Navigation: Loans > Loan Screens > Account Information Screen Group > Consumer Line-of-Credit Screen > Payment Schedule tab >

Multiple Payment Applications field group

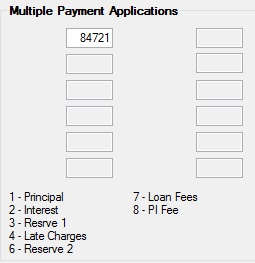

Use this field group to view and edit multiple payment application information for the customer line-of-credit (LOC) loan account on the payment schedule being created (if the Multiple Payment Application field is marked). Use this field group if your institution wants a different payment application for each month, rather than one standard Payment Application for the life of the loan (mnemonic LNAPPL, LNAPP2-LNAPP9, LNAPPA-LNAPPC).

To learn more about how LOC loans function, see the Line-of-Credit Loan Information help page.

Up to 12 fields are available for file maintenance in this field group (one for each month of the year. The left column represents January-June and the right represents July-December). Each field allows you to indicate how that month's payment will be applied. Using the number key that appears below these fields as reference, enter codes for the necessary month(s) that represent the order of payment application. The system rules for payment applications are as follows:

•Interest (2) must be paid first and principal (1) second, regardless of the written order.

•However, for LOC loans, the system allows late charges (4) to be paid before interest (2).

•The money remaining in the loan payment will then be spread to the other indicated applications in the order entered in these fields.

•Payments coming in from a lockbox bank are checked for extra funds. If extra funds are paid, the system will do one of the following:

| 1. Look for late charges. If any are owed, the payment will be posted first. Any remaining funds will be posted to late charges. |

2. If more funds are remitted, in addition to the first payment plus late charges, the system will post the payment first, then the late charges. The extra funds will be treated as a curtailment (principal decrease).

Late charges will not be assessed for months in which no information is entered in this field group.