Navigation: Deposit Reports > Deposit Reports - Alphabetical Order > Deposit Call Reports (FPSDR235) >

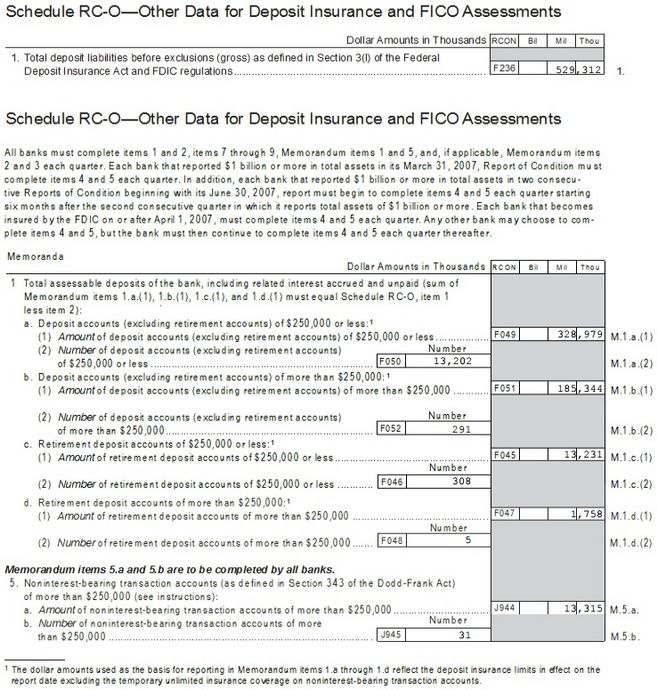

1.Total deposit liabilities before exclusions (gross) as defined in Section 3 (1) of the Federal Deposit Insurance Act and FDIC regulations

F236 – Total of F049, F051, F045, and F047 from the RC-O Memoranda section

Schedule RC-O Memoranda

1.Total assessable deposits of the bank, including related interest accrued and unpaid (sum of Memorandum items 1.a.(1), 1.b.(1), 1.c.(1) and 1.d.(1) must equal Schedule RC-O, item 1 less item 2):

a.Open deposit accounts - excludes closed deposit accounts, zero-balance accounts with zero accrued, and retirement accounts less than $250,000:

•(1) Amount of deposit accounts (excluding retirement accounts) of $250,000 or less

F049 - Amount of deposit accounts (excluding retirement accounts (DMDFRT = Y) but including HSA and EDU) with Current Balance (DMCRBL) of $250,000 or less.

•(2) Number of deposit accounts (excluding retirement accounts) of $250,000 or less

F050 - Number of deposit accounts (excluding retirement accounts (DMDFRT = Y) but HSA and EDU) with Current Balance (DMCRBL) of $250,000 or less.

b.Includes deposit accounts with balances > $250,000 and excludes retirement accounts:

•(1) Amount of deposit accounts (excluding retirement accounts) of more than $250,000

F051 - Amount of deposit accounts (excluding retirement accounts (DMDFRT = Y) but including HSA and EDU) with Current Balance (DMCRBL) of more than $250,000.

•(2) Number of deposit accounts (excluding retirement accounts DMDFRT = Y) of more than $250,000

F052 - Number of deposit accounts (excluding retirement accounts (DMDFRT = Y) but including HSA and EDU) with Current Balance (DMCRBL) of more than $250,000.

c.Retirement deposit accounts of $250,000 or less:

•(1) Amount of retirement deposit accounts of $250,000 or less

F045 - Amount of deposit accounts with retirement feature (DMDFRT = Y ) (excluding HSA and EDU) with Current Balance (DMCRBL) of $250,000 or less.

•(2) Number of retirement deposit accounts of $250,000 or less

F046 - Number of deposit accounts with retirement feature (DMDFRT + Y) (excluding HSA and EDU) with Current Balance (DMCRBL) of $250,000 or less.

d.Retirement deposit accounts of more than $250,000:

•(1) Amount of retirement deposit accounts of more than $250,000

F047 - Amount of deposit accounts with retirement feature (DMDFRT = Y) (excluding HSA and EDU) with Current Balance (DMCRBL) of more than $250,000.

•(2) Number of retirement deposit accounts of more than $250,000

F048 – Number of deposit accounts with retirement feature (DMDFRT = Y) (excluding HSA and EDU) with Current Balance (DMCRBL) of more than $250,000.

Memorandum items 5.a and 5.b are to be completed by all banks.

5. Noninterest-bearing transaction accounts (as defined in Section 343 of the Dodd-Frank Act) of more than $250,00 (see instructions):

a. Amount of noninterest-bearing transaction accounts of more than $250,000

J944 – Amount of deposit accounts without the interest feature (DMDFIN), General Category (DMGENL) 9 and Current Balance (DMCRBL) of more than $250,000.

b. Number of noninterest-bearing transaction accounts of more than $250,000

J945 – Number of deposit accounts without the interest feature (DMDFIN), General Category (DMGENL) 9 and Current (DMCRBL) of more than $250,000.