Navigation: Loans > Loan Screens > Insurance Screen Group > Force Place Screen >

This transaction is similar to the Force VSI Transaction (tran code 2870-00), except this transaction deals with Homegard insurance instead of VSI insurance. Other differences include:

The Amortization Method on the Loans > Insurance > Policy Detail screen is updated to "12–Pro Rata Daily" whenever this transaction is run. Also, the Refund Rule on that same screen is updated to "0–1-day rule (365 base)."

When this transaction is run, it does several things. It sets up an insurance record on the Policy Detail and fills in many of the fields on that screen (as described below).

Institution Option AMVP allows more than one insurance type 97 (Homegard insurance) on a loan without checking to see if other type 90s have expired.

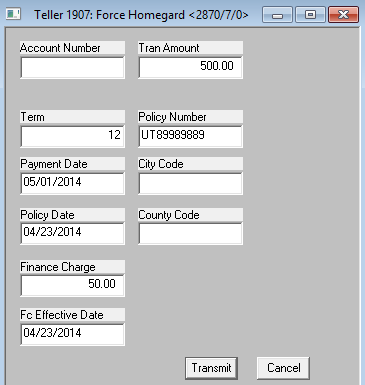

The Force Place Homegard Insurance transaction box is displayed in GOLDTeller after entering information for a Homegard insurance type and clicking ![]() on the Force Place screen. GOLDTeller must be open before clicking

on the Force Place screen. GOLDTeller must be open before clicking ![]() .

.

The transaction will also update fields on the Loans > Account Information > Account Detail screen. The following are the fields on the Account Detail screen that are updated when this transaction is run:

Principal Balance |

LNPBAL: Increased by the transaction. For precomputed loans, the principal balance is also increased by the amount of the finance charge. For loans based in Kentucky, the principal balance is also increased by the amount of municipal and surcharge. |

Principal/Interest Constant |

LNPICN: Increased by original premium divided by the remaining term of the insurance. |

Next P/I Constant |

LNPINX: The next P/I amount that reflects the increase of the insurance premium divided by the remaining term of the insurance. |

Constant Change Date |

LNPIEF: Policy effective date + insurance term INNREMINN |

LNPNX 1-12 LNPEF 1-12 |

At the end of the force-placed insurance policy term, the P/I will be changed back to the original P/I. |

The following are the fields on the Policy Detail screen that are updated when this transaction is run:

Insurance Type |

INTYPE: defaulted to type 97 |

|---|---|

Policy Description |

INDESC: defaults to "Homegard Insurance" |

Original Premium |

INOBAL: amount entered during transaction |

Policy Number |

Pulled from the Force Homegard Insurance transaction box. If left blank, it defaults to the loan number. |

INAMOR: 12–Pro Rata Daily |

|

Policy Term |

INTERM: term entered with transaction |

Policy Effective Date |

INOPND: policy date entered with transaction |

Refund Rule |

Defaults to "0-1 day rule (365 base)" |

Amortization Start Date |

INDLAC: same as policy effective date |

State Code |

INSTCD: the state code, as defined by GOLDPoint Systems. |

Producer Number (INPRDN) |

Defaults to 6500 bbbb (bbbb = 4-digit branch) |

Agent/Sub Number (INAGNO) |

Defaults to 6500 |

Individual or Joint |

Defaults to Individual |

Institution Option IHGL will assess a finance charge according to the following formula if the loan is a precomputed loan (payment method 3):

Finance charge = INOBAL * ((LNPICN * LNTRMO) - (LNPICN * (1 - ((1 + ((LNOAPR / 100) / 12)) ^ (- (LNTRMO))) * (12 / (LNOAPR / 100))) / (LNPICN * LNTRMO) - (LNPICN * LNTRMO) - (LNPICN * (1 - ((1 + ((LNOAPR / 100) / 12)) ^ (- (LNTRMO)))) * (12 / (LNOAPR / 100))) / (LNTRMO / 12)) / 12 * LNTRMO

For payment interest-bearing loans (payment method 6), Institution Option IHGL will assess a finance charge according to the following formula:

Finance charge = INOBAL * ((LNPICN * INTERM) - (LNPICN * (1 - ((1 + ((LNRATE / 100) / 12)) ^ (- (INTERM))) * (12 / (LNRATE / 100))) / (LNPICN * INTERM) - (LNPICN * INTERM) - (LNPICN * (1 - ((1 + ((LNRATE / 100) / 12)) ^ (- (INTERM)))) * (12 / (LNRATE / 100))) / (INTERM / 12)) / 12 * (INTERM - Months already passed)

Loans that have a Kentucky state code will have municipal tax and surcharge amounts calculated for them. These amounts will be added to the principal and, if a finance charge is calculated, it will be included in the finance charge amount. The rate used will be the rate set up in the TD detail record that matches the state, county code, and city code. If no TD record is set up, there will be no municipal tax or surcharge amount. The TD record is user-defined and found on the Miscellaneous > Tables > Tax Rate Detail screen in CIM GOLD.

The following fields are pulled from the GOLD Services > General Ledger > Setup G/L and Commissions screen.

Tran |

TORC |

Field |

Description |

|---|---|---|---|

110 |

124 |

Company Number |

Fills in INOORG, INOREM |

110 |

128 |

Branch Percentage |

Fills in INCORG, INCREM |

|

|

Corporate Percentage |

INOAMD receives policy effective date |

For precomputed loans (payment method 3), the following fields on the Finance Charge Information tab of the Policy Detail screen are also set up.

Finance Charge Original Amount |

INNORG: finance charge amount from transaction |

Finance Charge Remaining Amount |

INNREM: same as original amount |

Finance Charge Date Last Amortized |

INNAMD: finance charge effective date from transaction |

Finance Charge Effective Date |

INNEFF: finance charge effective date from transaction |

Finance Charge Amortization Method |

INIMET: defaults to 2 if institution option IHGL is set to "Y;" otherwise, default is blank (none). |

The following fields on the Tax & Surcharge tab of the Loans > Policy Detail screen are also set up:

Original Municipal Tax |

INMORG: Calculated original municipal tax |

Municipal Tax Rate |

INMUTR: Municipal tax rate |

Original Surcharge |

INSURG: Calculated original surcharge amount |

Surcharge Rate |

INSCRT: Surcharge rate |

City Code |

INCITC: Code for city loan is based in |

County Code |

INCNTY: Code for county loan is based in |

This transaction also processes the following General Ledger transactions:

1810 |

G/L transaction to Unearned Interest account listed on the GOLD Services > General Ledger > G/L Account By Loan Type screen. |

1810 |

G/L transaction to municipal (Tax) account listed on the GOLD Services > General Ledger > Setup G/L and Commissions screen. |

1810 |

G/L transaction to Surcharge account listed on the GOLD Services > General Ledger > Setup G/L and Commissions screen. |

1811 |

G/L transaction to corporate and/or branch G/L number in the Commission field group on the GOLD Services > General Ledger > Setup G/L and Commissions screen. |