Navigation: Deposit Reports > Deposit Reports - Alphabetical Order > Deposit Call Reports (FPSDR235) >

Note: Schedule RC-E accounts that don't fit in any of the categories (1–7 below) will be listed on the Unidentified Accounts Deposit FDIC Call Reports.

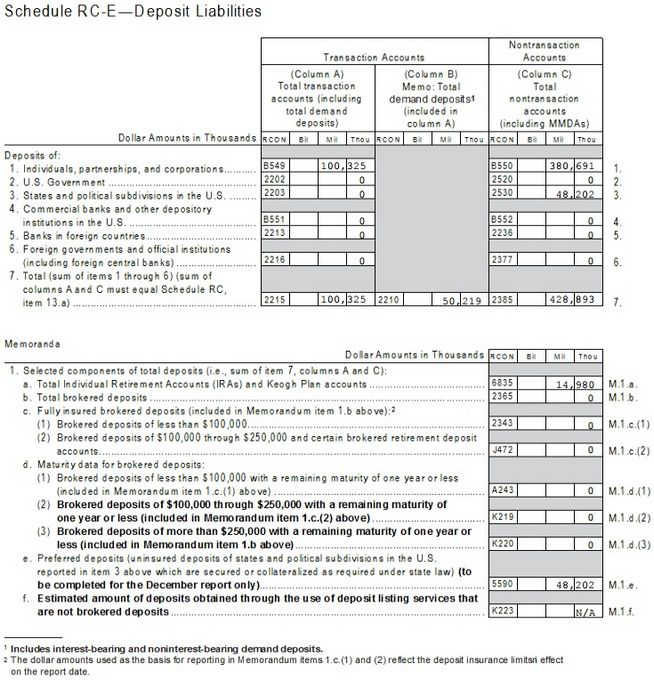

Deposits of:

1.Individuals, partnerships, and corporations

B549 - Transaction accounts (no CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with Sub Category (DMSUBC) of 00, 02, 03, 04, 15 or 16.

B550-Nontransaction accounts (CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with Sub Category (DMSUBC) of 00, 02, 03, 04, 15 or 16.

2.U.S. Government

2202 - Transaction accounts (no CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with subcategory (DMSUBC) of 05.

2520 - Nontransaction accounts (CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with Sub Category (DMSUBC) of 05.

3.States and political subdivisions in the U.S.

2203 - Transaction accounts (no CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with subcategory (DMSUBC) 02 or 06.

2530 - Nontransaction accounts (CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with Sub Category (DMSUBC) of 01 or 06.

4.Commercial banks and other depository institutions in the U.S.

B551 - Transaction accounts (no CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with subcategory (DMSUBC) of 07, 08, 09, or 10.

B552 - Nontransaction accounts (CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with Sub Category (DMSUBC) of 07, 08, 09 or 10.

5.Banks in foreign countries

2213 - Transaction accounts (no CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with subcategory (DMSUBC) of 11 or 13.

2236 - Nontransaction accounts (CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with Sub Category (DMSUBC) of 11 or 13.

6.Foreign governments and official institutions (including foreign central banks)

2216 - Transaction accounts (no CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with subcategory (DMSUBC) of 14.

2377 - Nontransaction accounts (CD feature (DMDFCD) or General Category (DMGENL) 5 or 6) with Sub Category (DMSUBC) of 14.

7.Total (sum of items 1 through 6)

2215 –Transaction Accounts: Total of FDIC fields B549, 2202, 2203, B551, 2213 and 2216.

2210 – Demand deposit accounts (no CD feature (DMDFCD) or General Category (DMGENL) 5, 6, 8 or 10) with interest feature (DMDFIN).

2385 –Nontransaction Accounts: Total of FDIC fields B550, 2520, 2530, B552, 2236, and 2377

RC-E Memoranda

1.Selected components of total deposits (i.e. sum of item 7, columns A and C):

a.Total individual Retirement Accounts (IRAs) and Keogh Plan accounts

6835 – RT feature (DMDFRT) excluding ESA/HSA accounts.

b.Total brokered deposits

2365 – Sub Category (DMSUBC) 4 or General Category (DMGENL) 13.

c.Fully insured brokered deposits (included in Memorandum item 1.b above):

•(1) Brokered deposits of less than $100,000

2343 – Sub Category (DMSUBC) 4 or General Category (DMGENL) 13 with Current Balance (DMCRBL) of less than $100,000.

•(2) Brokered deposits of $100,00 through $250,000 and certain brokered retirement deposit accounts

J472 - Sub Category (DMSUBC) 4 or General Category (DMGENL) 13 with Current Balance (DMCRBL) of $100,000 through $250,000.

d.Maturity data for brokered deposits:

•(1) Brokered deposits of less than $100,000 with a remaining maturity of one year or less (included in Memorandum item 1.c.(1) above)

A243 – Sub Category (DMSUBC) 4 or General Category (DMGENL) 13 with Current Balance (DMCRBL) of less than $100,000.

•(2) Brokered deposits of $100,000 through $250,000 with a remaining maturity of one year or less (included in Memorandum item 1.c.(2) above)

K219 - Sub Category (DMSUBC) 4 or General Category (DMGENL) 13 with Current Balance (DMCRBL) of $100,000 through $250,000.

•(3) Brokered deposits of more than $250,000 with a remaining maturity of one year or less (included in Memorandum item 1.b above)

K220 – Sub Category (DMSUBC) 4 or General Category (DMGENL) 13 with Current Balance (DMCRBL) of more than $250,000.

e.Preferred deposits (uninsured deposits of states and political subdivisions in the U.S. reported in item 3 above which are secured or collateralized as required under state law) (to be completed for the December report only). Preferred deposits can be excluded from the report by GOLDPoint Systems,

5590 – Sub Category (DMSUBC) 1 or 6 with Current Balance (DMCRBL) of more than $250,000.00.

f.N/A – K223 – Estimated amount of deposits obtained through the use of deposit listing services that are not brokered deposits

2.Components of total nontransaction accounts (sum of Memorandum items 2.a through 2.d must equal item 7, column C above):

a.Savings deposits:

(1) Money market deposit accounts (MMDAs)

6810 – Nontransaction accounts (CD feature (DMDFCD)) with General Category (DMGENL) of 6.

•(2) Other savings deposits (excludes MMDAs)

0352 - Nontransaction accounts (CD feature (DMDFCD)) with General Category (DMGENL) of 5.

b.Total time deposits of less than $100,000

6648 – Accounts with CD feature (DMDFCD) with Current Balance (DMCRBL) of less than $100,000.

c.Total time deposits of $100,000 through $250,000

J473 – Accounts with CD feature (DMDFCD) with Current Balance (DMCRBL) of more than $100,000 and less than or equal to $250,000.

d.Total time deposits of more than $250,000

J474 – Accounts with CD feature (DMDFCD) with Current Balance (DMCRBL) of more than $250,000.

e.Individual Retirement Accounts (IRAs) and Keogh Plan accounts of $100,000 or more included in Memorandum items 2.c and 2.d above

F233 – Accounts with CD and RT features (DMDFCD and DMDFRT) with Current Balance of $100,000 excluding HSA, EDU and qualified plan (DMRQLP) of 3 and 4.

3.Maturity and repricing data for time deposits of less than $100,00:

a.Time deposits of less than $100,000 with a remaining maturity or next repricing date of :

•(1) Three months or less

A579 – Accounts with CD feature (DMDFCD) with Current Balance of less than $100,000 and remaining maturity or Variable Rate (DMVART = Y) of three months or less.

•(2) Over three months through 12 months

A580 – Accounts with CD feature (DMDFCD) with Current Balance of less than $100,000 and remaining maturity of three months through 12 months.

•(3) Over one year through three years

581 – Accounts with CD feature (DMDFCD) with Current Balance of less than $100,000 and remaining maturity over one year through three years.

•(4) Over three years

A582 – Accounts with CD feature (DMDFCD) with Current Balance of less than $100,000 and remaining maturity of over three years.

b.Time deposits of less than $100,00 with a REMAINING MATURITY of one year or less (included in Memorandum items 3.a.(1) and 3.a.(2) above)

A241 - Accounts with CD feature (DMDFCD) with Current Balance of less than $100,000 and remaining maturity of one year or less. Note that if an account is variable and its remaining maturity is greater than a year, it will not be included in this total, but will be included in the less that 3 months total above (A579).

4.Maturity and repricing data for time deposits of $100,000 or more:

a.Time deposits of $100,000 or more with a remaining maturity or next repricing date of :

•(1) Three months or less

A584 - Accounts with CD feature (DMDFCD) with Current Balance of $100,000 or more and remaining maturity or Variable Rate (DMVART = Y ) of three months or less.

•(2) Over three months through 12 months

A585 - Accounts with CD feature (DMDFCD) with Current Balance of $100,000 or more and remaining maturity of three months through 12 months.

•(3) Over one year through three years

A586 - Accounts with CD feature (DMDFCD) with Current Balance of $100,000 or more and remaining maturity of one year through three years.

•(4 ) Over three years

A587 - Accounts with CD feature (DMDFCD) with Current Balance of $100,000 or more and remaining maturity of over three years.

b.Time deposits of $100,000 through $250,000 with a REMAINING MATURITY of one year less (included in Memorandum items 4.a(1) and 4.a(2) above)

K221 - Accounts with CD feature (DMDFCD) with Current Balance of $100,000 through $250,000 and remaining maturity of one year or less. Note that if an account is variable and its remaining maturity is greater than a year, it will not be included in this total, but will be included in the less that 3 months total above (A584).

c.Time deposits of more than $250,000 with a REMAINING MATURITY of one year or less (included in Memorandum items 4.a.(1) and 4.a(2) above)

K222 - Accounts with CD feature (DMDFCD) with Current Balance of over $250,000 and remaining maturity of one year or less. . Note that if an account is variable and its remaining maturity is greater than a year, it will not be included in this total, but will be included in the less that 3 months total above (A584).