Navigation: Security Screens > Setup Screen > Field Level Security Screen > All Fields field group > Record Type >

The table below displays the Mnemonic, Description, and CIM GOLD Location for fields available within the FPIR record, which mainly pertains to fields located on the GOLD Services > IRS GOLD > Forms screen.

These fields will appear in the All Fields list view when "FPIR" is selected in the Record Type field. Mark the Restrict checkbox next to each desired field to restrict that field for the selected employee or profile. See All Fields for more information about the process of setting up field security.

Mnemonic |

Description |

CIM GOLD Field Location |

|---|---|---|

IR1RTH |

Date 1st Roth Contribution |

GOLD Services > IRS GOLD > Forms.

•For Form 1099-B, it's Box 1C, Date sold or disposed. •For Form 1099-R, it's Box 11, 1st year of desig. Roth contrib. •For Form 5498, it's Box 12a, RMD date. |

IR2TIN |

2nd TIN Notice |

|

IRAADT |

Acquired Abandoned Date |

GOLD Services > IRS GOLD > Forms.

•For Form 1099-A, it's the Date of lender's acquisition or knowledge of abandonment (box 1). •For Form 1099-B, it's Box 1b, Date Acquired. •For Form 1099-C, it's Box 1, Date of identifiable event. •For Form 1099-S, it's Box 1, Date of closing. |

IRACTA |

Account Number |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRACTO |

Office Number |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRADR2 |

Payee 2nd Address |

For Form 1099-INT, it's Box 15, State. |

IRAMSA |

Amsa Indicator |

This is the Archer MSA box on Form 1099-SA in Box 5 and on Form 5498-SA in Box 6.. |

IRBPLR |

Borrower Liable |

For Form 1099-C, it's Box 5, If checked, the debtor was personally liable for repayment of the debt. |

IRBSIS |

Basis reported to IRS |

For Form 1099-B, this is Box 3, If checked, basis reported to IRS. |

IRCD01 |

Misc Code 1 |

|

IRCD02 |

Misc Code 2 |

For Form 5498, it's Box 14b, Code. |

IRCD03 |

Misc Code 3 |

|

IRCKDG |

Check Digit |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRCL01 |

Identifiable Event Code |

For Form 1099-C, it's Box 6, Identifiable event code. |

IRCORR |

Correction |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRCSSN |

Social Security Number |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRCUSP |

CUSIP Number |

For Form 1099-B, it's the CUSIP Number |

IRDDIB |

Debt Discharged |

|

IRDSCA |

Distrib Category/Seller Servicer Code |

For Form 1099-R, this is Box 7, Distribution code(s).

For Form 1099-SA, this is Box 3, Distribution code.

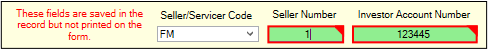

For Form 1099-A and 1099-C, this field is the Seller/Servicer Code, which is Fannie Mae or Freddie Mac. When you select a Seller/Servicer Code, the Seller Number and Investor Number fields are displayed and required (as shown below). These fields are saved in the record, but not printed on the form.

|

IRDTLU |

Date Last Updated |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRDTPT |

Date Posted |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IREDUC |

Education IRA |

For Form 5498, it's Box 11, If checked, required minimum distribution for 2017. |

IREINB |

Employer Id Number |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IREMPX |

Employee Number |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRFRGN |

Foreign Address |

For Form 1042-S, it's the Foreign Country field. |

IRGROS |

|

For Form 1099-B, this is Box 6, Gross Proceeds. |

IRHSAI |

HSA Indicator |

You can also restrict the user from marking the account as HSA directly on Form 1099-SA in Box 5 and on Form 5498-SA in Box 6. |

IRIACT |

Investor Acct Nbr |

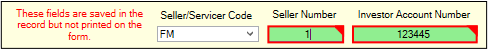

For Form 1099-A and 1099-C, this field is the Investor Account Number, which is Fannie Mae or Freddie Mac. When you select a Seller/Servicer Code, the Seller Number and Investor Number fields are displayed and required (as shown below):

|

IRIRSP |

Ira Sep Simple |

This is a yes/no field. If this account is an simplified employee pension (SEP) account, this field will display "Y" (yes). Deposit accounts are marked as SEP using the SEP box on the Deposits > Account Information > Additional Fields screen > Retirement Fields tab.

For Form 1099-R, this is the IRA/SEP/SIMPLE checkbox. |

IRLIAB |

Liable |

For Form 1099-A, it's box 5 (If checked, the borrower was personally liable for repayment of debt). |

IRLONG |

|

For Form 1099-B, this is Box 2, Long-term gain or loss. |

IRMECH |

Medicare Choice MSA |

This field is no longer used. This field previously indicated whether the deposit account was a Medicare+Choice MSA, which is no longer supported.

You can restrict users from marking the account as MA MSA directly on Form 1099-SA in Box 5 and on Form 5498-SA in Box 6. |

IRMODT |

Mortgage Origination Date |

For 1098, it's the Mortgage origination date (box 3). |

IRNCOV |

|

For Form 1099-B, this is Box 5, If checked, noncovered security |

IRNET |

|

For Form 1099-B, this is Box 6, Net Proceeds. |

IRNTSN |

IRCSSN Is Not An Ssn |

This will restrict users from selecting the "2" (Employee Identification Number) next to the Payer's/Borrower's taxpayer identification no. See below:

|

IRONOB |

Owner is not Beneficiary |

For Form 1099-MISC, this is Box 9, Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale.

For Form 1099-Q, this is Box 6, If this box is checked, the recipient is not the designated beneficiary. |

IRORFE |

Orig Fee Cap Int |

For Form 1098-E, this is box 2 (If checked, box 1 does not include loan origination fees and/or capitalized interest for loans made before September 1, 2004.) |

IRPADR |

Payee Address |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRPAF1 |

Payment Amount Fld 1 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For 1098, it's Box 1, Mortgage interest received from payer(s)/borrower(s). •For 1098-E, it's Box 1, Student loan interest received by lender. •For 1099-INT, it's Box 1, Interest Income. •For 1099-DIV, it's Box 1a, Total ordinary dividends. •For 1099-MISC, it's Box 1, Rents. •For 1099-Q, it's Box 1, Gross distribution. •For 1099-R, it's Box 1, Gross distribution. •For 1099-SA, it's Box 1, Gross distribution. •For 5498, it's Box 1, IRA contributions (other than amounts in boxes 2-4, 8-10, 13a, and 14a). •For 5498-ESA, it's Box 1, Coverdell ESA contributions. •For 5498-SA, it's Box 1, Employee or self-employed person's Archer MSA contributions made in THIS YEAR and NEXT YEAR for THIS YEAR. |

IRPAF2 |

Payment Amount Fld 2 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For Form 1098, it's Box 2, Points paid on purchase of principal residence. •For Form 1099-A, it's Box 2, Balance of principal outstanding. •For Form 1099-B, it's Box 1d, Proceeds. •For Form 1099-C, it's Box 2, Amount of debt discharged. •For Form 1099-DIV, it's Box 1b, Qualified dividends. •For Form 1099-INT, it's Box 2, Early withdrawal penalty. •For Form 1099-MISC, it's Box 2, Royalties. •For Form 1099-Q, it's Box 2, Earnings. •For Form 1099-R, it's Box 2a, Taxable amount. •For Form 1099-S, it's Box 2, Gross Proceeds. •For Form 1099-SA, it's Box 2, Earnings on excess cont. •For Form 5498, it's Box 2, Rollover contributions. •For Form 5498-ESA, it's Box 2, Rollover contributions. •For Form 5498-SA, it's Box 2, Total contributions made in YYYY. |

IRPAF3 |

Payment Amount Fld 3 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For Form 1098, it's Box 3, Refund of overpaid interest. •For Form 1099-B, it's Box 1e, Cost or other basis. •For Form 1099-C, it's Box 3, Interest if included in box 2. •For Form 1099-DIV, it's Box 2a, Total capital gain distr. •For Form 1099-INT, it's Box 3, Interest on U.S. Savings Bonds and Treas. obligations. •For Form 1099-MISC, it's Box 3, Other income. •For Form 1099-R, it's Box 3, Capital gain (included in box 2a). •For Form 5498, it's Box 3, Roth IRA conversion amount. •For Form 5498-SA, it's Box 3, Total HSA or Archer MSA contributions made in (NEXT YEAR) for (THIS YEAR). |

IRPAF4 |

Payment Amount Fld 4 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For Form 1098, it's Box 4, Mortgage insurance premiums. •For Form 1099-A, it's Box 4, Fair market value of property. •For Form 1099-B, it's Box 4, Federal income tax withheld. •For Form 1099-INT, it's Box 4, Federal income tax withheld. •For Form 1099-MISC, it's Box 4, Federal income tax withheld. •For Form 1099-Q, it's the box labeled: If the fair market value (FMV) is shown below, see Pub. 970, Tax Benefits for Education, for how to figure earnings. •For Form 1099-R, it's Box 4, Federal income tax withheld. •For Form 1099-SA, it's Box 4, FMV on date of death. •For Form 5498, it's Box 4, Recharacterized contributions. •For Form 5498-SA, it's Box 4, Rollover contributions. |

IRPAF5 |

Payment Amount Fld 5 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For Form 1099-MISC, it's Box 5, Fishing boat proceeds. •For Form 1099-R, it's Box 5, Employee contributions/Designated Roth contributions or insurance premiums. •For Form 1099-S, it's Box 5, Buyer's part of real estate tax. •For Form 5498, it's Box 5, Fair market value of account. •For Form 5498-SA, it's Box 5, Fair market value of HSA, Archer MSA, or MA MSA. |

IRPAF6 |

Payment Amount Fld 6 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For 1098, it's Box 2, Outstanding mortgage principal as of DD/MM/YYYY. •For 1099-DIV, it's Box 2b, Unrecap. Sec. 1250 gain. •For Form 1099-MISC, it's Box 6, Medical and health care payments. •For Form 1099-R, it's Box 6, Net unrealized appreciation in employer's securities. |

IRPAF7 |

Payment Amount Fld 7 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For 1099-C, it's Box 7, Fair market value of property. •For 1099-DIV, it's Box 2c, Section 1202 gain. •For Form 1099-MISC, it's Box 7, Nonemployee compensation. •For Form 1099-R, it's the percentage box (%) to the right of Box 8, Other. |

IRPAF8 |

Payment Amount Fld 8 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For 1099-DIV, it's Box 2d, Collectibles (28%) gain. •For Form 1099-MISC, it's Box 8, Substitute payments in lieu of dividends or interest. •For Form 1099-R, it's Box 8, Other. •For Form 5498, it's Box 8, SEP contributions. |

IRPAF9 |

Payment Amount Fld 9 |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For 1099-DIV, it's Box 3, Nondividend distributions. •For 1099-R, it's Box 9b, Total employee contributions. •For Form 5498, it's Box 9, SIMPLE contributions. |

IRPAFA |

Payment Amount Fld A |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For 1099-DIV, it's Box 4, Federal income tax withheld. •For Form 1099-MISC, it's Box 10, Crop insurance proceeds. •For Form 5498, it's Box 10, Roth IRA contributions. |

IRPAFB |

Payment Amount Fld B |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For 1099-DIV, it's Box 5, Investment Options. •For Form 1099-MISC, it's Box 13, Excess golden parachute payments. •For 1099-R, it's Box 15, Local tax withheld. •For Form 5498, it's Box 12b, RMD amount. |

IRPAFC |

Payment Amount Fld C |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For 1099-DIV, it's Box 6, Foreign tax paid. •For Form 1099-MISC, it's Box 14, Gross proceeds paid to an attorney. •For 1099-R, it's Box 16, Name of Locality. •For Form 5498, it's Box 13a, Postponed contribution. |

IRPAFD |

Payment Amount Fld D |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For Form 1099-DIV, it's Box 8, Cash liquidation distributions. •For Form 1099-MISC, it's Box 15a, Section 409A deferrals. •For Form 5498, it's Box 14a, Repayments. |

IRPAFE |

Payment Amount Fld E |

This field differs according to which form (pulled from GOLD Services > IRS GOLD > Forms screen).

•For Form 1099-DIV, it's Box 9, Noncash liquidation distributions. •For Form 1099-MISC, it's Box 15b, Section 409A Income. |

IRPASM |

Prop Addr Same As Mail Addr |

For Form 1098, this is Box 7. |

IRPAYE |

Payee Name |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRPCTY |

Payee City |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRPORS |

Prop Or Srvcs Rcvd |

For Form 1099-S, this is Box 4, Transferor received or will receive property or services as part of the consideration (if checked). |

IRPOTD |

Nbr Of Total Dist |

For Form 1099-R, this is Box 9a, Your percentage of total distribution. |

IRPROP |

Property Description |

•If Form 1099-A, it's Box 6, Description of property. •If Form 1098, it's Box 9, If property securing mortgage has no address, below is the description of the property. •If Form 1099-B, it's Box 1a, Description of property. •If Form 1099-C, it's Box 4, Debt Description. •If Form 1099-DIV, it's Box 7, Foreign country or U.S. possession. •If Form 1099-R, it's Box 17, Local distribution. •If Form 1099-S, it's Box 3, Address or legal description. |

IRPRP1 |

Property Address Line One |

For Form 1098, this is Box 8, Address of property securing mortgage (line 1). |

IRPRP2 |

Property Address Line Two |

For Form 1098, this is Box 8, Address of property securing mortgage (line 2). |

IRPYE2 |

Payee 2 Name |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRPZIP |

Payee Zip |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide |

IRPZP4 |

Payee Plus 4 Zip |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRRCHR |

Recharacterized Roth |

The process of reversing a Roth IRA conversion is known as recharacterization. It needs to be completed by the last date, including extensions, for filing or refiling prior-year tax return, which is typically on or about October 15. All or a portion of what was converted from a traditional IRA into a Roth can generally be recharacterized (reversed) back into a traditional IRA (or some other type of retirement account other than Roth).

To recharacterize a Roth, use transaction code 1220-08 in CIM GOLDTeller.

This field will display "Y" if this account is a recharacterized Roth. |

IRRIRA |

IRA Account |

This is a yes/no field. If this account is a traditional IRA account, this field will display "Y" (yes). Deposit accounts are marked as traditional using the Traditional box on the Deposits > Account Information > Additional Fields screen > Retirement Fields tab.

For Form 5498, this is the IRA checkbox in Box 7. |

IRROCV |

Roth Conversion |

This is the date a traditional IRA, SEP IRA, or Simple IRA was converted to a Roth IRA during the current calendar year. This field is populated when a Roth Conversion Contribution transaction (tran code 1220-07) is processed on the account. This is not used for rollovers from one Roth to another Roth. The amount of the rollover is displayed in the Roth Conversion Amount field on the Deposits > Account Information > Additional Fields screen > Retirement Fields tab. |

IRROTH |

Roth IRA |

This is a yes/no field. If this account is a Roth IRA account, this field will display "Y" (yes). Deposit accounts are marked as Roth using the Roth Account box on the Deposits > Account Information > Additional Fields screen > Retirement Fields tab.

For Form 5498, this is the SEP checkbox in Box 7. |

IRSDAM |

State Distrib Amount |

This is the state distribution amount if this is a deposit year-end form for a retirement account that included state distribution amounts. See the IRS Deposit Forms in the IRS GOLD User's Guide for more information.

For Form 1099-MISC, this is Box 18, State Income.

For Form 1099-R, this is Box 14, State distribution. |

IRSEPP |

Sepp Account |

For Form 5498, this is the SEP checkbox in Box 7. |

IRSHRT |

Short-term gain or loss |

For Form 1099-B, this is Box 2, Short-term gain or loss. |

IRSIMP |

Simple Retirement |

For Form 5498, this is the SEP checkbox in Box 7. |

IRSPCD |

Special Data |

For Form 1098, this is Box 10, Other.

For Form 1099-INT, this is Box 16, State Identification no.

For Form 5498, this is Box 13c, Code. |

IRSS# |

Seller Servicer Nmbr |

For Form 1099-INT, this is the Payer's RTN.

For Form 1099-MISC, this is Box 17, State/Payer's state no.

For Form 1099-R, this is Box 13, State/Payer's state no.

For Form 1099-A and 1099-C, the user must first enter a Seller/Servicer Code before they can enter the Seller Number, as shown below:

|

IRSSYS |

Source Systems |

This field only appears on Form 1099-MISC. It establishes where this 1099-MISC form origination: Accounts Payable or Loans. For more information on the Accounts Payable 1099-MISC forms, see Appendix D.1, 1099-MISC Processing in the Account Payable manual. |

IRSTA1 |

1st Status Flag |

|

IRSTA2 |

2nd Status Flag |

|

IRSTA3 |

3rd Status Flag |

|

IRSTA4 |

4th Status Flag |

|

IRSTAB |

State Abbreviation |

GOLD Services > IRS GOLD > Forms. See IRS GOLD Overview > Common Fields in IRS GOLD User's Guide. |

IRSTWH |

State Withhold Amt |

For Form 1099-INT, this is Box 17, State tax withheld.

For Form 1099-MISC, this is Box 16, State tax withheld.

For Form 1099-R, this is Box 12, State tax withheld. |

IRTCOR |

Correction Type |

You can restrict users from designating the type of correction for a form: either G (Error Type 1) or C (Error Type 2). See the Corrections field description on the IRS GOLD Overview topic. |

IRTDSB |

Total Distribution |

For Form 1099-R, it's the Total Distribution in Box 2b. |

IRTND |

Tax Not Determined |

For Form 1099-R, this is Box 2b, Taxable amount not determined. |

IRYEAR |

Year Ccyy |

This is the year of the IRS form record. If this is restricted, the user cannot choose a different year to view, create, delete, or change IRS forms from previous years. |

IRYR01 |

Misc Year Ccyy |

For Form 5498, it's Box 13b, Year |

IRYR1 |

Reporting Year Yy |

This is the reporting year of the IRS form. If this is restricted, the user cannot choose a different year to view, create, delete, or change IRS forms from previous years. |