

||

LPFREQ |

Payment Frequency |

||

LPFREX |

Fixed Rate Expiration |

||

LPFRT1 |

Fees Rate 1 |

||

LPFRT2 |

Fees Rate 2 |

||

LPFRT3 |

Fees Rate 3 |

||

LPFSTA |

Fees Status Byte |

||

LPFTM1 |

Fees Term 1 |

||

LPFTM2 |

Fees Term 2 |

||

LPFTM3 |

Fees Term 3 |

||

LPFTRM |

FHA Risk Based Premium Term |

||

LPFVNO |

FHA or VA Account Number |

||

LPGEMF |

GEM Frequency In Months |

||

LPGEMR |

GEM Pmt Change Percent |

||

LPGENL |

General Category |

||

LPGFEE |

Investor Loan Level Guaranty Fee |

||

LPGNET |

Stop Goldphone Advances |

||

LPGPIN |

Goldphone Pin |

||

LPGPMC |

GPM Current Year In The Plan |

||

LPGPMN |

GPM Negative Amortizing Plan |

||

LPGPMR |

GPM Annual Pmt Chng Percent |

||

LPGPXF |

Restrict Goldphone |

||

LPGRAD |

GPM Graduated Pmts |

||

LPHLD1 |

Hold Code 1 |

||

LPHLD2 |

Hold Code 2 |

||

LPHPMI |

Loan Has PMI |

||

LPHVEC |

Have EC Record On Account |

||

LPIACT |

Investor Assigned Account Num |

||

LPIBAS |

Interest Calc Code |

||

LPICAP |

Investor Per Rate Cap On Guar |

||

LPICDT |

Investor Guar Rate Change Due |

||

LPICMN |

Investor Curtailment Minimum |

||

LPIDYS |

Investor Days Before Rate Chg |

||

LPIEF1 |

Investor Next Rate Eff Date 1 |

||

LPIEF2 |

Investor Next Rate Eff Date 2 |

||

LPIEF3 |

Investor Next Rate Eff Date 3 |

||

LPIEF4 |

Investor Next Rate Eff Date 4 |

||

LPIEF5 |

Investor Next Rate Eff Date 5 |

||

LPIEF6 |

Investor Next Rate Eff Date 6 |

||

LPIEF7 |

Investor Next Rate Eff Date 7 |

||

LPIEF8 |

Investor Next Rate Eff Date 8 |

||

LPIEF9 |

Investor Next Rate Eff Date 9 |

||

LPIEFA |

Investor Next Rate Eff Date 10 |

||

LPIEFB |

Investor Next Rate Eff Date 11 |

||

LPIEFC |

Investor Next Rate Eff Date 12 |

||

LPIFRQ |

Investor Frequency Of Rate Chg |

||

LPIGNX |

Investor Next Guar Rate |

||

LPIGOF |

Investor Guar Rate Offset |

||

LPIGRP |

Investor Group Number |

||

LPIGRT |

Investor Guaranteed Rate |

||

LPIICL |

Investor Interest Calc Code |

||

LPILCL |

Investor Late Charge Calc Code |

||

LPIMAX |

Investor Guar Rate Ceiling |

||

LPIMDF |

Amort Def Fees By Interest Mthd |

||

LPIMIN |

Investor Guar Rate Floor |

||

LPIMPD |

Impaired Loan |

||

LPIMST |

Investor Master Number |

||

LPINAD |

Stop Internet Advances |

||

LPINNO |

Installments Made |

||

LPINR1 |

Investor Next Accrual Rate 1 |

||

LPINR2 |

Investor Next Accrual Rate 2 |

||

LPINR3 |

Investor Next Accrual Rate 3 |

||

LPINR4 |

Investor Next Accrual Rate 4 |

||

LPINR5 |

Investor Next Accrual Rate 5 |

||

LPINR6 |

Investor Next Accrual Rate 6 |

||

LPINR7 |

Investor Next Accrual Rate 7 |

||

LPINR8 |

Investor Next Accrual Rate 8 |

||

LPINR9 |

Investor Next Accrual Rate 9 |

||

LPINRA |

Investor Next Accrual Rate 10 |

||

LPINRB |

Investor Next Accrual Rate 11 |

||

LPINRC |

Investor Next Accrual Rate 12 |

||

LPINS# |

LIP Inspector Number |

||

LPINSU |

Insurer Code |

||

LPINXF |

Restrict Internet |

||

LPIPCL |

Investor Principal Calc Code |

||

LPIPIC |

Interest PI Constant |

||

LPIPLN |

Investor Guar Rate Cap Prd |

||

LPIPMN |

Investor Guar Rate Prd Min |

||

LPIPMX |

Investor Guar Rate Prd Max |

||

LPIPOF |

Investor Payoff Calc Code |

||

LPIPRE |

Investor PrePayment Calc Code |

||

LPIPSD |

Investor Guar Rate Period Start |

||

LPIPSR |

Investor Guar Rate At Period Start |

||

LPIPTR |

Investor Rate Pointer |

||

LPIR10 |

Investor Round Rate To Nearest 10th |

||

LPIRCL |

Investor Reserve Calc Code |

||

LPIRDN |

Investor Round Rate Down |

||

LPIRLS |

Investor Recoup Lost Int On Guar Rate |

||

LPIRN8 |

Investor Round Guar Rate To Nearest 8th |

||

LPIRPT |

Using Irregular Pmt |

||

LPIRRQ |

Investor Round Rate To Nearest 4th |

||

LPIRRS |

Investor Round Rate To Nearest 16th |

||

LPIRS1 |

Pay Interest On Reserve 1 |

||

LPIRS2 |

Pay Interest On Reserve 2 |

||

LPIRSC |

IRS Statement Corrected |

||

LPIRSI |

Interest Adjustment Amount |

||

LPIRSY |

Interest Adjustment Year |

||

LPIRUP |

Investor Round Rate Up |

||

LPISCL |

Investor Srvc Fee Calc Code |

||

LPISFC |

Investor Service Fee is a Constant |

||

LPISFM |

Investor Service Fees is a Minimum |

||

LPISLD |

Investor Percentage Sold |

||

LPISTA |

Investor Status Byte |

||

LPISUB |

Interest On Subsidy |

||

LPISVC |

Investor Service Fee Rate |

||

LPIUNU |

Investor Guar Rate Unused Points |

||

LPLACC |

LIP Accrued Interest |

||

LPLADT |

Date Last Escrow Analysis |

||

LPLATE |

Late Charges Due |

||

LPLBAL |

LIP Undisbursed Funds Balance |

||

LPLCAP |

LIP Periodic Rate Cap On LIP |

||

LPLCBS |

Last Credit Bureau Status Rpt |

||

LPLCGA |

LIP Charge Amount |

||

LPLCGR |

LIP Chargeing Int By Fixed Amt |

||

LPLCHD |

LIP Rate Change Date |

||

LPLCHG |

LIP Interest Charge Bill Code |

||

LPLCPM |

Stop Late Charge Past Orig Maturity Date |

||

LPLCRT |

LIP Billing Rate If Billed |

||

LPLDUE |

LIP Due Date |

||

LPLDYS |

LIP Days Before Rate Change |

||

LPLFIX |

LIP Uses Fixed Rate Roll |

||

LPLFRQ |

LIP Rate Change Frequency |

||

LPLHRT |

LIP Uses High Rate |

||

LPLIND |

LIP Inspection Date |

||

LPLLTC |

Life Of Loan Late Charges Collected |

||

LPLMAX |

LIP Lifetime Ceiling |

||

LPLMIN |

LIP Lifetime Floor |

||

LPLMTH |

LIP Method Code |

||

LPLND1 |

Late Notice Days 1st |

||

LPLND2 |

Late Notice Days 2nd |

||

LPLND3 |

Late Notice Days 3rd |

||

LPLNPR |

LIP Previous Index Rate |

||

LPLNXT |

LIP Next Interest Rate |

||

LPLOFF |

LIP Interest Rate Offset |

||

LPLPCC |

LIP Percent Complete |

||

LPLPCG |

LIP Prior Unpaid Billing |

||

LPLPEF |

Penalty Rate Days |

||

LPLPIN |

LIP Previous Index Rate |

||

LPLPLN |

LIP Rate Cap Period |

||

LPLPMN |

LIP Periodic Rate Minimum |

||

LPLPMX |

LIP Periodic Rate Maximum |

||

LPLPRT |

Penalty Rate |

||

LPLPSD |

LIP Rate Period Start Date |

||

LPLPSR |

LIP Periodic Starting Rate |

||

LPLPTR |

LIP Rate Pointer |

||

LPLR10 |

LIP Round Rate To Nearest 10th |

||

LPLRAT |

LIP Interest Rate |

||

LPLRDN |

LIP Round Rate Down |

||

LPLRET |

LIP Retention Amount |

||

LPLRIN |

Reserved For Interest Of LIP |

||

LPLRLS |

LIP Recoup Lost Int |

||

LPLRN8 |

LIP Round Rate To Nearest 8th |

||

LPLRRQ |

LIP Round Rates To Nearest 4th |

||

LPLRRS |

LIP Round Rate To Nearest 16th |

||

LPLRSV |

LIP Use Reserves On Statement |

||

LPLRUP |

LIP Round Rate Up |

||

LPLSTA |

LIP Status Byte |

||

LPLSTB |

Last Billed Amount |

||

LPLT10 |

10 to 29 Days Late |

||

LPLT30 |

30 to 59 Days Late |

||

LPLT60 |

60 to 89 Days Late |

||

LPLT90 |

90 Or More Days Late |

||

LPLTCD |

Late Charge Code |

||

LPLTDT |

Late Charge Date Last Assessed |

||

LPLTGR |

Late Charge Grace Days |

||

LPLTMN |

Late Charge Minimum |

||

LPLTMX |

Late Charge Maximum |

||

LPLTNO |

Times Late Life Of Loan |

||

LPLTP1 |

Late Notice Type 1 |

||

LPLTP2 |

Late Notice Type 2 |

||

LPLTP3 |

Late Notice Type 3 |

||

LPLTRT |

Late Charge Rate |

||

LPLTWV |

Late Charge Times Waived |

||

LPLYTD |

LIP YTD Interest |

||

LPLYTL |

LIP Previous Year YTD Interest |

||

LPMATD |

Maturity Date |

||

LPMATM |

Maturity Modifier |

||

LPMBNT |

Multiple Late Notices |

||

LPMEMO |

Loan Is To Be Memo Posted |

||

LPMEPB |

Month End Principal Balance |

||

LPMEXP |

Memo Expiration Date |

||

LPMISC |

Miscellaneous Funds |

||

LPMLRT |

Multi Rated Tiering |

||

LPMONY |

Money Tran On Memopost Loan |

||

LPMULP |

Multiple Pmt Appls Reqrd |

||

LPMVAL |

Market Value |

||

LPMVPT |

Market Value Pointer |

||

LPMVRT |

Market Value Rate |

||

LPNABB |

NonAccrual Book Balance |

||

LPNDX1 |

AML Index Rate |

||

LPNDX2 |

AML Index Rate 2 |

||

LPNDX3 |

AML Index Rate 3 |

||

LPNDX4 |

AML Index Rate 4 |

||

LPNDX5 |

AML Index Rate 5 |

||

LPNDX6 |

AML Index Rate 6 |

||

LPNDX7 |

AML Index Rate 7 |

||

LPNDX8 |

AML Index Rate 8 |

||

LPNDX9 |

AML Index Rate 9 |

||

LPNDXA |

AML Index Rate 10 |

||

LPNDXB |

AML Index Rate 11 |

||

LPNDXC |

AML Index Rate 12 |

||

LPNETX |

Surplus Check Amount |

||

LPNEVR |

AML Never Defer Interest |

||

LPNHST |

No Analysis History Stmt |

||

LPNLOC |

NonRevolving LOC |

||

LPNOIL |

Second Mtg No Intervening Liens |

||

LPNONP |

NonPerforming Loan |

||

LPNPRX |

Proxy On File |

||

LPNRRS |

Round Rate To Nearest 16th |

||

LPOADD |

Original Add On Amount |

||

LPOAPR |

Original APR |

||

LPOBAL |

Original Balance |

||

LPODOC |

Document Override |

||

LPOFCR |

Officer Number From GOLDTrak |

||

LPOFEE |

Original Loan Fees |

||

LPOINO |

Original Installment Nbr |

||

LPOLD# |

Old Account Number |

||

LPOPIC |

Original PI Constant |

||

LPOPMT |

Extra Principal With Auto Payment |

||

LPOPND |

Date Opened |

||

LPORGN |

Originated or Purchased |

||

LPORIG |

Origination Code |

||

LPOSTA |

Override Cushion |

||

LPOWNR |

Owner Occupied |

||

LPPACC |

Previous Month Accrued Int |

||

LPPAMD |

Date Premium Last Amortiz |

||

LPPBAL |

Principal Balance |

||

LPPBLD |

Passbook Date Last Updated |

||

LPPBLT |

Passbook Time Last Updated |

||

LPPCAP |

AML Uses Payment Caps |

||

LPPDDY |

Number of Days Prepaid |

||

LPPDTO |

Interest Paid To Date |

||

LPPDUE |

Principal Portion Of Pmt Due |

||

LPPEF1 |

AML PI Effective Date 1 |

||

LPPEF2 |

AML PI Effective Date 2 |

||

LPPEF3 |

AML PI Effective Date 3 |

||

LPPEF4 |

AML PI Effective Date 4 |

||

LPPEF5 |

AML PI Effective Date 5 |

||

LPPEF6 |

AML PI Effective Date 6 |

||

LPPEF7 |

AML PI Effective Date 7 |

||

LPPEF8 |

AML PI Effective Date 8 |

||

LPPEF9 |

AML PI Effective Date 9 |

||

LPPEFA |

AML PI Effective Date 10 |

||

LPPEFB |

AML PI Effective Date 11 |

||

LPPEFC |

AML PI Effective Date 12 |

||

LPPFRB |

Pledged For FRB |

||

LPPGLP |

Premium GL Posting Field |

||

LPPGRP |

Investor Previous IGRP Number |

||

LPPHH1 |

Mon Pymt Hst 1st Half |

||

LPPHH2 |

Mon Pymt Hst 2nd Half |

||

LPPHST |

Month Payment History |

||

LPPICN |

PI Constant |

||

LPPIEF |

AML PI Constant Change Date |

||

LPPINX |

AML Next PI Constant |

||

LPPIVD |

Investor Date Inv Changed |

||

LPPLCL |

Pledged For Collateral |

||

LPPLDG |

Loan Pledged But Not Sold |

||

LPPMAT |

Use Penalty Rate At Maturity |

||

LPPMET |

Premium Amortization Meth |

||

LPPMIC |

PMI Code |

||

LPPMIP |

PMI Percentage |

||

LPPMSC |

Account Uses Pmt Schedules |

||

LPPMTH |

Payment Method Code |

||

LPPNCH |

Force PIN Change |

||

LPPNX1 |

AML PI Constant 1 |

||

LPPNX2 |

AML PI Constant 2 |

||

LPPNX3 |

AML PI Constant 3 |

||

LPPNX4 |

AML PI Constant 4 |

||

LPPNX5 |

AML PI Constant 5 |

||

LPPNX6 |

AML PI Constant 6 |

||

LPPNX7 |

AML PI Constant 7 |

||

LPPNX8 |

AML PI Constant 8 |

||

LPPNX9 |

AML PI Constant 9 |

||

LPPNXA |

AML PI Constant 10 |

||

LPPNXB |

AML PI Constant 11 |

||

LPPNXC |

AML PI Constant 12 |

||

LPPORG |

Premium Original Amount |

||

LPPPEN |

PrePayment Penalty Code |

||

LPPREM |

Premium Remaining Amount |

||

LPPRT1 |

Premium Rate 1 |

||

LPPRT2 |

Premium Rate 2 |

||

LPPRT3 |

Premium Rate 3 |

||

LPPRTL |

Partial Payments Amount |

||

LPPSHI |

Prime High Limit |

||

LPPSLO |

Prime Low Limit |

||

LPPSTA |

Premium Status Byte |

||

LPPT99 |

Create 1099 PTL |

||

LPPTM1 |

Premium Term 1 |

||

LPPTM2 |

Premium Term 2 |

||

LPPTM3 |

Premium Term 3 |

||

LPPTST |

Pmt Test Applies |

||

LPPUDT |

Date Purchased |

||

LPPWOA |

Partial Write Off Amount |

||

LPPYTD |

Previous Year YTD Interest |

||

LPPYTR |

Previous Year YTD Int On Reserves |

||

LPPYTS |

Previous Year YTD On Subsidy |

||

LPPYTT |

Previous Year YTD Taxes |

||

LPR1AI |

Accrued Interest On Reserve 1 |

||

LPR1BL |

Reserve 1 Balance |

||

LPR1C2 |

2nd Reserve One Constant |

||

LPR1CN |

Reserve 1 Balance |

||

LPR1D2 |

2nd Reserve One Effective |

||

LPR1EF |

Next Reserve 1 Effective Date |

||

LPR1IN |

Charge Interest On Neg Reserve 1 |

||

LPR1IR |

Interest Rate For Reserve 1 |

||

LPR1LA |

Date Last Accrued Reserve 1 |

||

LPR1NX |

Next Reserve 1 Constant |

||

LPR1OF |

Rate Offset Reserve 1 |

||

LPR1RP |

Rate Pointer For Reserve 1 |

||

LPR2AI |

Reserve 2 Accrued Interest |

||

LPR2BL |

Reserve 2 Balance |

||

LPR2C2 |

2nd Reserve Two Constant |

||

LPR2CN |

Reserve 2 Constant |

||

LPR2D2 |

2nd Reserve Two Effective |

||

LPR2EF |

Second Rsrv Effective Date |

||

LPR2IN |

Charge Interest On Neg Reserve 2 |

||

LPR2IR |

Interest Rate For Reserve 2 |

||

LPR2LA |

Date Last Accrued Reserve 2 |

||

LPR2NX |

Next Reserve 2 Constant |

||

LPR2OF |

Rate Offset For Reserve 2 |

||

LPR2RP |

Rate Pointer For Reserve 2 |

||

LPRAMT |

LIP Fee Rate |

||

LPRATE |

Interest Rate |

||

LPRCAP |

AML Periodic Rate Cap Used |

||

LPRDDN |

AML Round Rate Down |

||

LPRDEX |

Escrow Deficiency At Last Analysis |

||

LPRDUP |

AML Round Rate Up |

||

LPRECP |

Recoup Lost Int |

||

LPREFA |

Refinanced Amount |

||

LPREPR |

Repricing Date |

||

LPRINF |

Late Rate Info |

||

LPRIRS |

Previous Year Int Reported |

||

LPRLAD |

Date Of Last Advance |

||

LPRLAV |

Average Balance For Period |

||

LPRLCC |

Current Finance Charge Due |

||

LPRLCL |

Credit Limit |

||

LPRLCU |

Credit Used |

||

LPRLDP |

Daily or Periodic Interest |

||

LPRLDS |

Stop Advances If Delinquent |

||

LPRLFC |

Finance Charge Code |

||

LPRLFD |

Date Of Last Finance Charge |

||

LPRLFP |

Secured Pledge |

||

LPRLHG |

High Balance For Period |

||

LPRLI1 |

Pmth 5 Billed PI 1 |

||

LPRLI2 |

Pmth 5 Billed PI 2 |

||

LPRLI3 |

Pmth 5 Billed PI 3 |

||

LPRLI4 |

Pmth 5 Billed PI 4 |

||

LPRLI5 |

Method 5 Billed PI 5 |

||

LPRLLI |

Lending Inventory Allowed |

||

LPRLLW |

Low Balance For Period |

||

LPRLMA |

Minimum Check Amount |

||

LPRLMD |

Minimum Payment Due |

||

LPRLNO |

Send Notice Of Overdraft Advance |

||

LPRLOC |

Allow Balance Over Credit Limit |

||

LPRLP1 |

Method 5 Remaining Unpaid 1 |

||

LPRLP2 |

Method 5 Remaining Unpaid 2 |

||

LPRLP3 |

Method 5 Remaining Unpaid 3 |

||

LPRLP4 |

Method 5 Remaining Unpaid 4 |

||

LPRLP5 |

Method 5 Remaining Unpaid 5 |

||

LPRLPA |

Pledged Percent Available |

||

LPRLPB |

Payment Percentage Of Balance |

||

LPRLPC |

Prior Finance Charge Due |

||

LPRLPT |

Payment Type Code |

||

LPRLRA |

Automatic Repayment Amount |

||

LPRLRC |

Automatice Repayment Code |

||

LPRLRP |

Automatic Repayment Percent |

||

LPRLS1 |

Status Code |

||

LPRLS2 |

Second Status Code For Pmt |

||

LPRLSA |

Service Fee Amount |

||

LPRLSC |

Security Acct Number |

||

LPRLSD |

Servicing Released |

||

LPRLSF |

Secured Account Stmt Freq |

||

LPRLSH |

Principal Short Amount |

||

LPRLSM |

Service Fee Method Code |

||

LPRLSP |

Service Fee Percent |

||

LPRLST |

Stop Advances |

||

LPRLTA |

Transfer Acct |

||

LPRLTF |

Transfer Account Stmt Freq |

||

LPRLWC |

Write Checks Against Loan |

||

LPROFF |

Interest Rate Offset |

||

LPROLL |

Date Due Date Rolled |

||

LPRPDU |

Remaining Portion Due |

||

LPRPMT |

Rounded Payment |

||

LPRPTR |

Interest Rate Pointer |

||

LPRR10 |

Rate Rounded To Nearest 10th |

||

LPRRND |

Rate Rounded To Nearest 8th |

||

LPRRTQ |

Rate Rounded To Nearest 4th |

||

LPRSBM |

Rate Starts Below Min |

||

LPRSDT |

Date Debt Restructured |

||

LPRSK1 |

Credit Risk Score 1 |

||

LPRSK2 |

Credit Risk Score 2 |

||

LPRSK3 |

Credit Risk Score 3 |

||

LPRSK4 |

Credit Risk Score 4 |

||

LPRSK5 |

Credit Risk Score 5 |

||

LPRSTM |

Date Of Last Statement Pmth 5 |

||

LPRTRW |

Reported To TRW |

||

LPRTSN |

Use AML Fields |

||

LPS2CN |

Second Subsidy Constant |

||

LPS2EF |

Second Subsidy Effective |

||

LPSACI |

Subsidy Accrued Interest |

||

LPSADV |

Advertising Code |

||

LPSB1M |

SBA Under 1 Million |

||

LPSBAL |

Subsidy Balance |

||

LPSBYR |

Subsidized By Rate |

||

LPSCON |

Subsidy Constant |

||

LPSCYC |

Statement Cycle Code |

||

LPSEC# |

Secured Account Branch |

||

LPSECA |

Secured Account Base |

||

LPSECC |

Secured Account Check Digit |

||

LPSECF |

Secondary Financing |

||

LPSECO |

Secured Account Office |

||

LPSEFF |

Subsidy Effective Date |

||

LPSELL |

Selling Price |

||

LPSEXP |

Subsidy Expiration Date |

||

LPSKCK |

Check For 600 IRS Limit |

||

LPSKDG |

Skip Delinquency Grading |

||

LPSKPA |

Skip Analysis |

||

LPSKR2 |

Reserve 2 To Skip Analysis |

||

LPSLAC |

Date Subsidy Int Last Accrued |

||

LPSLBL |

Balance When Sold |

||

LPSLDT |

Date Loan Sold To Investor |

||

LPSLOT |

Stop Late Charge Past Orig Term |

||

LPSMLN |

Small Claims Loan |

||

LPSNXT |

Next Subsidy Constant |

||

LPSPTR |

Subsidy Rate Pointer |

||

LPSSRC |

Subsidy Source |

||

LPSTA2 |

Status Indicator 2 |

||

LPSTA3 |

Status Indicator 3 |

||

LPSTA4 |

Status Indicator 4 |

||

LPSTA5 |

Status Indicator 5 |

||

LPSTA6 |

Status Indicator 6 |

||

LPSTA7 |

Status Indicator 7 |

||

LPSTA8 |

Status Indicator 8 |

||

LPSTA9 |

Status Indicator 9 |

||

LPSTAA |

Loan Status Byte 10 |

||

LPSTAB |

Loan Status Byte 11 |

||

LPSTAC |

Loan Status Byte 12 |

||

LPSTAD |

Loan Status Byte 13 |

||

LPSTAE |

Loan Status Byte 14 |

||

LPSTAF |

15th Status Flag |

||

LPSTAG |

Loan Status Byte 16 |

||

LPSTAH |

Loan Status Byte 17 |

||

LPSTAI |

Loan Status Byte 18 |

||

LPSTAT |

Account Status Indicator |

||

LPSTMT |

Statement Code |

||

LPSUBL |

Uses Sublimits |

||

LPTALL |

Set To Take All When Sold |

||

LPTERM |

Term Of Loan |

||

LPTIND |

Trading Indicator |

||

LPTPER |

Set To Take When Sold |

||

LPTPNT |

Rate Tier Pointer |

||

LPTRAN |

Date Of Last Tran |

||

LPTRBL |

Troubled Loan |

||

LPTRMO |

Original Term |

||

LPTSER |

Uses Teaser Rate |

||

LPTSRT |

Teaster Rate |

||

LPTYPE |

Loan Type |

||

LPUCIN |

Uncollected Interest |

||

LPUMIR |

Use Min Interest Required |

||

LPUNOP |

Unopened Loan |

||

LPUNPN |

New And Unopened |

||

LPUSER |

User Defined |

||

LPUSPN |

Use Penalty Rate |

||

LPUYS# |

Unamortized Yield Security |

||

LPVALL |

Valuation Allowance |

||

LPVESC |

Escrow Reserve Variance |

||

LPVPRN |

Principal Variance |

||

LPWHOLD |

Hold Code |

||

LPXFR# |

Formatted Transfer Account Number |

||

LPXFRA |

Transfer Account Base |

||

LPXFRC |

Transfer Account Check Digit |

||

LPXFRO |

Transfer Account Office |

||

LPYDTN |

Prior YTD Deferred Int |

||

LPYEPB |

Year End Principal Balance |

||

LPYITL |

YTD Interest This Year For Last |

||

LPYITN |

YTD Interest This Year For Next |

||

LPYLTL |

YTD Previous Year Late Charges |

||

LPYRBL |

Year Built |

||

LPYSTL |

YTD Subsidy This Year For Last |

||

LPYSTN |

YTD Subsidy This Year For Next |

||

LPYTDD |

YTD Deferred Interest |

||

LPYTDI |

YTD Interest |

||

LPYTDR |

YTD Interest ON Reserves |

||

LPYTDS |

YTD Subsidy Paid |

||

LPYTDT |

YTD Taxes |