Navigation: Deposit Reports > Deposit Reports - Numerical Order >

Availability

This report is run in November on the October 31 file every year as a test. On December 31 every year, this report and these notices are processed to meet IRS reporting requirements concerning fair market value and RMD disclosures.

Purpose

The Retirement 5498 Report shows all retirement accounts that require 5498 notices. Every account holder that has a balance or contribution for the year must receive a 5498 form by January 31. If the account holder has more than one account, only one account number will be printed. This account number must be used for any corrections after year-end.

The fair market value and the required minimum distribution (RMD) must be included on this form. The RMD amount is updated from the new year file in order to process the 5498 notices at year-end.

The notices are sorted by mail code, Social Security Number, retirement type, and plan number. There are no other sort options available.

The April 5498 reports and notices are processed using Retirement 5498 Report/Notices April Reporting (FPSDR042).

Accounts will be excluded from the report if the account owner does not have a Social Security Number or is a non-resident alien.

If the plan owner is deceased and it is a beneficiary plan (RTBENE=Y), then both the owner's and the beneficiary's name will be printed on the forms. Only name line 2 will print for a beneficiary plan.

|

GOLDPoint Systems Only: Create one setup for forms and another one for the report. Misc Opts 1 - Y = Print forms; N = Print report Misc Opts 2 - Y = Include all accounts Misc Opts 3 - Y = Include account number on the forms Misc Opts 4 - Y = Print forms with prior year contributions only (April run only--not used for year-end) Misc Opts 5 - Y = Skip printing RMD Misc Parm 15 - A = Alphabetical short name sort

To combine notices by Social Security Number, both the social security number and the retirement type Sort fields must be used, and used in this order. Sort fields and lengths are as follows: •90 - Mail code (1) •81 - Social security number (5) •82 - IRA type (4) •83 - Plan number (2) •84 - Short Name (10) •85 - CIS Plan (8) Note: The sort is not optional. Critical settings: 1 to 4 for notices, 1 to 16 for the report sorted by Social Security Number, 1 to 22 and 1 to 32 for the CIS plan, and 1 to 26 for the report sorted by short name. For notices only, the Subprog Cntrls Print field should be set to "Y." Because the year-end 5498 forms require some additional disclosure information for RMDs, there must be two report setups—one for year-end (FPSDR174), and one for April processing (FPSDR042). |

|---|

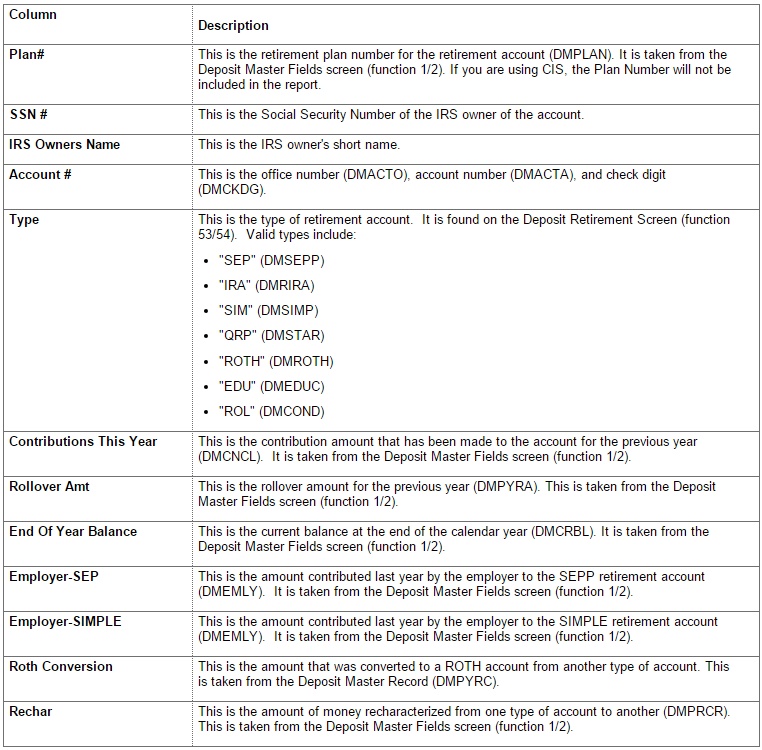

Report Column Information

See FPSDR174 Example for an example of this report.

Totals and Subtotals

Subtotals are provided by office number and totals by institution. Retirement 5498 Laser Notices are printed for all retirement accounts at year-end.

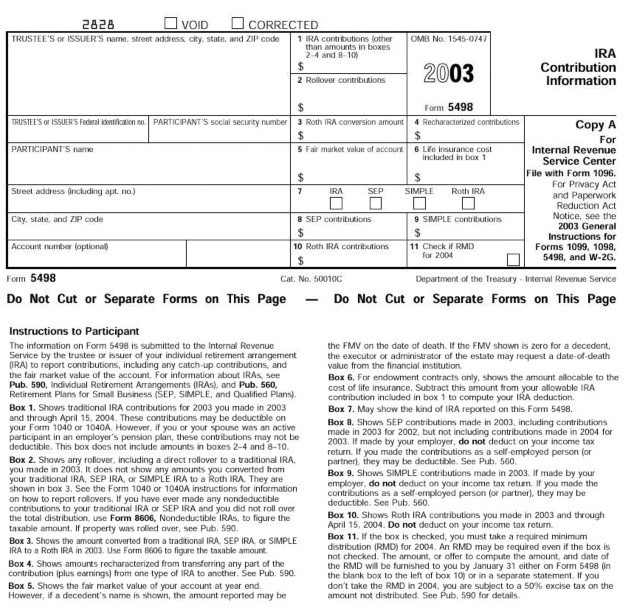

Retirement 5498 Notice

The notice above is an example only. Please note that the form is subject to change based on Federal Regulation and may appear different from the one illustrated above.