Navigation: Loans > Loan Screens > Credit Reporting > General Reporting Information >

The credit reporting name and address information is gathered from CIF when the credit reporting transmission is processed (see Credit Reporting Process).

You can view the names connected to an account from either the Customer Relationship Management > Households screen or Loans > Marketing and Collections screen > CIF tab in CIM GOLD. You can see the relationship each borrower has with the account (e.g., owner, co-owner, administrator, agent, etc.). You can also see the addresses associated with the account.

The property address associated with the account is reported as the unverified reference address for all the co-borrower names for the account. If no property address is attached to the account, the mailing address is used as the default address reported for the borrowers.

Only one borrower on the account (if the account has additional borrowers) must be designated as the IRS owner. The IRS owner is the individual or business name and tax ID number that is used to report information to the IRS.

|

Note: In order to be the IRS owner for an account, the borrower must have a Social Security or Federal Identification number entered on the system to report to the IRS. |

|---|

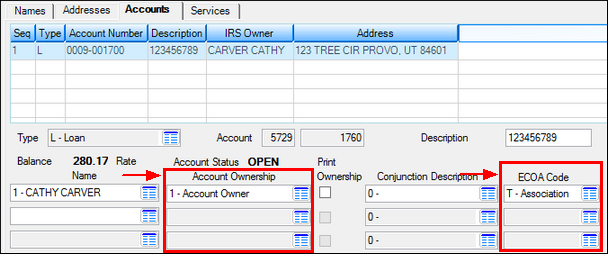

Use the Accounts tab to identify the ownership code and ECOA code of each person connected to the account, as shown below.

The Equal Credit Opportunity Act (ECOA) requires that a borrower’s relationship to an account be disclosed for the purposes of establishing equal credit for all involved. This is accomplished using an ECOA code. GOLDPoint Systems reports this code based on the borrowers’ account relationship, which allows the relationship of each borrower to be reported to the credit repositories.

You can only file maintain the ECOA code either on the Customer Relationship Management > Households screen or Loans > Marketing and Collections screen > CIF tab in CIM GOLD

Because a borrower’s relationship to the account is required, GOLDPoint Systems converts the Ownership code and reports that ECOA code, unless a specific code is entered in the ECOA Code field. (See ECOA Codes for the conversion table.)

|

WARNING: Borrowers with the following ownership codes will be reported to credit repositories:

If the ownership code is not one of these, that individual will not be reported. |

|---|

Businesses should have an ownership code of corporation, partnership, or LLC (see "W" in the ECOA Codes description).