Navigation: Loans > Loan Screens > Insurance Screen Group > Force Place Payment Analysis Screen >

Payment Information field group

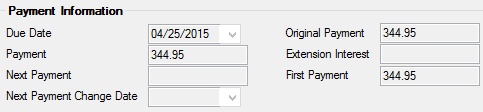

Use this field group to view and edit information about force place payments on the customer loan account.

The fields in this field group are as follows:

Field |

Description |

||

|

Mnemonic: LNDUDT |

This is the current due date on the loan. Options are available so that a due date never lands on a Sunday, Saturday (depending on if your institution does not process on Saturday), or holiday (depending on the holidays set up for your institution). Also, the Due Date Day field may also affect this field if the due date is set for the last day of the month.

|

||

|

Mnemonic: LNPICN |

This field contains the next regular payment amount for the loan, including principal and interest. This field is pulled from P/I Constant field on the Loans > Account Information > Account Detail screen. If the force-placed insurance is still in effect, this field can be file maintained.

No error checking is done on this screen. What is entered in these fields will be saved and used to control the payment and roll the due date. |

||

|

Mnemonic: LNPINX |

This field displays the next payment amount due (according to the loan frequency). This field is calculated by the system. If you need to make an adjustment to the next payment amount, you can enter it here. However, the Payment Analysis field is still calculated based on the payment amount with the original amount of the force-placed insurance. |

||

|

Mnemonic: LNPIEF |

This field contains the next principal/interest effective date, which is the date that the Next Payment amount will replace the current P/I Payment amount. You can change this field to a different date. |

||

|

Mnemonic: LNOPIC |

This field contains the original amount of the principal and interest payment on the loan. This field is originally entered when the loan is initially set up. |

||

|

Mnemonic: OTXINT |

If your institution collects extension interest, this field displays the amount. Extension interest is also called odd-days interest or interim interest. It is the interest earned on loans that contain a nonstandard payment period. In most cases, the additional interest is added on to the first payment. All remaining payment periods are uniform, assuming the loan has fixed payments and amortizes fully. An example of extension interest is when a loan is opened in the middle of a month. For example, suppose a customer gets a loan on September 20th and has the first payment due October 1; the system would accrue 10 days' worth of interest to cover the days to the beginning of October. That accrued amount would be displayed in this field. |

||

|

Mnemonic: OTFPAM |

This field displays the first minimum payment amount for the loan. Depending on how this loan is set up, the payment may be a monthly, bi-monthly, weekly, etc., payment. This payment amount includes both principal and interest, as designated by your institution. |