Navigation: Loans > Loan Screens > Insurance Screen Group > Auto & Home Owner Insurance Manager Screen > Insurance Manager Screen: Auto Insurance >

Coverage/Deductible fields

|

Note: This screen is being discontinued by GOLDPoint Systems. Institutions should use the Loans > Insurance > Tracking Insurance screen instead. If your institution still uses this screen, please consider migrating to the Tracking Insurance screen soon. GOLDPoint Systems plans to completely remove this screen in future updates for CIM GOLD. If your institution still uses this screen, see field help below. |

|---|

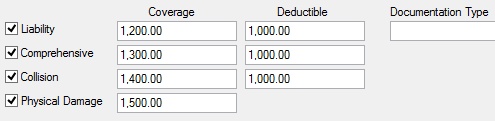

Use these fields to indicate the types of coverage included in the insurance policy being created/edited. These fields are also used to indicate the Coverage and Deductible amounts for each type of coverage.

These fields only appear on the Auto Insurance version of the Auto & Home Owner Insurance Manager screen.

Use the Documentation Type field to indicate the type of documentation used to verify that the insurance policy being created/edited is valid. Possible types of documentation include a letter from the insurance company, an insurance card, a phone call or fax, etc.

Mark the checkbox field by each type of coverage included in the policy. Possible coverage selections are:

•Liability: A liability insurance policy protects owners against any claims of negligence, personal injury, or property damage. This type of insurance is usually required by most states in order to license a vehicle. If a vehicle has a loan on it, however, most lending institutions require Comprehensive coverage until the loan is paid in full (mnemonics REALIA, REALCV, REALDE, REIDOC).

•Comprehensive: Most institutions require comprehensive coverage until a loan is paid in full. This coverage provides protection against any loss or damage to a vehicle resulting from loss other than a collision. This coverage also provides for supplemental payments for transportation expenses in the event of total theft of a vehicle. The vehicle must be insured for comprehensive or specified cause of loss coverage. Coverage begins forty-eight hours after the theft of a vehicle. Payments end when the vehicle is returned to use or the insurer pays for its loss (mnemonics REACOM, REACCV, REACDE).

•Collision: This coverage provides protection against damage from collision with another vehicle or object. Collision losses are paid regardless of fault (mnemonics REACOL, REACOV, REACOD).

•Physical Damage: This insuring agreement states that the insurer will pay all reasonable and necessary medical and funeral expenses incurred by the customer due to bodily injury caused by an accident. Payment can be made for expenses incurred within three years from the date of the accident. This coverage also includes family members and any other person injured while occupying the insured vehicle. Pedestrians or cyclists are also considered insured when struck by the vehicle. These payments are made without regard to fault (mnemonics REAPDM, REAPCV).

Once the appropriate checkbox fields are marked, use the adjacent fields to indicate the Coverage and Deductible amounts for each particular coverage type.

•Coverage is the maximum dollar amount the insurance policy will pay in the event of a claim being filed. The Coverage value for Liability coverage can be written as a single limit that applies to both bodily injury and property damage. The policy can also be written with split limits in which the limits of insurance for bodily injury and property damage are stated separately. For example, a policy with split limits quoted as $100,000/$300,000/ $25,000 would provide a maximum of $100,000 bodily injury coverage per person, $300,000 total bodily injury coverage per accident, and $25,000 total property damage liability coverage per accident.

•Deductible is the dollar amount the customer is responsible to pay before benefits from the insurance policy are available.