Navigation: Loans > Loan Screens > Marketing and Collections Screen > Delinquent Payments tab >

Times Late/Payment Profile fields

Mnemonic: BU12M, BU24M, BUPMHS

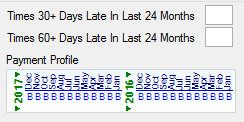

These fields on the Delinquent Payments tab indicate how many times the loan account was 30+ or 60+ days late in the last two years as well as the customer's payment profile.

The Times Late fields are calculated by the system but can be file maintained. They are mainly used by your institution for informational purposes. They are not used in Credit Reporting. See the New Payment Profile field on the Credit Reporting screen for information about past due payment reported to credit repositories.

The Payment Profile does not record payment activity until after the monthend Credit Reporting Update process has run. For example, if it is July of 2016, you will only see 24-month payment information from June of 2016 to July 2014.

The Payment Profile is an alphanumeric field and is reported to credit repositories. It is updated each monthend. As updating occurs, only the information for the prior month is updated. All other months remain the same, except the information for prior months shifts to the right. Payment Profile codes 0-6 show the number of days delinquent in 30-day increments.

This field is automatically updated by the system according to activity on the account. However, changes can be made to this field from the Loans > Credit Reporting screen. See help for that screen for more information.

Valid codes for the Payment Profile are as follows:

Codes |

Credit Profile Description |

|---|---|

0 |

Payments not past due (current) |

1 |

30-59 days past due date |

2 |

60-89 days past due date |

3 |

90-119 days past due date |

4 |

120-149 days past due date |

5 |

150-179 days past due date |

6 |

180 or more days past due date |

B |

No payment history prior to this time |

D |

No payment history available this month (Converting loans can have this.) |

E |

Zero balance and current account (zero balance line-of-credit loans) |

G |

Collection |

H |

Foreclosure |

J |

Voluntary Surrender |

K |

Repossession |

L |

Charge-off |

If any of the below-mentioned hold codes is present on an account at the end of the month, the Payment Profile for that month is updated as follows:

GOLDPoint Systems Hold Code |

Will Appear As: |

|---|---|

1 - Foreclosure completed |

H - Foreclosure |

2 - Charge off |

L - Charge off |

91 - Collection account |

G - Collection |

92 - Voluntary surrender |

J - Voluntary surrender |

93 - Repossession by grantor |

K - Repossession |